Investment Commentary – April 14, 2021

Year to Date Market Indices as of April 14, 2021

• Dow 33,677 (10.03%)

• S&P 4,141 (10.26%)

• NASDAQ 13,996 (8.60%)

• Gold $1,709 (-10.12%)

• OIL $61.65 (27.26%)

• Barclay Bond Aggregate (-3.07%)

• Fed Funds Rate 0-0.25 (0-0.25)

S&P 500 ends volatile day slightly higher, Apple pushes NASDAQ to another record close

The S&P 500 erased earlier losses and rose slightly to a record on Monday as investors prepared for a busy week of earnings featuring reports from the largest tech companies.

The broad equity benchmark closed the volatile day 0.4% higher at a new record close of 3,855.36. The S&P 500 fell 1.2% at its low of the day. The tech-heavy Nasdaq Composite gained 0.7% to reach a fresh closing high of 13,635.99. The Dow Jones Industrial Average, less susceptible to changes in technology shares, dipped 36.98 points, or 0.1%, to 30,960.00. At its session low, the 30-stock benchmark dropped more than 400 points.

This coming week, 13 Dow components and 111 S&P 500 companies are set to report earnings. Among the quarterly reports on deck include those from Apple, Microsoft, Netflix, Tesla, McDonald’s, Honeywell, Caterpillar and Boeing.

Apple shares gained 2.8% to an all-time high before its quarterly report Wednesday after the bell. Tesla, which also reports Wednesday, popped 4% to hit a record.

“The Street is anticipating robust results from Apple on Wednesday after the bell with Cupertino expected to handily beat Street estimates across the board,” wrote Dan Ives of Wedbush, who raised his 12-month price target on Monday to $175. “While the Street is forecasting roughly 220 million iPhone units [for 2021], we believe based on the current trajectory and in a bull case Cupertino has potential to sell north of 240 million units.”

Highly speculative action in stocks like GameStop was unnerving some investors, causing worry that parts of the market had detached from fundamentals and could cause the broader market to take a hit when the mania ends.

Shares of the brick-and-mortar video-game retailer soared more than 140% to top $150 at one point Monday as a slew of retail investors active in online chat rooms aimed to squeeze out short sellers. GameStop briefly turned negative in wild trading before closing 18% higher. Other heavily shorted names, including Bed Bath & Beyond, also jumped higher on Monday amid the buying frenzy.

“Signs of excess continue to concern investors, with markets at near-record highs on a variety of valuation metrics,” said Mark Hackett, Nationwide’s chief of investment research. “Other signs of extreme optimism include put-call ratios, credit spreads and momentum indicators.”

Companies kicked off the earnings season on a strong note. Of the S&P 500 components that have already reported earnings, 73% have beaten on both sales and EPS, according to data from Bank of America. The firm said this is tracking similar to last quarter when the number of companies beating hit a record.

Around the Web

Sustained momentum: The Dow and the S&P 500 climbed for the third week in a row, rising around 2% to 3% and pushing their record levels higher in a mostly quiet week of trading. The biggest moves came on Monday, when stocks rose on the heels of a strong monthly jobs report released on April 2, a day of a holiday market closure.

Earnings optimism: Wall Street analysts are expecting big things entering the quarterly earnings season that opens in mid-April, when major banks begin to issue results. First-quarter earnings for companies in the S&P 500 are forecast to jump more than 24%, with the consumer discretionary and financials sectors expected to see the biggest gains, according to FactSet.

Fed outlook: U.S. Federal Reserve Chair Jerome Powell said that the Fed is looking for “actual progress” rather than forecasts in reaching the central bank’s employment and inflation goals. He also reinforced expectations that the Fed will maintain its accommodative policy stance by noting that the economy still has a way to go before reaching the Fed’s targets.

Yield pullback: For the second week out of the past three, yields of U.S. government debt slipped as bond prices recovered, deflating some of 2021’s surge in yields. The yield of the 10-year U.S. Treasury bond fell to around 1.67%, down from a recent high of 1.74% on March 31. Nevertheless, the yield is still up sharply from 0.92% at the end of last year.

Dividend restoration: The dollar amount of dividend increases in U.S. common stocks in the just-completed first quarter was the largest quarterly figure in nine years, according to S&P Dow Jones Indices. For stocks in the S&P 500 Index, aggregate increases—not factoring in decreases—rose to $20.3 billion, compared with $13.9 billion in last year’s fourth quarter.

Upcoming Events

Thursday: Weekly unemployment claims, U.S. Department of Labor

Today in Stock Market History:

2000: The NASDAQ has one of its worst days ever, plunging s 355.49 points, or 9.67%, to finish at 3321.29, down 25.3% for the week. But “tech stocks have largely gone through their valuation adjustment,” says Lehman Bros. strategist Jeffrey Applegate, who urges investors to buy. Robert Froelich, chief executive of the Kemper Funds, scoffs that the drop is “the bear’s brief day in the sun” and adds, “this is the greatest opportunity for individual investors in a long time.” Thomas Galvin, strategist at Donaldson, Lufkin & Jenrette, pronounces that “there are only 200 or 300 points of downside for the NASDAQ and 2000 on the upside.” It turns out there are no points on the upside and more than 2000 on the downside, as the NASDAQ ends the year at 2470.52, on the way to its trough of 1114.11 in October 2002.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

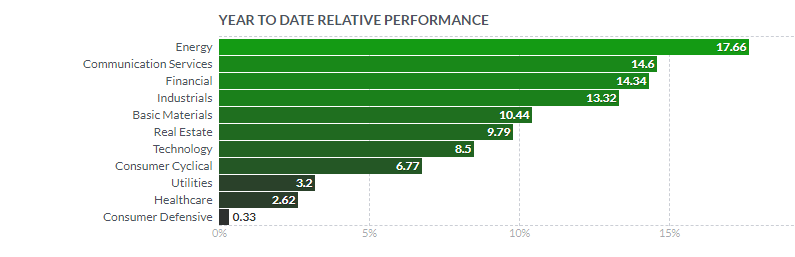

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.cnbc.com/2021/01/24/stock-market-futures-open-to-close-news.html

Securities Offered Through Client One Securities, LLC Member FINRA/SIPC and an Investment Advisor. Advisory Services Offered Through Client One Securities, LLC and ChangePath, LLC.

Affinity Asset Management, LLC, ChangePath, LLC and Client One Securities, LLC are separate entities.