Hello and Happy Monday to everyone.

First, a Happy Thanksgiving to everyone. We will not be producing a Monday email next Monday, November 23, the week of Thanksgiving.

Second, Affinity is buying back in your risk models this Wednesday 11/18/20. We are setting a date so you can have time to call us if you wish to stay more conservative and not participate in Wednesday’s buy in. Currently, we have Model 1 at 20% stocks and 80% bonds, and all other Models are 30%stocks and 70% bonds. (keep in mind, we do keep a little cash in each account so I am rounding these percentages for ease of discussion). Waiting until after the election was prudent in this situation, with these points listed below being considered.

We have dominos lined up, some positive, and some negative. Right now, the dominos lined up are more positives ones on the front and negative ones seem to be moved back. The positives right now are also bigger than the negatives.

Positives: (not in any particular order)

1. Black Friday sales started earlier and spread out so more social distancing when shopping and not have large crowds

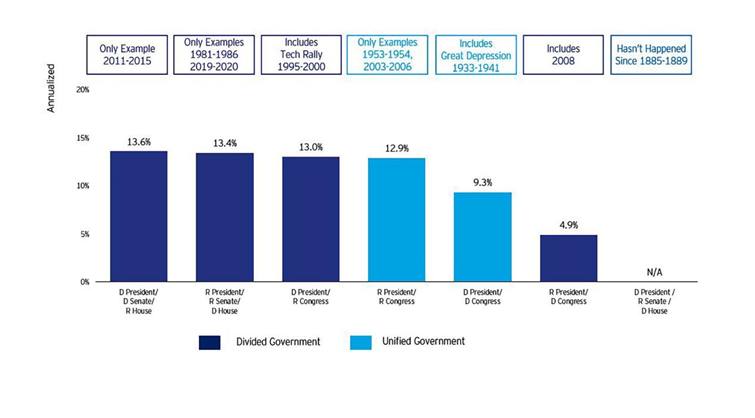

2. If politics stay where they are at, a divided congress is likely to be more favorable for the market. A divided congress means that any one President will still need congress approval, which means, one side can block the other side. Since the popular vote was so high this election, there is still a lot of support on both sides, meaning one side will not be as happy but content knowing that congress is divided. (please understand I am trying to say this as politically correct as I can and not to offend anyone’s political beliefs here)

3. Markets are more accepting of Covid-19. This is just weird to say, but we have dealt with this all year, and we are super close to a vaccine. Mask wearing is up everywhere and we are all becoming more accustomed to social distancing. New numbers going up and potential shut downs have not caused drops in the market.

4. November and December are typically the two best months of the year in the market as people will spend more. This also creates additional seasonal jobs.

5. Last Monday, Pfizer came out with an announcement that its close and its 90% efficient. Moderna did the same about a month ago, then again today saying they are 94.5% efficient and close.

6. Vaccine is coming

7. Stimulus is coming

8. Divided congress also means interest rates are likely will remain at zero even longer

9. Money is coming out of the bond market, meaning going into stocks

10. Overall economic numbers are improving-nowhere near 2019 levels, but improving…

11. Stock market remains steady through this election and with increasing covid-19 numbers.

Negatives: (not in any particular order)

1. The unknowns spook people

2. Lawsuits and the election are not completely over

3. Unemployment rate high

4. Interest rates, inflation, and income taxes will eventually go up

5. More people looking for jobs than there are jobs available. This also means employers can hire at a lower payroll since there are so many candidates willing to take that job with a lower pay.

6. PE ratios are still high (we here at Affinity are adding lots of diversification into the Models to reduce this risk)

Affinity understands and hears the same noises that our clients do from the news, drama-drama-drama. We continue to evaluate what is in the best interest of your accounts considering safety and growth. This buy in now, is just for now. If things change, and we need to go back to protection mode and reduce or get out of all stocks, then we will. We have created new Models for this buy-in. My analogy is that if you have been driving a Jeep Wrangler 4 door for years, we are putting you back into your Jeep Wrangler, but not your 2019 Wrangler. We are putting you back into a 2021 Jeep Wrangler. So if you were in model #3 for example, which was in 2019 a 60%stock and 40% bonds, you will be going back into that same stock/bond ratio and risk level. The investments within that are 60/40 split will have changed based on the latest analytics. We have also added in some ‘value’ type investments, not all ‘growth’ style investments (industry terms). Value style investing are stocks that produce a dividend, they fluctuates less and are more consistent.

2020 firsts: (first time in my life time)

1. Pandemic

2. President ordering a complete shut down

3. Interest rates dropping from 1.5% to 0% in one move

4. Stimulus of $2.7 trillion (largest in HISTORY and with another stimulus bill anticipated to come)

5. This combination of political leaders-after election (see chart below)

Your worries and concerns are justified. This is why we have delayed the buy-ins into the longevity Models until Wednesday so that everyone has time today or tomorrow to call us to stay more conservative, or to not call and we go ahead and get bought back in. My personal accounts have always been treated as client accounts. And, I too am being bought back in.

Here is the longevity models to jog your memory:

1. 20% stocks / 80% bonds

2. 40% stocks / 60% bonds

3. 60% stocks / 40% bonds

4. 73% stocks / 27% bonds

5. 88% stocks / 27% bonds

6. 100% stocks

Performance DJIA:

Mon 11/9 +2.95% (Pfizer came out with an update on a vaccine)

Tues 11/10 +0.90%

Wed 11/11 -0.08%

Thurs 11/12 -1.08%

Fri 11/13 +1.37%

Last week +4.08%

Since 2/19 market high +0.45%

Tid Bits:

1. From Invesco

a. Invesco Analyst: What could a divided government mean for US stocks?

i. Interesting chart. Assuming after all election process is finished from recounting to law suits and we remain with a Democrat President, a Republican majority Senate, and a Democrat majority House of Representatives . This chart below is showing we have not had this combination of politics since 1885-1889. Meaning, we have no historical stock market performance to see how things were handled in the past. We also went back to the analyst source to verify this chart was accurate, which it is.

1. Source: Yale University/Shiller database, Strategas Research Partners. US large-cap equities represented by the S&P 500 Index. Chart is meant for illustrative purposes only and is not meant to depict or predict the performance of any investment strategy. Indices cannot be purchased directly by investors. Past performance does not guarantee future results. R = Republicans, D = Democrats.

a. The prospects for a major fiscal stimulus package have decreased, but other supportive factors remain in place

b. As we wait for the votes to be counted, and perhaps recounted, in some key states, we’ve gotten some questions about the potential for a divided government and what it could mean for markets if the White House and Congress are split between parties.

2. Senate implications

a. Kristina Hooper: Chief Global Market Strategist: It appears all but certain that the Senate will remain Republican. This means that:

b. 1-Government will likely be divided, regardless of who wins the presidency. The stock market has historically reacted positively to divided government, as my colleague Brian Levitt explains below. I expect stocks to rise in this environment. This is especially so given that markets had feared a Democratic sweep. For example, as of Oct. 28, 34% of companies in the S&P 500 Index that had reported earnings mentioned the election – with taxes being the government policy most discussed in conjunction with the election.1 There was real fear about what policies such as higher taxes and a higher minimum wage would do to businesses. Now that those policies are very unlikely even with a Biden win, I would expect stocks to continue with a relief rally.

c. 2- The US is far less likely to get a large fiscal stimulus package, regardless of who is president. This suggests a slower economic recovery for the US, which would likely mean defensives and secular growth stocks could outperform.

d. 3- If Biden wins the presidency, I think we will see a new era of fiscal conservatism ushered in despite being in the midst of an economic recovery, as proposed spending measures would require approval by Senate Republicans. This would be similar to what we saw during the Obama administration with sequestration while the US economy was still recovering from the global financial crisis. This suggests a slower, less robust economic recovery. With lower government spending and borrowing, I would expect to see lower 10-year Treasury yields.

e. 4- If Trump wins the presidency, I would expect to see less of an emphasis on fiscal conservatism by Senate Republicans, although I don’t believe there will be anything close to profligate spending. This suggests more spending and borrowing (though not nearly what we would have expected with a Democratic sweep), and potentially higher 10-year Treasury yields.

3. Market implications

a. Brian Levitt: Global Market Strategist: Gracie Allen famously quipped, “This used to be a government of checks and balances. Now it’s all checks and no balances.” Allen’s observation, while funny, is not applicable to the 2020 US election. For all the uncertainty surrounding the outcome of the presidential election, the partisan control of the US Congress was never really in question. For the next president, be it Donald Trump or Joe Biden, there will be balances on their power. The prospect of outsized fiscal support, Allen’s joke notwithstanding, has diminished.

b. The markets have initially responded favorably to the perception that little will get done in the first two years of the next administration. Incessant hand wringing over the key issues and concerns over the prospects of higher taxes, a Green New Deal, changes to the Affordable Care Act and much more appears to have been for naught. The US system is inherently designed for incrementalism, and gradual progress is about the most either party can now wish for in the coming two years.

c. It is said that markets prefer divided government. The numbers bear that out, although I would argue that analysis is not all that statistically significant. Rather, the returns, in most instances, tend to be driven by a handful of notable years.

2. Biden win signals tax, regulatory changes for advisors

a. By Andrew WelschNovember 07, 2020, 2:30 p.m. EST

b. What does former Vice President Joe Biden’s win mean for advisors? Retooled advisor regulation, potentially higher taxes for wealthy Americans and new rules governing retirement plans, experts say. Certainly, addressing the coronavirus pandemic and economic turmoil will be top priorities for Biden. Beyond that his administration will likely pursue a more investor friendly regulatory approach, according to experts and industry observers. That would represent a sharp contrast to the Trump administration, which has generally rolled back or eased regulations that irked Wall Street. “The contrast is likely to be night and day even if you get an [SEC] chair who is on the more moderate end of the spectrum,” says Barbara Roper, director of investor protection for the Consumer Federation of America. The SEC’s controversial Regulation Best Interest is at the top of the list for revision. The rules package, which went into effect earlier this year, changed advisor and broker standards of conduct. Critics — including the SEC’s own investor advocate — charge it tilted the playing field in favor of brokers and poorly defined what best interest means within the context of the regulation, among other criticisms. For example, the Form CRS document firms are now required to provide to clients expressly prohibits RIAs from mentioning that they are fiduciaries. Laura Posner, a partner at law firm Cohen Milstein and former bureau chief for the New Jersey Bureau of Securities, notes that the Democratic Party’s platform called for stronger investor protections. Without naming Reg BI, the platform said financial advisors “should be legally obligated to put their client’s best interests first.” The Republican Party did not adopt a new policy platform this year beyond stating it “will continue to enthusiastically support” President Trump’s agenda. How a Biden administration would handle regulatory change remains an open question. Revision may not result in wholesale replacement by a Biden-appointed SEC chair. Roper says new leadership at the regulator may opt to focus on giving Reg BI more enforcement teeth. In other words, they may choose to renovate an existing house rather than tear it down to build anew. Retooling over replacing could be a more efficient path to significant changes, according to Posner. “If they scrap Reg BI entirely, then that is a long process of putting together new regulations, have a new comment period, and have a vote. But if they were to issue guidance on what best interest actually means, they could do that quickly,” she says. Congress gets a say too, and that can either accelerate or hinder change. Biden’s proposal to alter 401(k) tax benefits — effectively curtailing the benefit for high income earners and enhancing it for low income earners — could meet resistance in Congress from both parties. If the proposal went into effect, it would likely make Roth IRA accounts more appealing to wealthy Americans, according to Paul Swanson, vice president of intermediary distribution at CUNA Mutual Retirement Solutions. The Biden administration may view many policy goals as important in their own right. And other objectives — such as improving retirement savings among low income workers — may seem even more important at a time of severe economic stress. In short: The incoming administration will have its hands full.

3. White House, Pelosi Bicker Again Over Size Of Any Stimulus

a. NOVEMBER 6, 2020 • ERIK WASSON, MARIO PARKER, LAURA LITVAN White House economic adviser Larry Kudlow said the Trump administration opposes a $2 trillion fiscal stimulus in the wake of stronger-than-expected economic numbers, while U.S. House Speaker Nancy Pelosi again rejected a scaled back pandemic relief package. The comments Friday suggested a continuing impasse despite promises from both sides to renew negotiations after Tuesday’s election. “We’re not interested in, you know, two or three trillion,” Kudlow told reporters. House Democrats had pressed for a $2.4 trillion package before the election. “It would still be a targeted package to specific areas” that the administration wants, Kudlow said, even after the administration last month proposed a deal around $1.9 trillion. Pelosi said that a smaller bill “doesn’t appeal to me at all.” She emphasized at a news conference “that isn’t something we should be looking at.” She also urged the administration to return to negotiations, saying that another stimulus is needed now even as the Democrats prepare for Joe Biden — who’s leading in the presidential-election count — to take the White House. Senate Majority Leader Mitch McConnell called for a scaled-back relief bill, highlighting that Democrats failed to make significant gains in congressional elections and that the latest jobs numbers showed a bigger-than-expected drop in the U.S. unemployment rate. McConnell spoke after the Labor Department reported that the jobless rate slid by a percentage point to 6.9% in October. “That clearly ought to affect the size of any additional stimulus package we do,” McConnell said at a briefing in Kentucky Friday. Senate Republicans have proposed a $500 billion relief plan. Kudlow advocated for more help for small businesses, renewed supplemental jobless benefits, Covid-19 liability protections and spending for hospitals and schools. He also said President Donald Trump and Treasury Secretary Steven Mnuchin, along with McConnell, still want a stimulus deal after months of stalemate with Pelosi. With Trump behind in the presidential vote count and alleging fraud, it’s unclear whether Democrats and Republicans will be able to compromise on a Covid-19 relief bill in the lame duck session of Congress that precedes the new administration taking office in January. “It would be to everybody’s advantage to get it done in the lame duck,” Missouri Republican Senator Roy Blunt, a member of McConnell’s leadership team, said Friday morning. “The vast majority of her members also think she needs to give ground here,” Blunt said, referring to Pelosi. She exuded confidence in a Biden presidency, telling reporters once he’s inaugurated he would be able to use the bully pulpit to shepherd a large spending bill that includes infrastructure construction — even through a Senate continuing under Republican control. “The public wants a big jobs bill,” she said. “Now we have the upper hand.”

Facts:

Coronavirus

a) Global 54,958,942 cases 1,326,665 deaths

b) US 11,367,214 cases 251,901 deaths (+6.51%, +15,400 increase from last week) ***A little more than double the numbers from last week.

c) KS 117,197 cases 1,256 deaths

d) MO 251,453 cases 3,534 deaths

Highlights from analysts and economics

1. From Northern Trust Investment

a. While results are still being finalized, it looks like the U.S. election has resulted in split government – a Democratic president, a likely-Republican Senate, and a Democratic House with a reduced majority. We think this scenario will be positive for the growth outlook as it could result in further fiscal stimulus without tax hikes.

b. Meanwhile, the U.S. economy continues to show improving trends. October job creation was solid, and the third quarter earnings reports have been better than expected, leading us to nudge up our 2021 earnings estimates. The jump in COVID-19 cases globally remains a near-term concern, but this concern is overshadowed by the recent news on the 90%+ efficacy of the Pfizer coronavirus vaccine. Growth in the European services sector has been hit by increased lockdowns, while the continued strong rebound in China is underpinning solid growth across Asia. We increased the recommended tactical risk in our global policy model this month as increased policy clarity has emerged and the economy continues to adapt to the pandemic. Near-term, we are watching the risk of a fiscal shortfall as the prior stimulus has mostly run out and the path to the next plan is unclear. In the meantime, hopeful news on the outlook for COVID19 vaccines (from Pfizer and other companies) is underpinning continued momentum in risk markets.

c. U.S. equities are responding favorably to the expected divided government, including the prospects for a status quo tax environment. Still, the unexpected outcome is creating some winners and losers. Republican Senate control is expected to act as a governor on fiscal spend, impacting cyclical sectors, while a lessening of the prospects for inflation is bringing down long-term interest rates – hurting banks and benefiting growth areas like big tech. The election outcome should allow for the market to think less about politics and more about fundamentals – where we continue to see improvement.

d. We modestly boosted our 2021 U.S. earnings outlook this month, though we lowered it in Europe. Earnings expectations for 2021 collapsed similarly across regions through April, though the U.S. and emerging markets have shown an improvement while developed ex-U.S. has been largely flat. Third quarter earnings are coming in materially better than expected. While the U.S. market is expensive relative to history, we increased our exposure to U.S. and emerging market equities to neutral. This reflects our view that looks beyond the current increase in coronavirus cases and toward an effective vaccine, as well as a clearer political environment in the U.S.

2. From JP Morgan

a. A Long-Term Perspective on Investing

i. Of all the challenges facing investors in this blighted year, maintaining a long-term perspective may be the hardest. In recent weeks, markets have swayed back and forth in reaction to case counts, vote counts, vaccine news and stimulus views, obscuring longer-term trends on economic growth, inflation, earnings and interest rates. It has also been tempting to ignore the crucial importance of current valuations in driving long-term returns or to underestimate the potential for recently unloved assets to reduce current portfolio volatility and enhance long-term returns.

ii. Given all of this, it is particularly timely that last week we released the 2021 edition of our Long-Term Capital Market Assumptions. This project, now in its 25th year, draws from experts across JPMorgan Asset Management in developing investment themes, economic forecasts and return and correlation projections across all major markets and asset classes for the next 10 to 15 years.

iii. Among the key themes this year:

1. Despite the pandemic, the long-term paths of slow growth and low inflation remain intact, albeit with greater uncertainty around inflation.

2. The pandemic has triggered even easier monetary policy. However, fiscal policy is likely to take the leading role in promoting economic growth in the decade ahead.

3. Strong returns from equities and high-quality bonds through the pandemic have left valuations stretched. A traditional 60/40 portfolio of global stocks and U.S. bonds presents a very subdued frontier of potential returns.

4. However, many other asset classes shine above this low horizon, including international equities, high-yield and emerging market debt and an assortment of alternative investments. In addition, active management should be able to take advantage of distortions in relative valuations that have been created by years of central bank intervention and momentum investing.

b. Weekly Market Recap

i. While the ominous rise in case counts suggests an even greater human toll in the months ahead, given that the inherent value of stocks depends on future earnings over many years, equities have been more sensitive to vaccine prospects rather than current case counts. Last week, promising news around a potentially highly effective COVID-19 vaccine led to a broad style rotation in stocks, with value outperforming growth. As the probability rises for a vaccine arriving in early 2021, investors are considering whether value can finally outperform growth over an extended period. Good Judgment, a global network of professional forecasters who collaborate to tackle forecasting questions around complex macro themes, has been polling its members on when an effective vaccine could be broadly distributed. Notably, these forecasts now suggest an 83% probability of a vaccine being distributed in 1Q21, up from 48% at the beginning of the month. When the probability of an effective vaccine being broadly distributed by the end of 1Q21 has increased by more than 5% w/w, on average, traditional value sectors have outperformed the broader index while growth has lagged. Moreover, relative valuations continue to favor value over growth, and 2021 analyst estimates suggest a more robust earnings recovery among the more beaten up value sectors. While we still prefer active stock selection across styles, we are cautiously optimistic that as vaccine prospects improve, value should turn the corner.

Opportunities:

***Open enrollment for Medicare is coming up. Here is a referral for you…

As an independent insurance agent that contracts with major carriers, I can help you decide which plan is right for YOU! Whether you are in the market for Medicare Supplements, Prescription Drug Plans, Advantage Plans, or just want to know your options, I can guide you through the process.

Community Café – Due to upcoming holiday schedules we are taking a couple weeks off to return in December

Social Security and Tax Strategy Webinar on Tuesday November 17 at 6:00pm, Wednesday November 18 at 11:00am & Saturday November 21 at 10:00am

To Register for either date please email Stacy at [email protected]

If you would like a copy of my 30 minute recording of Community Café on the topic of “Tax saving Strategies”, please contact Stacy and we can email it to you. [email protected]

Referral rewards program:

Mark Roberts, President

Affinity Asset Management

13220 Metcalf Ave Suite 220

Overland Park, KS 66213

phone (913)381-4800

fax (913)381-4804

www.affinityasset.com

Securities and Advisory Services offered through Client One Securities, LLC Member FINRA/SIPC and an Investment Advisor. Affinity Asset Management and Client One Securities, LLC are not affiliated. Please do not send orders via e-mail because there is no assurance of receipt and they are not legally binding. The information above is from sources believed to be reliable. There is no guarantee to accuracy. This is not an official statement or confirmation.

Notice: This E-mail (including attachments) is covered by the Electronic Communications Privacy Act, 18 U.S.C SS2510-2521 and is confidential and may be legally privileged. If you are not the intended recipient, you are hereby notified that any retention, dissemination, distribution or copying of this communication is strictly prohibited. Please reply to sender if you have received this message in error; then permanently delete it. Thank you