Investment Commentary – February 9, 2021

Year to Date Market Indices as of February 9, 2021

• Dow 31,375 (2.51%)

• S&P 3,911 (4.13%)

• NASDAQ 14,007 (8.69%)

• Gold $1,838 (-3.31%)

• OIL $58.33 (20.47%)

• Barclay Bond Aggregate (-1.03%)

• Fed Funds Rate 0-0.25 (0-0.25)

Stocks Close Narrowly Mixed, As Leading Stocks Shine

The stock market shook off early weakness as indexes closed mixed, but leading stocks spearheaded gains.

Small caps led the stock market as the Russell 2000 added 0.5%. The Russell, Nasdaq composite and S&P 500 made record highs for the fourth consecutive day, even though they tailed off in the final minutes.

The Nasdaq was the first of the major indexes to climb out of negative territory Tuesday. It closed 0.1% higher. The S&P 500 eased 0.1% as gains faded late.

The Dow Jones Industrial Average made a new high also, but closed fractionally lower. Its 30 components were pretty quiet. Walt Disney (DIS) fell but held above the 183. 50 buy point of Monday’s breakout.

Volume rose on the Nasdaq and fell on the NYSE, unconfirmed numbers showed.

While there is reason to be cautious about the stock market and many stocks look hyperextended, investors were in the mood to buy growth stocks Tuesday.

Innovator IBD 50 ETF (FFTY) rallied 0.8% and is up in six of the past seven sessions. 360 DigiTech (QFIN) surged about 16% and SciPlay (SCPL) roared 15%, both to new highs. Digital game publisher SciPlay gapped past the 18.85 buy point of a handle in heavy volume. 360 Digitech jumped more than 30% in just two weeks from its 18.16 entry.

Dozens of Breakouts in Stock Market

More thaNautilus (NLS) broke out of a cup with handle base in heavy volume. The fitness equipment maker closed a bit extended from the 27.65 buy point.

Affirm Holdings (AFRM) broke out of an IPO base, but shares closed below the 138.08 buy point. Affirm provides online commerce tools for merchants.

SelectQuote (SLQT) jumped above the 25.90 buy point of yet another cup with handle. Volume swelled after Barclays raised the price target to 36 from 32 on the provider of insurance products for seniors.

HanesBrands (HBI) soared 25% to a new high after the apparel maker beat profit and sales expectations. A breakaway gap for the stock means a higher buy point than normal. Even so, shares are extended.

Comcast (CMCSA) edged above the 52.59 buy point of a flat base, but volume was pale. Inovalon (INOV) cleared the 27.60 buy point of a cup with handle, but the health care software provider closed with most of the day’s gain gone.

Transportation and industrial sectors were among Tuesday’s best. Communications services, where Alphabet (GOOGL) and Facebook (FB) are the largest stocks, also climbed. Energy, materials and consumer discretionary were some of the poorest S&P sectors. Two dozen stocks topped buy points, including several quality companies.

Around The Web

Rebound rally

The major U.S. stock indexes posted weekly gains from around 4% to 6%, more than making up for the previous week’s losses. The S&P 500 and the NASDAQ set new record highs, eclipsing their levels from a couple weeks earlier, while the Dow was just 0.001% shy of its record.

Small-cap sizzle

Small-cap stocks extended their recent run of outperformance relative to their large-cap peers, as the Russell 2000 Index, a small-cap benchmark, posted a nearly 8% gain to set another record high. Since the end of September 2020, the Russell 2000 has surged 48%.

Stimulus movement

The weak U.S. jobs report was seen as a positive catalyst for stocks, which climbed modestly on Friday amid expectations that labor market stagnation could increase pressure for further economic stimulus. The Senate narrowly backed President Biden’s $1.9 trillion plan, setting up the prospect that the measure could eventually secure final approval through a reconciliation process with a simple majority in the Senate.

Earnings momentum shift

Fourth-quarter earnings results continued to improve, and U.S. companies are now expected to report a modest overall earnings increase, rather than the small decline that had been forecast just a week earlier. With results in from 59% of companies in the S&P 500 as of Friday, earnings were projected to end up 1.7% higher than they were a year earlier, according to FactSet. Senate.

Upcoming Events

Thursday: Weekly unemployment claims, U.S. Department of Labor

Today in Stock Market History

February 09:

1969: A giant new jet airplane — 231 feet long, weighing 735,000 pounds, and capable of carrying up to 490 passengers — makes its maiden flight. Before long, the Boeing 747 has made jet flight a commonplace of daily life for millions of travelers.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

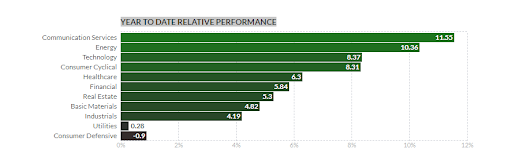

https://finviz.com/groups.ashx (YTD Performance Chart)

Securities Offered Through Client One Securities, LLC Member FINRA/SIPC and an Investment Advisor. Advisory Services Offered Through Client One Securities, LLC and ChangePath, LLC.

Affinity Asset Management, LLC, ChangePath, LLC and Client One Securities, LLC are separate entities.