Investment Commentary – September 1, 2021

Year to Date Market Indices as of September 1, 2021

• Dow 35,372(15.57%)

• S&P 4,535 (20.77%)

• NASDAQ 15,370 (16.54%)

• Gold $1,814 (-4.06%)

• OIL $68.30 (41.08%)

• Barclay Bond Aggregate (-1.84%)

• Fed Funds Rate 0-0.25 (0-0.25)

• Annual Inflation Rate 5.4% (As of 8/11/21)

UBS Analyst: The S&P 500 is headed for 5,000, says UBS. Here’s the when and how

“The S&P 500 has posted at least 1 new closing high every week since the week of June 7, 2021, 13 weeks in a row. August 2021 has posted 12 new closing highs in the 21 trading days, with one day left to go,” noted Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

“Year-to-date the index has posted 53 new closing highs, and is tied for the 4th highest in index history (from 1926),” added Silverblatt, who added that even if the market seems wacky, “if you’re not in it, you’re nuts, and most likely out of a job (keep your finger on the button).”

Our call of the day from UBS’s chief investment officer Mark Haefele, sees the S&P 500 is on a solid path to another big milestone — 5,000. That’s his end-2022 goal, while the bank sees the index reaching 4,600 by the end of this year.

“The S&P 500 has broken above 4,500 for the first time, taking gains for 2021 to over 20%. This might seem surprising given the recent run of negative news, including disappointing U.S. consumer data and a continual rise in COVID-19 infections. But we believe that the momentum toward reopening and recovery is intact and that there is further upside to equities,” Haefele told clients in a note.

He rattles off a list of supportive factors, including a fifth-straight quarter of robust results with more than 85% of companies beating second-quarter earnings and sales estimates; aggregate corporate profits up nearly 90% from year-ago levels; earnings nearly 30% higher than pre-pandemic levels; and revenue growth so robust it’s overwhelming cost pressures.

“We believe cost pressures for businesses should subside as supply begins to catch up. In addition, consumers’ balance sheets are at their strongest in decades due to the significant buildup in household savings over the past year, and retailers will continue to restock to keep up with demand,” said Haefele.

Show us the stocks? “With the economic recovery broadening, we expect cyclical sectors, including energy and financials, to take the lead,” he added.

That’s even as investors worry about “overbought” markets due for a pullback and stats showing September returns since 1928 have been down about 0.1%. In a note to clients, Lee counters that seasonality factors change when a first half is strong — the first six months of 2021 saw a more than 13% gain, the 10th best since 1928.

News Around The web:

Taper talk: U.S. Federal Reserve Chairman Jerome Powell on Friday confirmed that the central bank expects to begin tapering its bond purchasing program later this year. However, he didn’t set a specific date, and he warned against rushing to tighten monetary policy in response to recent inflation. Stocks rallied following his speech at the virtual Jackson Hole conference.

Small-cap surge: The Russell 2000, an index of U.S. small-cap stocks, climbed more than 5% for the week, outperforming its large-cap peers by a wide margin. Small caps’ biggest daily gain came on Friday in the wake of comments by U.S. Federal Reserve Chairman Jerome Powell. The Russell 2000 nevertheless remains more than 3% below its record high, which was set in March 2021.

Oil recovery: U.S. crude oil prices surged around 10% for the week, reversing the previous week’s decline and rising back above $68 per barrel. The gains came as U.S. government data showed that domestic demand for oil climbed to its highest level since the start of the pandemic.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

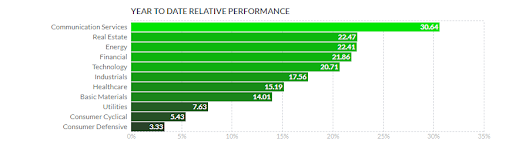

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.marketwatch.com/story/the-s-p-500-is-headed-for-5-000-says-ubs-heres-the-when-and-how-11630407516?mod=mw_more_headlines