Good morning and happy Chiefs week this week. Expectations are high for the Chiefs. I am excited but nervous.

Again, we apologize for the delay in the January email, there were new industry regulations and new compliance that caused the delay in approving the email.

All our mass communications are approved by compliance before we can send them out.

This email is timely considering all the news last week on GameStop as well as RobinHood.

First, let me say that Affinity Asset Management does not short the market or buy investments on margin. This is a very aggressive behavior where the downside can be considerable.

See information below on additional details.

Performance

January 1st-31st, 2021

DJIA -2.04% 30 US stocks/0 Bonds

S&P500 (no Dividends) -1.11% 500 US stocks/0 Bonds

AAM Growth #1 -0.48% 20%S/80%B

AAM Growth #2 -0.16% 40%S/60%B

AAM Growth #3 -0.18% 60%S/40%B

AAM Growth #4 -0.19% 73%S/27%B

AAM Growth #5 -0.32% 88%S/12%B

AAM Growth #6 -0.32% 99%S/1%B

**We keep 1%-2% in cash, which is reflected under the Bond (B) side.**

**AAM=Affinity Asset Management**

**AAM models are showing net of average annual fee of 1.28% (some fees are higher and lower based on individual asset size) (fees are deducted 1/12 of the annual fee each month)

Tid Bits:

Your next stimulus check: Congress to speed along $1,400 payments this week

- Congress plans to take steps this week toward quickly passing President Joe Biden’s coronavirus aid proposals, including a third wave of direct relief payments for most Americans.

- The next batch of stimulus checks would be for $1,400 — to top off the $600 payments that started going out in late December. Democrats and former President Donald Trump had wanted to provide $2,000 in that round but were thwarted by Republicans leading the Senate at that time.

- Now, there’s a new Senate, with Biden’s Democratic party in control. That could make it easier for the new checks to pass, though there are a few potential challenges.

- Here’s what to expect this week, plus the latest estimate on when you’re likely to get more cash:

- Biden has announced a wide-ranging $1.9 trillion COVID rescue package, containing the new stimulus checks. He says the recent $600 payments were “simply not enough.”

- The first $1,200 relief payments Americans received last spring were largely spent on expenses for just getting by, including groceries and rent, the U.S. Bureau of Labor Statistics has said.

- What’s the possible timing on 3rd checks?

a) Some members of the party are already talking about a potential plan B if there’s a struggle to pass the president’s entire aid package. They say the $1,400 direct payments and money for vaccine distribution could be pulled out into a separate bill that might win quick approval, maybe with support from Republicans.

b) If both the House and Senate are able to approve the new stimulus checks early next month — which is indeed possible — you could receive yours by late February. But if there are any snags — and those are also possible — you might have to wait until March or even April.

://finance.yahoo.com/news/next-stimulus-check-congress-speed-153600418.html

From Fox News

- If you’re confused as to why GameStop is shaking up Wall Street, you’re not alone.

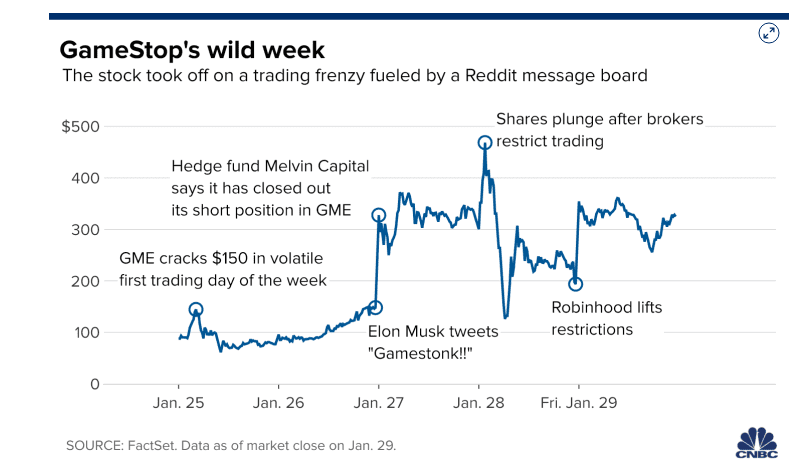

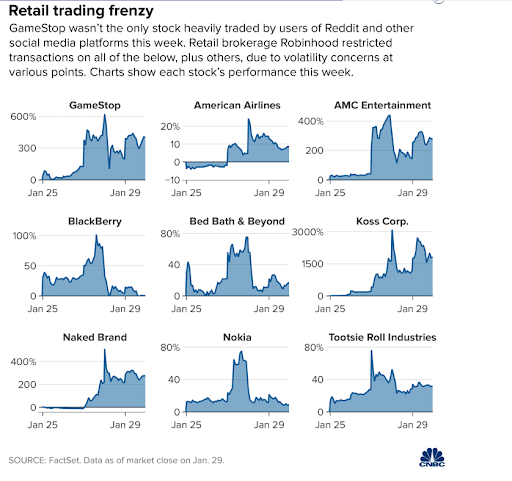

- Earlier this week, trading volume surged in shares of GameStop, AMC Entertainment, as well as Bed Bath & Beyond and BlackBerry, stunning Wall Street firms betting that the value of those stocks would fall.

- The surges came from small retail investors with trading accounts ranging from $500 to $2,500 banding together in an economic tug-of-war against major investment firms.

- Companies like Citron Research and Melvin Capital had placed bets that GameStop shares would fall in a practice called short selling.

- What is short selling?

- It’s how investors can make money off a stock falling.

- In a short sale, they borrow a share of GameStop and then sell it. Later, if the stock price does as they expect, they can buy the stock at a lower price and keep the difference. GameStop is one of the most heavily shorted stocks on Wall Street.

- But small-time investors weren’t having it. They banded together, helping to raise the stock price of GameStop to stunning levels.

- These smaller investors are using Reddit and other discussion boards to encourage each other to buy GameStop resulting in what’s known as a short squeeze.

- One Reddit group in particular, “WallStreet Bets” consists of discussions full of ideas for the next big trade to jump on, self deprecation and an appreciation of both winning and losing bets — as long as they’re bold.

- They’ve recently been encouraging each other to keep buying GameStop to push it even higher, or “to the moon.”

- After sitting at around $18 per share three Fridays ago, GameStop’s stock value doubled in four days. It kept shooting higher, before nearly doubling on Tuesday and then more than doubling again on Wednesday to $347.51. On Thursday, it gave back a chunk of those gains and finished the day at $193.60, down 44%. But it was still up an amazing 928% through the first few weeks of 2021.

- While short selling can be profitable, the practice is not without risk: Gains from short selling are limited (a stock can only go to zero), but the losses don’t have a cap as there is no limit as to how high a stock’s price may climb.

- Short-selling is loathed by many CEOs, including Tesla’s Elon Musk, who declared that the practice “should be illegal.”

- What is a short squeeze? It’s what happened with GameStop’s stock.

- When a stock is very heavily shorted, a rise in its price can force short sellers to get out of their bets.

- To do that, they have to buy the stock, which pushes the stock even higher and can create a feedback loop. As GameStop’s short sellers have gotten squeezed this month, smaller and first-time investors have been egging each other on to keep the momentum going.

https://www.fox13news.com/news/gamestop-stock-explained-heres-what-short-selling-is-and-why-its-shaking-up-wall-street

From CNBC

- GameStop, Reddit and Robinhood: A full recap of the historic retail trading mania on Wall Street

- PUBLISHED SAT, JAN 30 20219:40 AM ESTUPDATED SAT, JAN 30 202110:14 AM EST

- Shares of GameStop skyrocketed 400% in the past week, closing out January with a whopping 1,625% gain.

- A band of amateur traders on WallStreetBets aimed to bid up heavily shorted stocks “to the moon,” creating massive short squeezes.

- Members in the Reddit forum have tripled to 6.5 million in just a week.

- The mania backfired on free-trading pioneer Robinhood, which had to throttle back trading in the short-squeeze names and raise new funds to meet rising deposit requirements with its clearinghouse.

- GameStop mania took Wall Street by storm, thanks to a legion of retail traders glued to the WallStreetBets message board on Reddit.

- Shares of the struggling brick-and-mortar video game retailer skyrocketed 400% in the past week, closing out January with a whopping 1,625% gain. A band of amateur traders in

- WallStreetBets forum, whose members have tripled to 6.5 million in just a week, aimed to bid up heavily shorted stocks “to the moon,” creating massive short squeezes that some believes caused a turmoil in the broader market.

- The rally backfired on Robinhood, the free-trading pioneer and popular app. The young broker that wants to go public this year had to tap credit lines, raise new funds and throttle back trading in a list of the short-squeeze names. We learned Saturday morning in a new post from Robinhood why, with the broker explaining that the central Wall Street clearinghouse mandated a ten-fold increase in the firm’s deposit requirements on the week in order to ensure smooth settlement in trades involving the securities experiencing unprecedented volatility.

- The reckless retail buying frenzy drew attention from high-profile investors including Elon Musk and Chamath Palihapitiya as well as a slew of lawmakers calling on regulators to intervene.

Here’s how the mania unfolded in the past week:

The Securities and Exchange Commission said Friday it is reviewing recent trading volatility that has led to a meteoric rise in GameStop and AMC.

“We will act to protect retail investors when the facts demonstrate abusive or manipulative trading activity,” the SEC said in a release. The regulator also pledged to clamp down on brokerages that may have “unduly” limited customers’ ability to trade.

https://www.cnbc.com/2021/01/30/gamestop-reddit-and-robinhood-a-full-recap-of-the-historic-retail-trading-mania-on-wall-street.html?__source=iosappshare%7Ccom.apple.UIKit.activity.Mail

Highlights from analysts and economics

From American Century

- The so-called “Nerds versus Wall Street” battle over GameStop is grabbing headlines and attracting speculators hoping to cash in on the dramatic stock price movements. The controversy also has captured the interest of people who had previously expressed little interest in the financial markets. Watching from the sidelines may be entertaining and some people will make money, but speculative activity like this may not be the right strategy for investors.

- What’s Going on with GameStop?

- Once a leading retailer of video games and consoles, GameStop is fighting the same headwinds that have led to the demise of countless brick-and-mortar retailers in the age of Amazon.

- Between 2017 and 2019, the company’s net income dropped from a profit of $353 million to a loss of $795 million. Its stock declined from $25 per share to $6 during the same period.*

- COVID-19 has further accelerated the demise of the company’s traditional retail business model and its stock price dropped to $2.80 per share on April 3, 2020.*

- Many professional hedge fund managers saw this as an opportunity to profit using a risky technique known as short selling. This involves selling borrowed GameStop shares in the hopes of reacquiring them at an even lower price. The manager makes (or loses) money on the difference between the short sale price and the cost to buy the shares back.

- The key risk for short sellers is that the stock price can go up. Theoretically, the price can go up infinitely, forcing them to reacquire the shares at a much higher price than they sold them.

- Why Is GameStop’s Stock Price Going Up?

- After struggling for years, GameStop rebounded slightly in 2020 due to an uptick in game sales amid the pandemic, rising to $19 by the end of the year. Since the beginning of this year, however, the stock price surged to $347 on January 27.*

- This incredible rise began when a group of investors sought to trigger a “short squeeze” by buying GameStop shares or purchasing options to buy the stock. These purchases caused the stock price to rise and squeezed short sellers because they had to buy quickly at a higher price to reduce losses. The short sellers’ purchases inflated prices further. This, in turn, drew even greater speculative momentum as more investors joined into buying the stock.

- Surging Stock Prices Do Not Reflect the Company’s True Value

- If I offered you a dollar for quarters, would you pay me more than four quarters in exchange for my dollar? The answer is an obvious “no.” In our view, recent trading activity around

- GameStop and other notable highly shorted stocks, including Bed Bath & Beyond and AMC Theatres, does not reflect their financial strength or competitive position.

- Despite its slight business improvement during 2020, GameStop lost $296 million—or $4.56 per share—during the first three quarters of 2020.* We believe the disconnect between its rapidly rising stock price and business reality is partly due to the rising influence of speculative investors. These investors collaborate on trading ideas through chat forums on sites such as

- Reddit and then implement their ideas through digital apps such as Robinhood.

From JP Morgan

- If nothing else, the events over the past few weeks have highlighted that the retail investor is alive and well. If this behavior continues, perhaps investors will begin to view retail investor positioning in the same way they take into account the positioning of quantitative or systematic funds. However, it is important to recognize that excess liquidity has led asset prices in certain markets and sectors to become unhinged from their fundamentals. It is uncommon, but not unheard of, for the bursting of financial market bubbles to drag the broader economy into recession. That said, the current set of risks seem concentrated in specific areas of the capital markets. If this behavior becomes more widespread it will be a greater cause for concern, suggesting investors would be wise to watch how things develop over the coming months.

2021 should bring stabilization and a reset for a number of disruptions experienced this year, with front-loaded market momentum and an economic recovery to follow. J.P. Morgan Global - Research forecasts volatile but strong global growth as economies reopen. Heading into the New Year, J.P. Morgan Global Research analysts believe recovery, reflation and rotation against the backdrop of accommodative monetary and fiscal support will set the backdrop for key market and economic calls for 2021. “Global growth will be below trend in early 2021, but the strongest global recovery in a decade will play out by the end of 2021 if the vaccine prospects play out as expected,” said Joyce Chang, Chair of Global Research.

- Thought on the Week Ahead: The fourth quarter earnings season is upon us, and with 49.9% of S&P 500 companies reporting earnings, we are currently tracking operating earnings per share (EPS) of $37.93. This represents a 3.2% decline from a year prior, as 84% of companies have beaten earnings estimates and 70% of companies have beaten revenue estimates. Results from financial companies have been better than expected, as the sector has benefited from the release of large loan loss reserves on the back of improving credit metrics. That said, early reporting industrial names have offset these better-than-expected results, as economic lockdowns continue to weigh heavily on the airline industry. As the earnings season unfolds, we expect technology and health care to outperform, while energy and consumer discretionary companies are likely to struggle. Looking at the three main drivers of earnings, margins continue to improve, with 4Q20 trending slightly below 4Q19 levels at 10.5%; on the other hand, revenues and share buybacks look set to weigh on EPS growth this quarter. Looking ahead, and assuming a successful deployment of vaccines, 2021 earnings will likely be driven by those factors most hindered by the pandemic such as consumer spending and travel. In such a scenario, we expect the more cyclical and value-oriented areas of the equity market (financials, industrials, energy, and materials) will outperform versus growth. Furthermore, given their more cyclical orientation, we also expect international equities to outperform the U.S., particularly those companies in emerging markets. Currencies’ return are based on foreign currencies per U.S. dollar. An appreciation of the foreign currency against the U.S. dollar would be positive and a depreciation of the foreign currency against the U.S. dollar would be negative.

Opportunities:

On Demand Webinar – “How to Protect Your Assets from a Long Term Care Spend Down”

A link will be emailed for you to watch the webinar at any time. To Register please email Stacy at stacy@affinityasset.com

a. Avoid Probate

b. Avoid Taxes

c. What is the 5 year look back & how you can be protected from it

c. Co-hosted by Glenn Stockton with Stockton & Stern Law firm

Social Security and Tax Strategy Webinar on Monday February 15 at 6:00pm, Tuesday February 16 at 11:00am

To Register for either date please email Stacy at stacy@affinityasset.com

If you would like a copy of my 30 minute recording of Community Café on the topic of “Tax saving Strategies”, please contact Stacy and we can email it to you. stacy@affinityasset.com

Referral rewards program:

Mark Roberts, President

Affinity Asset Management

13220 Metcalf Ave Suite 220

Overland Park, KS 66213

phone (913)381-4800

fax (913)381-4804

www.affinityasset.com

Securities Offered Through Client One Securities, LLC Member FINRA/SIPC and an Investment Advisor. Advisory Services Offered Through Client One Securities, LLC and ChangePath, LLC.

Affinity Asset Management, LLC, ChangePath, LLC and Client One Securities, LLC are separate entities.

Please do not send orders via e-mail because there is no assurance of receipt and they are not legally binding. The information above is from sources believed to be reliable. There is no guarantee to accuracy. This is not an official statement or confirmation.

Notice: This E-mail (including attachments) is covered by the Electronic Communications Privacy Act, 18 U.S.C SS2510-2521 and is confidential and may be legally privileged. If you are not the intended recipient, you are hereby notified that any retention, dissemination, distribution or copying of this communication is strictly prohibited. Please reply to sender if you have received this message in error; then permanently delete it. Thank you

Any results discussed herein are model results only and do not represent the results of actual trading of investment assets. The performance shown or discussed does not reflect the impact that material economic and market factors had or might have had on decision making if actual investor money had been managed.

These returns are unaudited and have been computed by Affinity Asset Management based on allocations mandated by the Model. Returns are presented net of fees calculated using using daily valuations and reflect the reinvestment of interest, dividends, and capital gains. Model performance reflects the fees and expenses of the underlying mutual funds and ETFs.

Actual fees will vary, and individual client results can differ from stated model results due to differences in timing and prices of trades. The model performance does not consider taxes.

The data is intended for illustrative purposes only and is not indicative of historical or future performance of the model overall or its chances of success. Investing involves risk, including the loss of principal. No investment strategy can guarantee a profit or protect against loss in a period of declining values.

Market index information shown herein is included to show relative market performance for the periods indicated and not as standards of comparison. Benchmarks indexes are unmanaged, statistical composites and their returns do not reflect payment of any brokerage commissions or fees an investor would pay to purchase the securities they represent. Benchmark indexes may include a different number of securities and have potentially different risk characteristics than the model portfolios displayed. Past performance of a benchmark index is no indication of future returns.

The information contained herein regarding is confidential and proprietary and intended only for use by the recipient. This document is not intended to be, nor should it be construed or used as, an offer to sell, or a solicitation of any offer to invest in or buy any product offered by Affinity Asset Management, Client One Securities, ChangePath or its affiliates.

Securities Offered Through Client One Securities, LLC Member FINRA/SIPC and an Investment Advisor. Advisory Services Offered Though Client One Securities, LLC and ChangePath, LLC. Affinity Asset Management, LLC, ChangePath, LLC and Client One Securities, LLC are separate entities.