Investment Commentary – Aug 24, 2021

Year to Date Market Indices as of Aug 24, 2021

• Dow 35,368 (15.22%)

• S&P 4,486 (19.44%)

• NASDAQ 15,019 (16.54%)

• Gold $1,805 (-5.08%)

• OIL $67.48 (39.69%)

• Barclay Bond Aggregate (-1.79%)

• Fed Funds Rate 0-0.25 (0-0.25)

• Annual Inflation Rate 5.4% (As of 8/11/21)

S&P 500 and Nasdaq close at records ahead of Fed summit

Stocks were higher Tuesday following a broad-based rally on news that U.S. regulators granted full approval for Pfizer-BioNTech’s Covid vaccine.

The Dow Jones Industrial Average rose 30.55 points, or less than 0.1%, to 35,366.26. The S&P 500 added 0.1% to a new closing high of 4,486.23. The Nasdaq Composite gained 0.5% to 15,019.80, also a new closing high.

Chinese stocks led the Nasdaq as investors have been getting more clarity on China’s regulatory outlook and buying shares of names that have taken a beating lately. Pinduoduo jumped 22.2% while JD.com rose 14.4%, Tencent Music Entertainment climbed 12.7% and Baidu gained 8.6%.

“There is follow through on dip buying in Chinese tech after several firms reiterated buys on the stocks, but the jury is still out on whether there’s more pain to come on further government crackdowns in this sector,” said Jamie Cox, managing partner for Harris Financial Group.

On Tuesday afternoon, Gary Gensler, chairman of the U.S. Securities and Exchange Commission, said the agency will demand U.S.-traded Chinese companies disclose political and regulatory risks to investors, an extension of recently imposed requirements for firms seeking initial public offerings, according to a Bloomberg report. Corporations could begin including the enhanced disclosures in their annual reports as early as next year, Bloomberg found.

Shares of vaccine makers pulled back Tuesday. Pfizer and BioNTech were more than 3% lower. Moderna fell 4.1% and Trillium Therapeutics, which surged about 180% in the prior session on news it would be acquired by Pfizer, closed 0.6% lower on Tuesday.

Travel stocks extended their rally from Monday, with several airline and cruise stocks rising Tuesday. Casino operators Las Vegas Sands and Wynn Resorts were also higher by about 7%, after Macau eased travel restrictions with the improvement of the Covid-19 case outlook in China’s Guangdong province, a key visitor source for the gambling capital.

“Markets seem to believe that the latest Covid flare up has peaked, and that’s a good thing,” Cox said. “Even though some airport data suggest traffic is rolling over a bit, any change to the trajectory of the delta variant will have that data rocketing back.”

News Around The web:

Fed minutes release: Minutes of the U.S. Federal Reserve’s July 27–28 meeting revealed an emerging consensus to start reducing asset purchases before the end of the year. The minutes, which were released on August 18, also showed that Fed officials made it clear that a tapering isn’t a precursor to an imminent rate hike.

Record-breaking earnings: Nearly 91% of S&P 500 companies reported their earnings for the second quarter. Nearly 87% of the reported companies have actual revenues above the mean revenue estimate.

Upcoming: Thursday

Second-quarter GDP, second estimate, U.S. Bureau of Economic Analysis

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

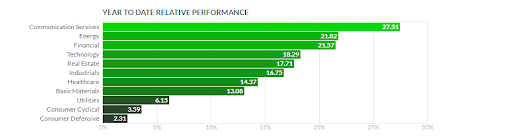

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.cnbc.com/2021/08/23/stock-market-futures-open-to-close-news.html