Investment Commentary – April 20, 2021

Year to Date Market Indices as of April 20, 2021

• Dow 32,627 (11.34%)

• S&P 3,913 (10.26%)

• NASDAQ 13,215 (7.96%)

• Gold $1,768 (-6.96%)

• OIL $63.70 (31.56%)

• Barclay Bond Aggregate (-3.07%)

• Fed Funds Rate 0-0.25 (0-0.25)

2021’s expected earnings blowout begins

First-quarter earnings so far have been very strong, outpacing even the rosy expectations from Wall Street and that’s a trend that’s expected to continue for all of 2021. S&P 500 companies are on pace for one of the best quarters of positive earnings surprises on record, according to FactSet.

Why it matters: The results show that not only has the earnings recession ended for U.S. companies, but firms are performing better than expected and the economy may be justifying all the hype.

By the numbers: After a strong week of bank earnings last week, 81% of S&P 500 companies have reported a positive EPS surprise for Q1, on pace to tie the mark for the second-highest percentage of positive EPS surprises since FactSet started tracking the data in 2008.

*The blended earnings growth rate for Q1 is 30.2%, which if it stands would mark the highest year-over-year earnings growth for the S&P in more than a decade (34% in Q3 2010).

*The lofty numbers have jumped in a short time, as the estimated earnings growth rate for Q1 2021 was 23.8% as recently as March 31.

*Last week’s reports were dominated by the big banks, with JPMorgan Chase, Goldman Sachs and Morgan Stanley all reporting record earnings.

The big picture: The big numbers in the first quarter are not expected to be an aberration. Analysts also predict double-digit earnings growth for the remaining three quarters of 2021 thanks to a combination of higher earnings and an easier comparison to 2020 as a result of the COVID-19-pandemic.

*Goldman Sachs’ derivatives research team said in a note to clients that options markets are pointing to broad upside moves for stocks during earnings season.

Yes, but: Only 9% of S&P 500 companies have reported earnings, and those have largely been in the banking sector, which has gotten a major boost from lower-than-expected loan losses.

*Banks delivered a blowout year-over-year earnings growth rate of 248%.

What’s next: This week will bring earnings reports from dozens of big names including Coca-Cola, Johnson & Johnson, United Airlines, Intel and Netflix, with the Dow and S&P starting the week at record highs.

Around the Web

Four in a row: The S&P 500 and the Dow climbed for the fourth week in a row, rising more than 1% and pushing their record levels higher. Over that four-week stretch, the S&P 500 has gained about 7% and the Dow 4%; the NASDAQ’s gain has been 6%.

Earnings launch: Quarterly earnings season got off to a strong start, with profits of companies in the S&P 500 expected to rise around 30% as of Friday, based on the relatively small number of companies that have reported so far and forecasts for upcoming reports. That 30% growth rate exceeds the 25% gain that had been expected prior to the start of earnings season, according to FactSet.

Economic healing: Two reports released on Thursday suggested an acceleration in the U.S. economic recovery. Retail sales jumped 9.8% in March, and first-time unemployment claims fell to 576,000 in the latest weekly count—the lowest level since the pandemic began to severely weaken the labor market.

Upcoming Events

Thursday: Weekly unemployment claims, U.S. Department of Labor

Today in Stock Market History:

1983: Pres. Ronald Reagan signs into law the Social Security Amendments of 1983, delaying cost-of-living adjustments and making 50% of Social Security benefits taxable. “This bill,” declares Reagan, “demonstrates for all time our nation’s ironclad commitment to Social Security.” The Social Security Administration forecasts that the system can now remain solvent until the year 2063. By 1994, that date shrinks to the year 2029; by 2004, almost no one thinks Social Security can survive in its present form.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

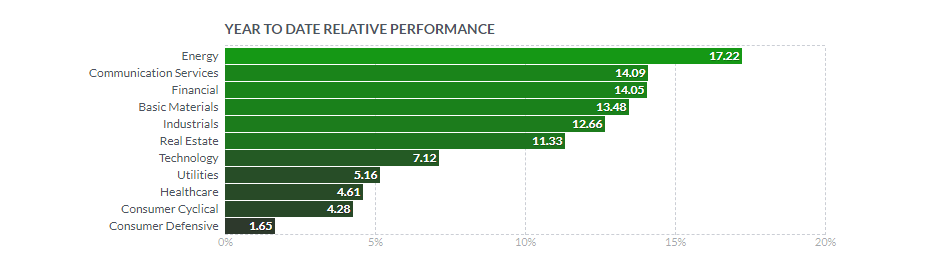

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.axios.com/earnings-stock-companies-sp500-39dd003c-f7b1-44b0-8adf-d8193d3ac268.html

Securities Offered Through Client One Securities, LLC Member FINRA/SIPC and an Investment Advisor. Advisory Services Offered Through Client One Securities, LLC and ChangePath, LLC.

Affinity Asset Management, LLC, ChangePath, LLC and Client One Securities, LLC are separate entities.