Investment Commentary – June 30, 2021

Year to Date Market Indices as of June 30, 2021

• Dow 34,097 (12.41%)

• S&P 4,276 (15.39%)

• NASDAQ 14,559 (13.13%)

• Gold $1,757 (-7.57%)

• OIL $73.72 (52.21%)

• Barclay Bond Aggregate (-2.85%)

• Fed Funds Rate 0-0.25 (0-0.25)

• Annual Inflation Rate 5% (As of 6/1/21)

A key indicator shows we are past peak inflation fear, supporting the stock market rally

*Over the past month, inflation fears have abated, and a chart diagramming the trend could be signaling the next leg up in the market.

*The 5-year breakeven rate is now at 2.45% while the 10-year sits at 2.33%, indicating that markets see inflation falling over a longer time frame.

One of the biggest fears investors have faced this year is the threat that inflation could run amok and thwart the post-pandemic economic recovery.

But over the past month, those fears have abated significantly, and a chart diagramming the trend could be signaling the next leg up in the stock market.

A popular measure of market anticipation for inflation is the difference between Treasury yields and inflation-indexed bonds of the same duration. The metric is known as the “breakeven” rate, and investors and economists most often look at the 5- and 10-year spreads.

After rising in May to their highest levels in about eight years, those breakeven rates have been falling consistently, indicating that investors no longer see inflation maintaining its current blistering pace far into the future. The 5-year breakeven rate is now at 2.45% while the 10-year sits at 2.33%, indicating that markets see inflation falling over a longer time frame.

“To us, this signals that markets are starting to give up on the idea of structurally higher US inflation,” DataTrek Research co-founder Nick Colas wrote. “Looking into the back half of 2021, this may well be the single most important data point to watch.”

Inflation is important to investors because higher prices can eat into company profits.

But those price pressures also can signal the economy is running too hot. In turn, that can cause the Federal Reserve to start tightening monetary policy. That would mean higher interest rates and the likelihood that the central bank would turn off the spigots on its monthly bond buying program, which currently is running at a pace of at least $120 billion.

However, Fed officials have been steadfast in their view that the current spate of inflation is “transitory.” The assertions come even though the personal consumption expenditures price index, which is the Fed’s preferred inflation gauge, increased 3.4% year over year in May excluding food and energy prices. Headline consumer price index inflation ran at a 5% clip for the month.

Those levels are well above the Fed’s 2% goal, and some officials have conceded that inflation has been stronger and more persistent than they had anticipated.

Richmond Fed President Thomas Barkin said Monday that market-based inflation measures like the breakeven rates “at least give me some comfort” that expectations are for a cooling-off in the long run. But he added Tuesday that the current pace “reasonably” meets the Fed’s “substantial further progress” inflation goal, even while the labor market is falling short.

The market view

To be sure, the inflation question is far from settled.

Allianz chief economic advisor Mohamed El-Erian warned Monday that the Fed is falling behind the inflation curve and may be forced to tighten policy quickly, potentially causing a recession down the road. Market heavyweights such as hedge fund billionaire Paul Tudor Jones and Bank of America CEO Brian Moynihan have called on the Fed to take its foot off the pedal as inflation increases.

But from the market’s perspective, Treasury yields have been dropping consistently and stocks have continued to set a succession of new records.

“If inflation expectations start to pick up again, markets will rightly worry if the Federal Reserve will have to raise rates sooner,” DataTrek’s Colas wrote. “If they continue to trend lower, then the market’s expectation of one rate increase in 2022 will be a safe assumption.”

Fed officials did pull forward earlier this month their expectations for the next rate hike to 2023, but it was a narrow miss for 2022, and market participants think an increase could come earlier than the central bank forecasters anticipate.

Colas sees a solid path ahead for stocks, based on a low-inflation environment combined with an accommodative Fed and a solid earnings picture.

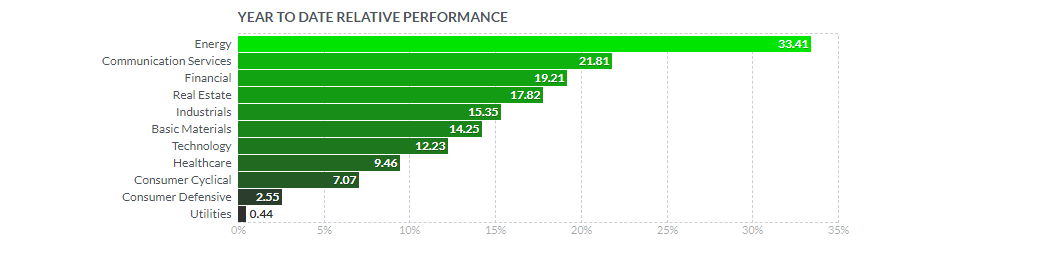

Analysts collectively see a 12.2% gain for the S&P 500 over the next 12 months. Colas said he remains most bullish on energy and financials.

News Around The web:

Positive earnings outlook: Ahead of the mid-July start of quarterly earnings season, nearly twice as many companies that have issued guidance prior to their earnings releases raised their expectations compared with the number that lowered their forecasts. Sixty-six companies in the S&P 500 had issued positive guidance as of Friday, while 37 had issued negative guidance, according to FactSet.

Oil’s rise: U.S. crude oil prices climbed for the fifth week in a row, rising 4% and reaching $74 per barrel—the highest level since October 2018. As recently as early April, oil was trading below $60.

Jobs ahead: A monthly employment report scheduled to be released on Friday will show whether recent moderation in jobs growth carried over into June. The last monthly report, released in early June, showed that the economy generated 559,000 new jobs in May compared with 278,000 in April and 785,000 in March.

Fed’s inflation outlook: A week after U.S. Federal Reserve members lifted their inflation forecast at their latest policy meeting, Fed Chairman Jerome Powell largely downplayed inflation concerns in testimony before Congress. Powell said he continues to believe that the recent spike in consumer prices will eventually ease, although he did acknowledge economic uncertainty will persist as pandemic restrictions are lifted.

Infrastructure breakthrough?: After months of negotiations, President Biden and a bipartisan group of senators announced an agreement on a roughly $1 trillion plan to improve the nation’s physical infrastructure. The White House will now try to move the package through Congress alongside a broader measure sought by Democrats that extends to nontraditional forms of infrastructure.

THIS DAY IN FINANCIAL HISTORY

Infrastructure breakthrough?

After months of negotiations, President Biden and a bipartisan group of senators announced an agreement on a roughly $1 trillion plan to improve the nation’s physical infrastructure. The White House will now try to move the package through Congress alongside a broader measure sought by Democrats that extends to nontraditional forms of infrastructure.

Views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.cnbc.com/2021/06/29/this-chart-shows-we-are-past-peak-inflation-fear-supporting-the-stock-market-rally.html