Investment Commentary –April 7th, 2021

Year to Date Market Indices as of April 7th 2021

• Dow 32,627 (9.23%)

• S&P 3,913 (8.46%)

• NASDAQ 13,215 (6.29%)

• Gold $1,709 (-10.12%)

• OIL $61.65 (27.26%)

• Barclay Bond Aggregate (-3.29%)

• Fed Funds Rate 0-0.25 (0-0.25)

CNBC Report: Jamie Dimon says economic boom fueled by deficit spending, vaccines could ‘easily run into 2023’

“I have little doubt that with excess savings, new stimulus savings, huge deficit spending, more QE, a new potential infrastructure bill, a successful vaccine and euphoria around the end of the pandemic, the U.S. economy will likely boom,” Dimon said. “This boom could easily run into 2023 because all the spending could extend well into 2023.”

*Dimon, in his annual shareholder letter, sees strong growth for the world’s biggest economy in the near term, thanks to the U.S. government’s response to the coronavirus pandemic that has left many consumers flush with savings.

*While Dimon called stock market valuations “quite high,” he said a multiyear boom may justify current levels because markets are pricing in economic growth and excess savings that make their way into equities.

Jamie Dimon is bullish on the U.S. economy – at least for the next few years.

In his annual shareholder letter, the long-time JPMorgan Chase chairman and CEO said he sees strong growth for the world’s biggest economy; thanks to the U.S. government’s response to the coronavirus pandemic that has left many consumers flush with savings.

“I have little doubt that with excess savings, new stimulus savings, huge deficit spending, more QE, a new potential infrastructure bill, a successful vaccine and euphoria around the end of the pandemic, the U.S. economy will likely boom,” Dimon said. “This boom could easily run into 2023 because all the spending could extend well into 2023.”

Dimon, who managed JPMorgan through the 2008 financial crisis, helping to create the biggest U.S. bank by assets, pointed out that the magnitude of government spending during the pandemic far exceeds the response to that previous crisis. He said the longer-term impact of the reopening boom won’t be known for years because it will take time to ascertain the quality of government spending, including President Joe Biden’s proposed $2 trillion infrastructure bill.

“Spent wisely, it will create more economic opportunity for everyone,” he said.

While Dimon called stock market valuations “quite high,” he said a multiyear boom may justify current levels because markets are pricing in economic growth and excess savings that make their way into equities. He said there was “some froth and speculation” in parts of the market but didn’t say where exactly.

“Conversely, in this boom scenario it’s hard to justify the price of U.S. debt (most people consider the 10-year bond as the key reference point for U.S. debt),” Dimon said. “This is because of two factors: first, the huge supply of debt that needs to be absorbed; and second, and the not-unreasonable possibility that an increase in inflation will not be just temporary.”

Around the Web

S&P 500 @4K: The S&P 500 eclipsed 4,000 for the first time on Friday. It’s been a rapid rise to the 4,000 mark, as the index first breached 3,000 on July 12, 2019. It took nearly three times that long to rise from 2,000 to 3,000.

Positive signs: All three major U.S. stock indexes finished in positive territory in a holiday-shortened trading week, with the NASDAQ outperforming the Dow by a wide margin in a reversal of recent trends. The NASDAQ finished nearly 3% higher, the S&P 500 was up more than 1%, and the Dow rose

Labor market recovery: Friday’s labor market report—released on a day when U.S. stock exchanges were closed—delivered two positive surprises. The U.S. economy generated 916,000 jobs in March—far exceeding expectations—and initial jobs gain estimates for January and February were revised upward by a total of 156,000.

Infrastructure price tag: The Biden administration detailed its financial plans to spend $2.25 trillion to improve America’s infrastructure. The cost would be covered by $2 trillion in corporate tax increases over 15 years, with the corporate tax rate rising to 28% from the current 21%.

Growth fights back: For the first time in eight weeks, U.S. large-cap growth stocks outperformed their value counterparts. Some of the biggest technology stocks had a strong week for a change, while stocks of companies more sensitive to cyclical economic changes lagged.

Upcoming Events

Thursday: Weekly unemployment claims, U.S. Department of Labor

Today in Stock Market History:

1999: Online traders spot a Bloomberg News Service page reporting the news that PairGain Technologies has agreed to be acquired by ECI Telecom at a rich premium over its current stock price. PairGain stock promptly soars 31%, then crashes as PairGain and Bloomberg announce that the news page is a fraudulent announcement cleverly designed to look like a genuine Bloomberg news report.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

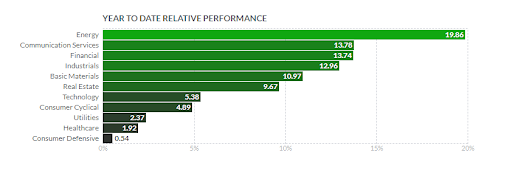

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.cnbc.com/2021/04/07/jamie-dimon-says-economic-boom-fueled-by-deficit-spending-vaccines-could-easily-run-into-2023.html