Hello again,

Mark spends his weekends shoveling dirt and planting vines so it is Angela again (aka Mark’s surrogate keyboard Jedi) helping make sure he is minimizing usage of his wrist. An update with his injury is that he was lucky enough not to fracture any bones but his doctor confirmed that he tore multiple muscles in both his hand and wrist. Maybe now I have a shot at beating him at golf (ha!), but before I change topics, Mark would like to extend a special thank you for all the get well wishes he has been receiving.

He is also a Star Wars fan and in the spirit of national Star Wars day, he said “May the 4th be with you”…

* You may not realize that these Monday emails take around 3 to 4 hours for me to create. That is after the large amounts of up to date and relevant research our investment committee sends in. We have an office full of rock stars. All of these emails are time consuming but it is worth it to keep our clients informed and educated during these unique and stressful times.*

We invite you and your friends, family, and co-workers to listen in on this week’s Teleconference.

Next Teleconference: Special Guest Justin Maddox with Blackrock

Wednesday 5/6/20

800-747-5150

Passcode : 3814800# (must hit the # at the end)

2:00pm CST

Performance DJIA:

Mon 4/27 +1.51%

Tues 4/28 -0.13%

Wed 4/29 +2.21%

Thurs 4/30 -1.17%

Fri 4/31 -2.55%

Last week -0.22% (3 weeks in a row, very little change)

Since 3/11 day before selling +0.72%

Since 2/19 market high -19.16%

Bond model you are in:

Last week +0.43%

Since bought in -0.47%

Tid Bits:

- Todays message is about “patience”. With a couple weeks of the market going up from optimism on the CARES stimulus package, to now several weeks in a row of very little market movement. We are getting the sense, some investors, including us, are getting antsy to get some activity going. To get some “cycle trading” going. We have a long ways to go for this market we are in now. We have way too much back lash that needs to come from massive layoffs, to the economy shutting off, the economy turning back on very slowly, some Americans getting their jobs back, and some won’t. There are major industries that will be affected for a long time from this, thus a continued negative affect on the markets.

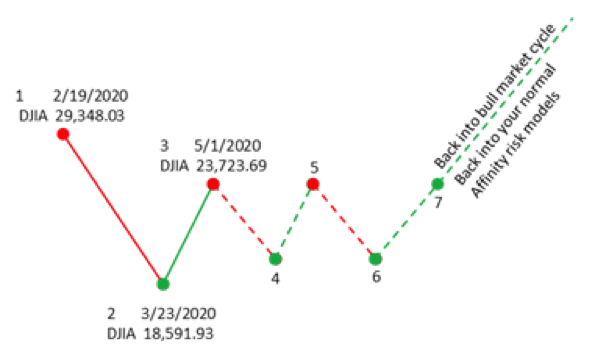

- Data points. This is another one of our terms here in the office, not necessarily industry terms as we look to use verbiage that the majority of our clients will easily understand. We have had 3 data points so far and are waiting on the 4th.

- First data point, market hits all time highs, 29,348 February 19, 2020.

- Second data point, market has a fast drop to 18,591 by March 23, 2020

- Third data point, where we are today. The market is hovering between 22,000 and 24,000.

- It’s like the market has priced in various things and waiting for the next blast of bad news to have the next dip.

- This next dip is where we look to “Cycle Trade”. Taking our fee based accounts, IRAs, Roth, Non-IRAs, all above $25,000 in account value, and selling out of 50% of the bonds, and going into 50% stocks. Ultimately diversified in a 50/50 stock/bond mixture. Using the stock side to take advantage of the data points moving from the 4th data point, to the 5th data point. That way we can manage risk by maintaining 50% in bonds for stability.

- This “buying in” of “cycle trading” will be a day by day situation. See what the drops are like, how many days in a row, how fast the drops are coming, and what is the information and news behind this so we can make an informed and calculated decision.

- When we get to a 5th data point, meaning the market had a bounce up, then we will sell out of those stocks and go back to 100% bonds until we get to the next data point.

Facts:

- Coronavirus

- Global 3,586,380 cases 248,791 deaths

- US 1,189,024 cases 68,609 deaths (+13,194 , 24% increase from last week)

- KS 5,155 cases 144 deaths

- MO 8,434 cases 377 deaths

- On the Federal Government side, last week Congress approved a further $484 billion package to supplement the CARES Act. All told, the federal government has now enacted 4 separate pieces of legislation to address the pandemic. The Congressional Budget Office estimates that these will add $2.7 trillion to the federal debt over the next 18 months. It should also be noted that the small business grant program, enhancements to unemployment benefits and aid to state and local governments, appear designed to support the economy only until the middle of this summer. If, as seems likely, large parts of the U.S. economy remain shut until the distribution of a vaccine, hopefully by the second quarter of next year, then the federal government could easily approve a further $1 trillion in aid.

- This, combined with interest costs and the automatic impact of a deep recession on both revenues and spending, could result in deficits of an astonishing $3.8 trillion this fiscal year and $2.9 trillion next fiscal year, boosting the debt from 79% of GDP at the end of the last fiscal year to 109% of GDP by the end of fiscal 2021, thus eclipsing the all-time record of 108% of GDP set in 1946 as the U.S. added up the extraordinary costs of fighting World War II.

Highlights from analysts and economists:

- From JP Morgan

- Risk assets rose in April as volatility eased, yet pessimism persisted as the global economy deteriorated, the services sector collapsed and labor market outlooks were deeply negative.

- Risk assets have risen despite weak data, likely inspired by flattening infection curves, plenty of emergency policy support and markets’ tendency to move ahead of the economy.

- Bond markets saw a more traditional bid for protection following Federal Reserve intervention to restore proper market functioning. Where central bank purchases were aggressive (Canada, Germany), bonds outperformed.

- From Blackrock

- All else equal, a selloff in a given asset class makes it more attractive through a valuation lens, mechanically increasing our expected returns in the coming five years. Even after the substantial rebound in recent weeks across risk assets, their price declines this year still imply a hefty boost to our expected returns. Conversely, the rally in government bonds points to lower future returns compared with our expectation at the start of the year.

- The pandemic has triggered an abrupt, deliberate stop to economic activity. What matters to long-term asset prices is the cumulative impact of the growth shortfall over time. We believe that the policy actions to cushion the impact of the virus shock should help limit permanent damage to growth fundamentals. Given successful policy execution throughout the shock, the cumulative impact would be well below that seen after the 2008 global financial crisis. We are assessing other potential structural changes the outbreak might bring on in the years ahead – and the implications on asset classes. Think of the reorganization of global supply chains that had started before the pandemic amid heightened trade tensions, with their potential impact on corporate profits and inflation.

- From CNBC

- Airline shares fell sharply again, this time after Warren Buffett cashed out of his stakes in the four largest U.S. carriers.

- US airlines recently posted their biggest losses in years because of the coronavirus pandemic.

- U.S. airline shares were down sharply again on Monday, this time after Warren Buffett said Berkshire Hathaway sold its entire stakes in the four largest U.S. carriers as coronavirus devastates travel demand. Berkshire was among the largest investors in the four — American, Delta, Southwest and United. Buffett announced on Saturday that the firm dumped those shares. Berkshire posted a net loss of close to $50 billion in the first three months of the year.

- Warren Buffet has made famous the investment contrarian theory, meaning do opposite of what the mass investors do. When investors are buying, he is selling and vice versa. This is an interesting point because it is obvious airline stocks are way down and a perfect time for investors to buy, but he is selling. It makes us wonder if he is trying to set the market by driving the stock price lower to ultimately buy back in later. Interesting. When you have billions of dollars, you can easily move a stock price.

- From American Century Investments

- Economic growth will be pressured, but we expect the U.S. to remain stronger than other developed markets.

- Accommodative central bank policy is positive for emerging markets but may not be enough to calm the headwinds they face.

- We expect continued robust demand for Treasuries, which should support higher-quality bonds and ultimately help improve valuations among corporate bonds.

- Avoid making decisions based on daily price movements. Rather, take this opportunity to review whether your asset allocation is aligned with your time horizon and willingness to accept short-term volatility.

- From Capital Group (American Funds) 5 Realities of This Recession

- We’ve been here before (sort of) : The largest post-1950 quarterly GDP decline was 10% in the first quarter of 1958. As parts of the U.S. look to ease restrictions, I believe that a bounce back in activity could begin as early as June in some sectors and more broadly in the third quarter.

- Recessions have tended to be short; the subsequent expansions have been powerful : The good news is that recessions generally haven’t lasted very long. While this time may be different, our analysis of 10 cycles since 1950 shows that recessions have ranged from eight to 18 months, with the average lasting about 11 months. For those directly affected by job loss or business closures, that can feel like an eternity. While there’s no way to minimize that feeling, investors with a long-term investment horizon should try to look at the big picture. The average expansion increased economic output by 25%, whereas the average recession reduced GDP by less than 2%.

- It’s about the consumer : The U.S. consumer accounts for approximately two-thirds of the economy. With unemployment claims skyrocketing — although many may be temporary — and consumers staying in their homes, a weakening economy is no surprise. The $2 trillion stimulus package will help support some levels of consumer activity, but employment uncertainty is likely to keep many consumers in a frugal mindset.

- Lower oil prices may be a tailwind for the economy

- Timing may not be everything : While the adage that the stock market is not the economy is true, market volatility tends to be captured, with a lag, in economic data. So even as financial markets are on a path to recovery, it may take time for the economy to catch up. Focusing on long-term investing can help investors navigate short-term volatility.

Opportunities:

- Roth Conversions

- Taking withdrawals

- We never want to discourage you for taking withdrawals. However, the more you leave in the account, the more you will have working for you in our diversified investment mixture when the market goes up. If you need money always feel free to give us a call so that we can collaborate on what is best for your specific situation

- Referrals – Please share us with your loved ones

- If you are still working, call your 401K company, (not your HR department of your employer) and ask if you have access to an “in-service rollover”. And if you do, let us know ASAP as there are potential large benefits that you don’t have at work in that 401K.

Reminders:

- Don’t forget that the news creates drama. The stock market moves for 2 reasons which are greed and fear.

- Justin Maddox with Blackrock will be joining us for this Wednesday’s edition of our weekly teleconference. I will speak for approximately 20 minutes, then Affinity Asset Management has created questions that we will ask Justin on behalf of Affinity and Affinity’s clients.

- “Trusted Contact Form” you received by C1S. Just fill out one per person and mail them back in the same envelope. This form is a new regulation in our industry, helping us as your advisor and C1S. In the event you don’t return our calls, emails, or text messages, and this is uncharacteristic of you, then you are giving us another name and number of someone who might know how to reach you. That’s all. This person doesn’t not have access to anything with your accounts.

- Any service work you would like us to do for you, please email your request to us.

- We are being told by our broker/dealer, Client One Securities (CIS), that your brokerage accounts should now be able to integrate with your personal tax software for those who do their own tax returns. Any problems or questions on this, can be directed to C1S directly at 913-814-6097

Please feel free to share this email and/or the teleconference information as the best way to battle anxiety is education

Next Teleconference: Special Guest Justin Maddox, Market Leader Vice President with Blackrock

Wednesday 4/29/20

800-747-5150

Passcode : 3814800# (must hit the # at the end)

2:00pm CST

Thank you for your time in reading these updates.

Please share them with anyone you want to help

Stay safe and stay healthy.

Mark Roberts/Angela Hudson

Leave A Comment