Investment Commentary – May 25, 2021

Year to Date Market Indices as of May 25, 2021

• Dow 34,312 (12.11%)

• S&P 4,188 (11.5%)

• NASDAQ 13,657 (5.97%)

• Gold $1,870 (-0.09%)

• OIL $66.06 (36.29%)

• Barclay Bond Aggregate (-2.85%)

• Fed Funds Rate 0-0.25 (0-0.25)

S&P 500 ends volatile day slightly higher, Apple pushes Nasdaq to another record close

The S&P 500 erased earlier losses and rose slightly to a record on Monday as investors prepared for a busy week of earnings featuring reports from the largest tech companies.

The broad equity benchmark closed the volatile day 0.4% higher at a new record close of 3,855.36. The S&P 500 fell 1.2% at its low of the day. The tech-heavy Nasdaq Composite gained 0.7% to reach a fresh closing high of 13,635.99. The Dow Jones Industrial Average, less susceptible to changes in technology shares, dipped 36.98 points, or 0.1%, to 30,960.00. At its session low, the 30-stock benchmark dropped more than 400 points.

This coming week, 13 Dow components and 111 S&P 500 companies are set to report earnings. Among the quarterly reports on deck include those from Apple, Microsoft, Netflix, Tesla, McDonald’s, Honeywell, Caterpillar and Boeing.

Apple shares gained 2.8% to an all-time high before its quarterly report Wednesday after the bell. Tesla, which also reports Wednesday, popped 4% to hit a record.

“The Street is anticipating robust results from Apple on Wednesday after the bell with Cupertino expected to handily beat Street estimates across the board,” wrote Dan Ives of Wedbush, who raised his 12-month price target on Monday to $175. “While the Street is forecasting roughly 220 million iPhone units [for 2021], we believe based on the current trajectory and in a bull case Cupertino has potential to sell north of 240 million units.”

Highly speculative action in stocks like GameStop was unnerving some investors, causing worry that parts of the market had detached from fundamentals and could cause the broader market to take a hit when the mania ends.

News Around The web:

Positive indicators: An index of leading U.S. economic indicators recorded its strongest monthly gain since last July. The 1.6% April increase that was reported on Thursday by The Conference Board marked the second consecutive solid monthly gain for the index.

NASDAQ comeback: For the first time in six weeks, the NASDAQ outperformed the S&P 500, and an index of U.S. large-cap growth stocks ended a dry spell by edging a large-cap value index. Technology stocks that had recently been hit by concerns about rising interest rates were among the latest week’s top performers.

Home sales slowdown: U.S. sales of existing homes fell 2.7% in April compared with the previous month, making it the third straight monthly decline at a time of year when sales typically pick up. Friday’s report from the National Association of Realtors followed a recent surge in home prices amid a low supply of available properties.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

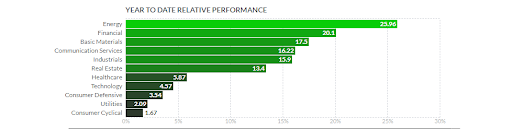

https://finviz.com/groups.ashx (YTD Performance Chart)

https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/weekly-market-recap/

https://www.cnbc.com/2021/01/24/stock-market-futures-open-to-close-news.html