Investment Commentary – June 23, 2021

Year to Date Market Indices as of June 23, 2021

• Dow 33,895 (11.74%)

• S&P 4,241 (14.43%)

• NASDAQ 14,273 (10.89%)

• Gold $1,783 (-6.25%)

• OIL $73.72 (52.21%)

• Barclay Bond Aggregate (-2.85%)

• Fed Funds Rate 0-0.25 (0-0.25)

Annual Inflation Rate 5% (As of 6/1/21)

S&P 500 ends volatile day slightly higher, Apple pushes Nasdaq to another record close

The S&P 500 erased earlier losses and rose slightly to a record on Monday as investors prepared for a busy week of earnings featuring reports from the largest tech companies.

The broad equity benchmark closed the volatile day 0.4% higher at a new record close of 3,855.36. The S&P 500 fell 1.2% at its low of the day. The tech-heavy Nasdaq Composite gained 0.7% to reach a fresh closing high of 13,635.99. The Dow Jones Industrial Average, less susceptible to changes in technology shares, dipped 36.98 points, or 0.1%, to 30,960.00. At its session low, the 30-stock benchmark dropped more than 400 points.

This coming week, 13 Dow components and 111 S&P 500 companies are set to report earnings. Among the quarterly reports on deck include those from Apple, Microsoft, Netflix, Tesla, McDonald’s, Honeywell, Caterpillar and Boeing.

Apple shares gained 2.8% to an all-time high before its quarterly report Wednesday after the bell. Tesla, which also reports Wednesday, popped 4% to hit a record.

“The Street is anticipating robust results from Apple on Wednesday after the bell with Cupertino expected to handily beat Street estimates across the board,” wrote Dan Ives of Wedbush, who raised his 12-month price target on Monday to $175. “While the Street is forecasting roughly 220 million iPhone units [for 2021], we believe based on the current trajectory and in a bull case Cupertino has potential to sell north of 240 million units.”

Highly speculative action in stocks like GameStop was unnerving some investors, causing worry that parts of the market had detached from fundamentals and could cause the broader market to take a hit when the mania ends.

Shares of the brick-and-mortar video-game retailer soared more than 140% to top $150 at one point Monday as a slew of retail investors active in online chat rooms aimed to squeeze out short sellers. GameStop briefly turned negative in wild trading before closing 18% higher. Other heavily shorted names, including Bed Bath & Beyond, also jumped higher on Monday amid the buying frenzy.

“Signs of excess continue to concern investors, with markets at near-record highs on a variety of valuation metrics,” said Mark Hackett, Nationwide’s chief of investment research. “Other signs of extreme optimism include put-call ratios, credit spreads and momentum indicators.”

Companies kicked off the earnings season on a strong note. Of the S&P 500 components that have already reported earnings, 73% have beaten on both sales and EPS, according to data from Bank of America. The firm said this is tracking similar to last quarter when the number of companies beating hit a record.

Wall Street was coming off a winning week amid the strength in the technology sector. The Dow and the S&P 500 gained 0.6% and 1.9%, respectively. The Nasdaq advanced 4.19% last week for its best week since November as shares of Big Tech names pushed the index to a record.

The move higher came as President Joe Biden tries to push through a $1.9 trillion stimulus program that many congressional Republicans oppose. The fiscal aid includes direct checks to millions of Americans, aid to state and local governments, funding for Covid vaccines and testing, a boost to the minimum wage and enhanced unemployment benefits, among other things.

News Around The web:

Fed reality check: A revised outlook issued by the U.S. Federal Reserve on Wednesday rippled across the markets, weighing on stocks and many other assets. Policy makers signaled that they expect to raise interest rates by late 2023—sooner than the Fed had previously projected—and members also boosted their inflation forecast.

Value slump: For the second week in a row, an index of value-oriented stocks trailed a growth-stock benchmark by a wide margin, with value tumbling 4.1% compared with a 0.5% gain for growth. The result chipped away at value’s year-to-date outperformance relative to growth.

Uneven retail: U.S. retail sales fell 1.3% in May, more than most economists had expected. Analysts said recent retail data show that consumers may be spending less at department stores and more on restaurants, lodging, and travel as vaccination rates rise.

THIS DAY IN FINANCIAL HISTORY

1836: With the U.S. national debt eliminated in 1835, and the federal budget running a huge surplus, Pres. Andrew Jackson’s plan to distribute the surplus to the states is enacted. Jackson repeatedly declares that with no more national debt, the U.S. will “always” have a budget surplus. Here’s a better signal of what the future really holds: By the time the distribution is actually paid out, in 1837, it has already shrunk below $37.5 million, 25% less than the government’s original estimate of $50 million.

Views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

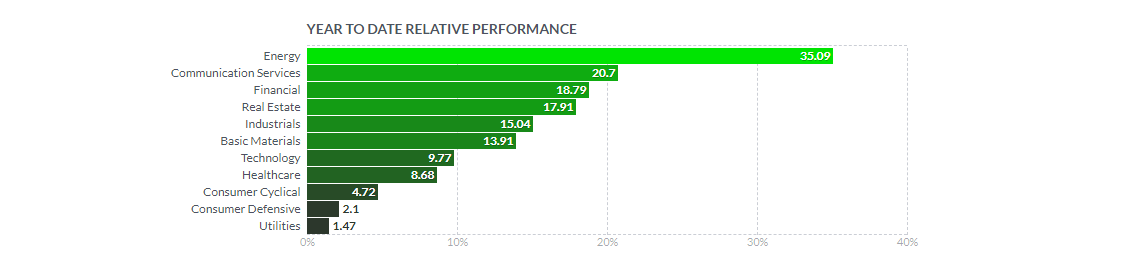

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.cnbc.com/2021/01/24/stock-market-futures-open-to-close-news.html