Investment Commentary – May 18, 2021

Year to Date Market Indices as of May 18, 2021

• Dow 34,060 (11.29%)

• S&P 4,127 (9.9%)

• NASDAQ 13,330 (3.22%)

• Gold $1,870 (-1.66%)

• OIL $66.06 (36.39%)

• Barclay Bond Aggregate (-2.54%)

• Fed Funds Rate 0-0.25 (0-0.25)

JP Morgan Thought of the week

With more than 90% of S&P 500 market cap having reported earnings, our current estimate for 1Q21 operating earnings per share (EPS) is $47.29, representing year-over-year growth of 143%. In a sharp departure from 2020, these positive results have been spread across all sectors, with those areas of the market hit hardest by pandemic now leading the charge.

The energy sector is tracking earnings growth of over 900% following the collapse in energy prices a year ago, while financials are expected to see earnings growth of 146% as massive loan loss reserve releases, a steeper yield curve and robust capital markets activity offset weak loan demand. Additionally, increased levels of consumer spending and mobility have supported results in consumer discretionary and industrials, which are currently tracking growth of 118% and 39% versus a year ago, respectively.

Looking ahead, earnings growth should be very strong in 2021, but could slow as profit margins come under pressure next year; many management teams cited profit headwinds stemming from higher input costs in their quarter results, noting the impact of rising commodities prices and transportation costs specifically. These findings are further evidenced by the April CPI report, which saw the largest monthly increase in more than a decade. Although this surge is likely “transitory,” it reflects a rapidly improving economy, strengthening the case for cyclical stocks and posing a challenge for long-duration bonds.

News Around The web:

Fed chatter: In the wake of April’s spike in consumer prices; comments from U.S. Federal Reserve policymakers reiterated their belief that they don’t see any short-term need to depart from currently accommodative monetary policies. On Thursday, for example, one member of the Fed’s governing board said that he’ll need to see several more months of data on jobs and inflation before determining when to begin tightening policies.

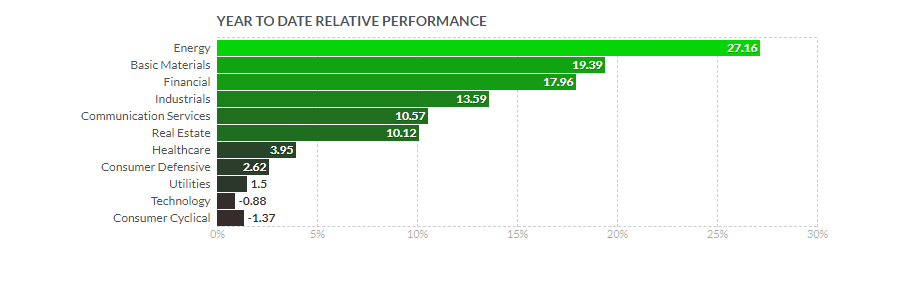

Value’s comeback: Large-cap U.S. value stocks again extended their run of year-to-date outperformance versus their large-cap growth counterparts, beating them for the fourth week in a row. A value stock benchmark slipped about 0.7% while a growth benchmark fell about 2.0%.

Earnings catalyst: With earnings season now almost over, the earnings growth rate could end up as the fastest for any quarter in 11 years, according to FactSet. As of May 10, first-quarter earnings of companies in the S&P 500 were up more than 49% from the same period a year earlier―more than double the 24% rate that analysts had projected at the end of March.

Today in Stock Market History:

1801: Well over a century after stock trading began in Britain, the cornerstone of the stock exchange building is finally laid in the City of London.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

https://finviz.com/groups.ashx (YTD Performance Chart)

https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/weekly-market-recap/