Independent Financial Services Firm Works for Its Clients – and Not a Company

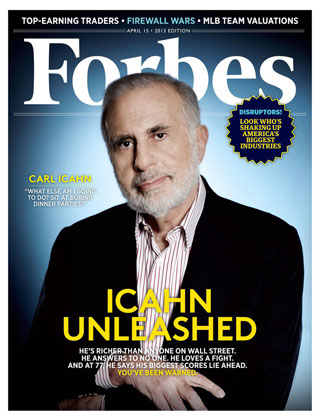

For the second year in a row, Affinity Asset Management has been featured by EMI Network in a special promotional section in Forbes magazine honoring Kansas City Financial Leaders.

Have you ever wondered why your advisor chose certain financial products for your investment portfolio? Surprisingly, it’s a question people rarely ask. But they have a right to, and they should, says Mark Roberts, owner and president of Affinity Asset Management, a full-service investment advisory firm in Overland Park, Kansas.

“All too often,” Roberts says, “we find that people have good investments but not the right combination of investments. In other words, you can have all the right ingredients, but if you mix them together incorrectly or in the wrong proportions, then the end product is not what you thought it would be. How we mix those ingredients is what sets us apart.”

“All too often,” Roberts says, “we find that people have good investments but not the right combination of investments. In other words, you can have all the right ingredients, but if you mix them together incorrectly or in the wrong proportions, then the end product is not what you thought it would be. How we mix those ingredients is what sets us apart.”

In Roberts’ experience, many investors underestimate the degree of risk in their portfolios. “Many people are not nearly as diversified as they think they are or as they should be,” he says. “People will show me a statement and in their minds they are diversified, but having a lot of investments does not equal diversification. Once we run their portfolio through our analysis, we often find their risk is much higher than they expected it to be. This causes big swings in their portfolio.”

Roberts explains that Affinity Asset Management works for its clients, not a company. “Therefore, we do not have a company that tells us what to sell, or when or how to sell it. We have access to the world of products so we can get clients exactly what they need.” Roberts and his team reach out to clients for regularly scheduled reviews to update them on their portfolios, any changes that need to be made, and to tell them about any relevant financial, economic and political developments. “This is one of the things our clients like best about our firm,” says Roberts. “Most clients say their previous advisor met with them only once or twice a year.”

‘The Rules to your Money’: Tax Strategies for a Financially Successful Retirement According to Roberts, the key to a financially successful retirement is often a matter of knowing – and taking advantage of – “the rules to your money.” “We obviously can’t control what the IRS or Congress does,” he explains, “but we can show clients strategies to minimize their income taxes in retirement. Whether you’re working or retired, the earlier in life you design tax strategies, the more you will save in income taxes over your lifetime.” Every new client goes through a financial planning process before any products are discussed.

While Roberts acknowledges that no one has a crystal ball, he believes another market downturn is inevitable at some point in the not-too-distant future. When it comes, his clients will be ready. “We‘re proactive,” he says. “We believe in shifting clients’ asset risk up or down based on their risk tolerance and market conditions. We position ourselves to take clients out of the stock market as we see changes in economic conditions.

“At Affinity Asset Management, our compensation is directly tied to how well our clients’ portfolios perform. That way, we have the strongest possible incentive to manage clients’ money as effectively as possible.”

Leave A Comment