Investment Commentary – March 16, 2021

Year to Date Market Indices as of March 16, 2021

• Dow 32,825 (7.25%)

• S&P 3,962 (5.50%)

• NASDAQ 13,471 (4.53%)

• Gold $1,730 (-9.02%)

• OIL $34.12 (27.84%)

• Barclay Bond Aggregate (0.98%)

• Fed Funds Rate 0-0.25 (0-0.25)

Blackrock Weekly Commentary: A strong restart, not a recovery

Restart underappreciated

We lay out three reasons why we see a strong economic restart, rather than a normal recovery, and believe markets still underappreciate its size and speed.

Market backdrop

U.S. Treasury yields hit 13-month highs. We see the recent rise in real yields as justified given the growth outlook and remain tactically pro-risk.

Central banks in focus

Investor focus is set to shift to policy meetings of major central banks for their reaction to rising yields, after passage of the $1.9 trillion U.S. fiscal package.

We see the path out of the Covid-19 shock as a “restart” – not a typical business cycle “recovery.” The key reasons are the distinct nature of the shock, broad-based pent-up demand and different inflation dynamics. The passage of a $1.9 trillion fiscal package and an accelerating vaccination ramp-up in the U.S. magnify these factors, and we believe the restart will likely be stronger than markets expect.

The bottom line: We see a much stronger post-Covid economic restart than what we would expect in a normal recovery. The rapid upward adjustment in U.S. Treasury yields and more muted movement in inflation-adjusted yields make sense in this respect, and are still consistent with our New nominal theme. The restart bolsters our pro-risk stance over the next six to 12 months, and makes us lean further into cyclical assets.

Around The Web

COVID-19 relief: Following its narrow approval in Congress, a $1.9 trillion COVID-19 relief bill was signed into law on Thursday by President Biden. In addition to helping fund vaccinations, the measure will provide a $1,400 check to many Americans, extend a $300 weekly jobless-aid supplement, and expand the child tax credit for one year.

Value leads growth: For the fourth week in a row, U.S. value stocks outperformed growth stocks—a short-term shift that threatens to reverse the growth style’s run of outperformance in recent years. A value stock benchmark gained 3.2% while a growth benchmark added 2.5%; over four weeks, the value index rose 5.9% while its growth counterpart fell 5.5%.

Fed ahead: The U.S. Federal Reserve is widely expected to keep its benchmark interest rate unchanged—and at a near-zero level—when it concludes a two-day meeting on Wednesday. Fed statements will be closely watched in the wake of a recent rise in bond yields, driven in part by inflation concerns.

Upcoming Events

Wednesday

U.S. Federal Reserve Board concludes two-day policy meeting, Chairman Jerome Powell holds press conference

Today in Stock Market History

1933: President Franklin D. Roosevelt takes the U.S. off the gold standard, removing the yellow metal from coinage and circulation, even banning it as a collectible.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

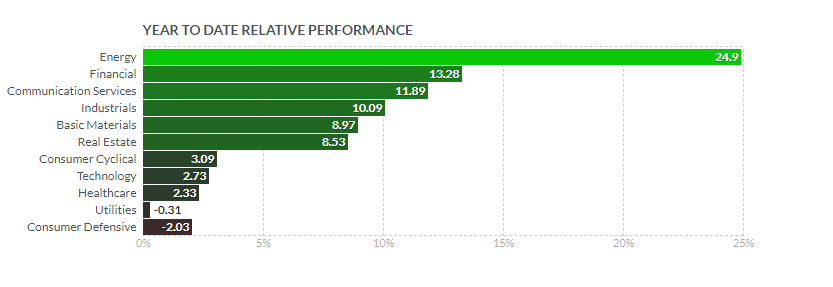

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.blackrock.com/us/individual/insights/blackrock-investment-institute/weekly-commentary

Securities Offered Through Client One Securities, LLC Member FINRA/SIPC and an Investment Advisor. Advisory Services Offered Through Client One Securities, LLC and ChangePath, LLC.

Affinity Asset Management, LLC, ChangePath, LLC and Client One Securities, LLC are separate entities.