Investment Commentary – April 28, 2021

Year to Date Market Indices as of April 28, 2021

• Dow 33,873 (11.34%)

• S&P 4,189 (10.26%)

• NASDAQ 14,086 (7.96%)

• Gold $1,768 (-6.96%)

• OIL $63.70 (31.56%)

• Barclay Bond Aggregate (-3.07%)

• Fed Funds Rate 0-0.25 (0-0.25)

75% of stock owners won’t be subject to Biden’s proposed capital gains tax hike. Here’s why

*Around 3 out of every 4 U.S. stock investors wouldn’t be subject to an increase in the capital gains tax rate, according to a UBS research note.

*That’s because they bought stock in 401(k) plans, individual retirement accounts and other types of accounts not subject to the tax.

*President Joe Biden is expected to propose raising the top federal tax rate on long-term capital gains to 39.6%, from 20%. It would apply to millionaires.

*Roughly 75% of U.S. stock investors wouldn’t be subject to an increase in the capital gains tax rate due to the types of accounts they own, according to UBS.

*President Joe Biden is expected to propose raising the top federal capital gains tax to 39.6%, from the current 20%, for millionaires.

*When factoring in a Medicare surtax, the richest taxpayers would pay a total 43.4% rate on capital gains. It would apply to investment returns on stock and other assets held for over a year.

Retirement accounts

Many people would be shielded from the policy, however.

To that point, about 75% of investors own U.S. stock in accounts that aren’t subject to a capital gains tax, according to a UBS research note published Friday.

They include retirement accounts like individual retirement accounts and workplace retirement plans such as 401(k) plans. Endowments and foreign investors also don’t pay capital gains tax.

“If the average American owns stock, stock mutual funds or exchange-traded funds in a qualified [retirement] plan, it doesn’t have any impact,”.

Around the Web

Upbeat earnings: Earnings season continued to exceed expectations. Profits at companies in the S&P 500 were expected to rise 33.8% as of Friday, based on the roughly one-quarter of companies that have reported so far and forecasts for upcoming reports, according to FactSet. That rate would mark the highest year-over-year earnings growth since the third quarter of 2010, when growth was 34.0%.

Housing strength: Sales of new U.S. single-family homes jumped nearly 21% in March—more than most economists had expected. Analysts said new home sales were boosted entering the typically busy spring buying season by a shortage of previously owned houses on the market.

GDP on tap: The U.S. government’s initial estimate of first-quarter GDP growth is scheduled to be released Thursday. Most economists are expecting that GDP growth accelerated from the fourth quarter’s 4.3% rate as the economy continues to recover from the pandemic.

Upcoming Events

Thursday:

First-quarter GDP, advance estimate, U.S. Bureau of Economic Analysis

Weekly unemployment claims, U.S. Department of Labor

Today in Stock Market History:

1983: Pres. Ronald Reagan signs into law the Social Security Amendments of 1983, delaying cost-of-living adjustments and making 50% of Social Security benefits taxable. “This bill,” declares Reagan, “demonstrates for all time our nation’s ironclad commitment to Social Security.” The Social Security Administration forecasts that the system can now remain solvent until the year 2063. By 1994, that date shrinks to the year 2029; by 2004, almost no one thinks Social Security can survive in its present form.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

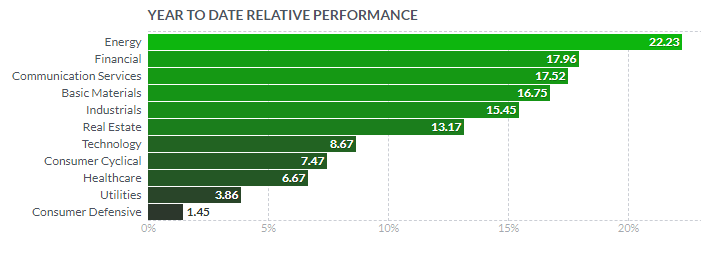

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.cnbc.com/2021/04/26/75-percent-of-stock-owners-wont-pay-bidens-likely-capital-gains-tax-hike.html

Securities Offered Through Client One Securities, LLC Member FINRA/SIPC and an Investment Advisor. Advisory Services Offered Through Client One Securities, LLC and ChangePath, LLC.

Affinity Asset Management, LLC, ChangePath, LLC and Client One Securities, LLC are separate entities.