Hello again,

May is here, flowers and trees are blooming, and the weather is warming up. May is my favorite month of the year. Every day gets longer and I love waking up to sunlight, and the sun stays out long into the night. Plus lots of outdoor activities, and summer is right around the corner. I’m not a cold weather guy. I find as I get older, I like the winter less and less. So happy SPRING to everyone.

Please check your junk/spam folder for any emails from Kellie@affinityasset.com please. Kellie is Affinity’s Vice President. We are being told by some that they are not receiving emails when we have verified those emails are being sent to correct email addresses. We want to make sure you are seeing any invitation to the webinars, Community Café, and other Affinity communication.

Performance DJIA:

Mon 5/11 -0.45%

Tues 5/12 -1.89%

Wed 5/13 -2.17%

Thurs 5/14 +1.62%

Fri 5/15 +0.25%

Last week -2.65% (4 weeks in a row, very little change)

Since 2/19 market high -19.29%

Bond model you are in:

Last week +0.10%

Since bought in -0.26%

Tid Bits:

1. We have stopped sending the weekly blog emails that you receive on Mondays. These blogs were an article on current events that we find and email to everyone. That is being stopped so everyone can receive these emails for now instead. Mondays, we are emailing in the afternoon these Affinity Coronavirus update emails, as well as invitations to watch on zoom.com or on Facebook, our Community Café.

a. Times like this, we want to give all our clients opportunities to stay up to date on the latest information, yet try not to over burden you with too many touches.

b. Please go back over the past several weeks and look for any emails from Kellie@affinityasset.com and un-spam/un-junk those so you can start to get them into the future.

2. We are heading into our 5th week of low volatility. 5 weeks of not a lot of ups or downs in the market.

a. During these times, it takes very little information “to move the needle”. A little positive news, makes the market go up, but just a little. Some bad news, makes the market go down, but just a little as well.

b. Remember to stay patient as Affinity does have a plan to re-enter the market, we just need the market to give us dips so we can buy in lower.

c. Reminder of sequence of events. The stock market reacts very quickly and the economy reacts very slowly. In this case with Coronavirus and the Stay at Home Order, this is the first time the economy reacted very quickly. Just because the economy moved quickly to turn off, does not mean it will move quickly to turn on. All the vast information we have access to points to the economy turning on like a Nike swoosh, slow climbing. And we are not there yet. We ARE NOT in the healing stages yet. With these economic conditions, analysts and economists believe there are more W’s (ups and downs) to come with the stock market.

d. As we try to remind our clients, we want to get back in the market just as much as they do, we have yet to see a down turn. And many down turns are still expected as more and more effects of unemployment and the stay at home order will later show themselves.

e. This is also an Election year. Negative campaigning is expected and then nasty debating, thus causing volatility and more market swings, in both directions.

3. Next week, is Memorial Day week, Monday 5/25/20. Affinity wants to say thank you to all our military personnel and veterans. We all thank you for your support.

a. If this week turns into a relatively minimal moving week in the market, and next week being a short week, we will skip the Monday email and Wednesday teleconference. We will get to the end of this week to determine this.

4. Comments from the Federal Reserve chief also added to the bullish sentiment.

a. Federal Reserve Chairman Jerome Powell said to CBS’ “60 Minutes” that “there’s a lot more we can do” to help the economy. “We’ve done what we can as we go. But I will say that we’re not out of ammunition by a long shot. No, there’s really no limit to what we can do with these lending programs that we have.”

b. Interesting to note here, last week he commented a “prolonged recession”, and the markets bumped up a bit last week. Now this weekend, he gave a different tone. Literally just days later saying two different things, and the market is reacting both directions.

Facts:

1. Coronavirus

a. Global 4,827,272 cases, 317,174 deaths

b. US 1,528,179 cases, 90,988 deaths (+10,199, 12.6% increase from last week)

c. KS 7,953 cases, 195 deaths

d. MO 11,057 cases, 604 deaths

Highlights from analysts and economists:

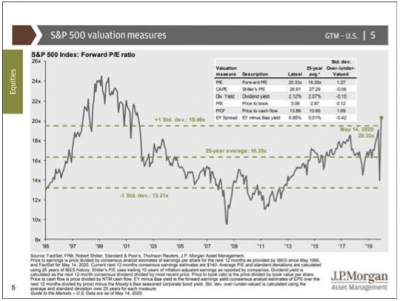

1. This graph is showing the latest spike in P/E ratio after the CARES stimulus package came out, creating a rebound.

a. The 25 year average of the S&P500 PE ratio is 16.35x

b. We are currently at 20.85x.

c. This has also created a +1 in standard deviation which is big jump in risk.

d. Look at the far right of this graph, and see how it dropped after the announcement of the Stay at Home order.

e. Then after it dropped, it bounced back up and went even higher than before the Coronavirus hit.

f. Short term large spikes up or down, are causing Affinity and analysts and economics we get information from, some concerns.

2. From JP Morgan

a. With “stay at home” orders across the U.S. approaching previously announced deadlines and slowly coming to an end, investors and policymakers alike hope that a reopening of the U.S. economy will mark the start of the recovery. However, while turning off the economy was as easy as flipping a light switch, reopening the economy will require the use of a dimmer, as it is a far more complex and gradual process. High frequency data can help measure economic activity in real time. While the data broadly shows that economic activity remains depressed and suggests that there has not been a large pick-up in economic activity following these re-openings, it is reassuring that some of these indicators have seemingly troughed, suggesting that barring a second wave of infections, the worst could be behind us. Additionally, the divergence among industries, in both the severity of declines and reopening progress, suggests not only that certain industries were hit harder than others as a result of this shutdown, but also that the reopening process will not be uniform across industries. Overall, we continue to believe that the economy is currently experiencing the steepest decline since World War II, and that growth will remain muted throughout the remainder of the year as businesses partially reopen. However, we do anticipate a surge in economic growth once a vaccine or viable treatment becomes available, which will likely be around the middle of 2021.

3. From Pimco-Conference call on Friday 5/15/20

a. PIMCO sees additional stimulus coming in June – likely in the $1-1.5 trillion range.

b. They see a 10% “peak to trough” contraction in the economy. They see a 40% annualized contraction in GDP in the 2nd quarter.

c. They see a short-lived contraction with a gradual recovery.

d. There will likely be an uneven recovery, with a 6% contraction for 2020.

e. Economy could take until 2022 to fully recover.

f. Federal Reserve is likely “on hold” until the end of 2022, beginning of 2023.

g. Widespread re-occurrence of the virus is possible.

h. Regarding the election, there is a massive structural advantage for the incumbent.

i. While there are many “swing” states, PIMCO sees 5 battleground states: Florida, Pennsylvania, Wisconsin, Michigan, and Arizona

4. From Franklin Templeton

a. The April jobs report has brought home the catastrophic impact that the lockdown has inflicted on US workers. Non-farm payrolls suffered the largest decline on record, falling by 20.5 million and bringing employment back to early-2011 levels. The unemployment rate jumped by more than ten percentage points to 14.7%, corresponding to 16 million more unemployed people. The broader “U6” measure, which includes workers marginally attached to the labor force or working part time for economic reasons (namely unable to find full-time work), jumped to nearly 23%.

b. Don’t let the financial markets’ reaction fool you, however. The labor market has suffered a tremendous blow, and now faces a formidable challenge to rebuild jobs and livelihoods. To get the full sense of the damage, consider the following: while the ranks of the unemployed swelled by 16 million people, once we add workers marginally attached to the labor force or working part time for economic reasons, we get to almost 22 million jobs lost—broadly equal to the decline in employment. To these numbers we must add the roughly 6.4 million people who exited the labor force.

c. And finally, we have seen a sharp increase (about 5.5 million) in workers classified as “working but absent from work”: they remain attached to their employers but are not actively working . This brings us to close to 34 million people—broadly in line with the 33 million who filed jobless claims.

d. If states move at a rapid pace to reopen their economies while deploying smart, targeted measures to keep contagion under control and protect those most vulnerable to the virus, we can still make fast progress in reducing unemployment to less daunting levels. Time, however, is not on our side; the longer unemployment hovers at the current stratospherical levels, the harder it will be to get the economy going again—and the greater the long-term human and economic costs.

5. From CNN Jeffrey D Sachs (news type news-more drama-not from analysts and economists)

a. Of the record 20.5 million jobs lost in April, most will not come back any time soon, whether or not states declare their economies open. The continued spread of the virus itself will block any meaningful rapid recovery. So too will deep structural changes that will cause a significant, albeit unknowable, proportion of today’s job losses to be permanent.

b. Many business firms will reorganize their workflows to allow for far more work from home, and this will leave office complexes sparsely populated. Many companies will downsize their space, meaning new commercial construction will remain depressed for years to come.

c. But there are three true steps out of the new great depression.

i. First, and most urgently, we must end the epidemic through the public health measures — testing, tracing and quarantining — that Trump has consistently neglected.

ii. Second, we must work with other countries, including China, to stop the epidemic everywhere in the world so that trade and travel can safely resume, and so that the millions of jobs dependent on trade, transport and tourism are at least partly restored.

iii. Third, we must build new industrial and service sectors, not prop up the old and moribund ones. Recovery will come not through oil and gas fracking, but through a boom of US companies producing solar panels, wind turbines, advanced batteries, advanced electric vehicles and the hardware and software of smart grids; combined with a service industry boom based on new models of low-cost healthcare, education and office work, that combines online and in-person service delivery.

Opportunities:

1. Community Café is Wednesday, May 20 at 8:00am for 30 minutes. Topic will be 5 Critical Estate Planning documents to have to protect your family, money, and property.

a. Will live stream on Facebook Live anyone who is friends with me on Facebook.

b. Email invitations were sent to join on the Zoom.com platform

c. Co-Hosted by Glenn Stockton with Stockton & Stern

d. Invitations will go out via email with a link to join, plus those who are friends with me on Facebook

2. Estate Planning webinar on Tuesday, May 19th at 12:00 noon for 1 hour and 15 minutes

a. Pros and cons of a Will based estate plan

b. Pros and cons of a Trust based estate plan

c. Co-hosted by Glenn Stockton with Stockton & Stern Law firm

d. Interested in attending? Please email Stacy at Stacy@affinityasset.com

3. Referrals – Please share us with your loved ones

4. Roth Conversions

5. Taking withdrawals

a. We never want to discourage you for taking withdrawals. However, the more you leave in the account, the more you will have working for you in our diversified investment mixture when the market goes up. If you need money always feel free to give us a call so that we can collaborate on what is best for your specific situation

6. If you are still working, call your 401K company, (not your HR department of your employer) and ask if you have access to an “in-service rollover”. And if you do, let us know ASAP as there are potential large benefits that you don’t have at work in that 401K.

Reminders:

1. Don’t forget that the news creates drama. The stock market moves for 2 reasons which are greed and fear.

2. Any service work you would like us to do for you, please email your request to us.

3. We are being told by our broker/dealer, Client One Securities (CIS), that your brokerage accounts should now be able to integrate with your personal tax software for those who do their own tax returns. Any problems or questions on this, can be directed to C1S directly at 913-814-6097

Please feel free to share this email and/or the teleconference information as the best way to battle anxiety is education

Thank you for your time in reading these updates.

Please share them with anyone you want to help

Stay safe and stay healthy,

Mark Roberts