Investment Commentary – October 12, 2022

Year to Date Market Indices as of October 12, 2022

• Dow 29,322 (-19.46%)

• S&P 3,589 (-24.75%)

• NASDAQ 10,428 (-33.39%)

• OIL $87.57 (15.31%)

• Barclay Bond Aggregate (-16.22%)

Yahoo Finance: Stocks rise as investors weigh inflation data, Fed minutes

U.S. stocks inched higher Wednesday even as producer price data showed inflation inched up last month and a readout of Federal Reserve meeting minutes affirmed officials were likely to proceed with their rate-hiking plans.

The S&P 500 (^GSPC) was up roughly 0.3% in afternoon trading, while the Dow Jones Industrial Average (^DJI) 160 points, or about 0.6%. The technology-heavy Nasdaq Composite (^IXIC) advanced 0.5%.

U.S. stocks inched higher Wednesday even as producer price data showed inflation inched up last month and a readout of Federal Reserve meeting minutes affirmed officials were likely to proceed with their rate-hiking plans.

The S&P 500 (^GSPC) was up roughly 0.3% in afternoon trading, while the Dow Jones Industrial Average (^DJI) 160 points, or about 0.6%. The technology-heavy Nasdaq Composite (^IXIC) advanced 0.5%.

The September producer price index (PPI), a measure of prices at the wholesale level, rose 0.4% in September after falling 0.2% during the prior month as inflation persisted. Economists expected the headline figure to rise 0.2%. The PPI release comes before Thursday’s highly anticipated release of the government’s consumer price index (CPI) report.

“Prices remain elevated so it shouldn’t be a surprise to see producer goods and services rise. Keep in mind the increase is still below what we were seeing consistently month after month earlier this year,” wrote Mike Loewengart, Head of Model Portfolio Construction at Morgan Stanley Global Investment Office.

“No doubt the Fed still has its work cut out for them, and if tomorrow’s CPI read is hot, don’t be surprised to see some investors come to grips with how long the road to tamer inflation may be,” Loewengart added.

Investors also mulled minutes from the Federal Reserve’s latest monetary-policy meeting, which indicated restrictive monetary policy would stay in place until inflation meaningfully comes down.

Inflation and the Auto Industry:

When Will Car Prices Drop?

J.P. Morgan Research explores the factors driving up vehicle prices and when inflationary pressures will abate.

Why Are Car Prices Rising?

Car prices are rising due to global supply chain issues. An ongoing chip shortage is holding up production in the auto industry, creating a supply crunch. Rising raw material costs are also driving car prices up, exacerbated by the Russia-Ukraine crisis.

Data from J.D. Power shows U.S. consumers forked out an average of $45,869 for a new vehicle in July 2022, a record high. “We estimate that half of the increase in new vehicle prices relates to the passing along of higher input costs, including raw material costs,” said Ryan Brinkman, Lead Automotive Equity Research Analyst at J.P. Morgan. The weighted average cost of raw materials used to produce a new vehicle hit an all-time high in 2021, rising 116% year-over-year, J.P. Morgan Research data shows. Electric vehicles have been especially affected by rising material costs, as the prices of key metals including lithium, nickel and cobalt — essential components of electric car batteries — have spiked.

What’s more, chip shortages mean that manufacturers are prioritizing their most expensive vehicles, in what Brinkman dubs a “forced mix-up” of car segments — further increasing average transaction prices. “If automakers don’t have enough semiconductors, and if semiconductors were interchangeable — and to some degree they are — why would they put them in $25,000 cars instead of $85,000 cars?” said Brinkman.

These supply chain woes have compounded the already existing imbalance of supply and demand in the auto industry, which was precipitated by COVID-19. In the U.S., there are historically more than 3.5 million vehicles in dealer lots at the end of each month. However, this figure fell to 2.7 million before the chip crisis even began, due to pandemic-induced factory shutdowns. At the same time, demand remained heightened throughout COVID-19, as pandemic stimulus checks and accumulated savings meant that many consumers were still willing — and able — to purchase new cars.

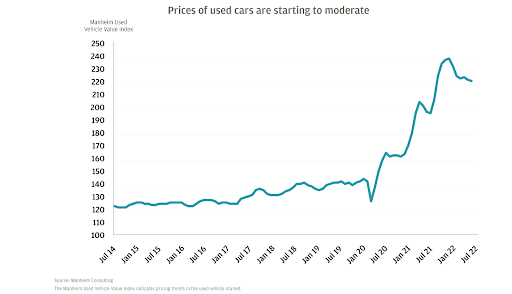

Inflationary pressures are also percolating down to the used car market. According to car shopping app CoPilot, consumers in the U.S. today are paying an average of $10,046 more for a used car than if typical depreciation expectations were in play. Likewise, data from the U.S. Bureau of Labor Statistics shows that used car prices surged 7.1% year-over-year in June 2022.

When Will Car Prices Drop?

Used car prices are already starting to drop as the market cools, having seemingly peaked in early 2022. On the other hand, new vehicle prices are unlikely to drop in 2022 due to persistent inflationary pressures.

“There’s still a lot of inflation bubbling up in the new vehicle supply chain. Even though raw material costs are falling, suppliers have a lot of other higher non-commodity costs — diesel, freight, shipping, logistics, labor, electricity — to pass on to automakers,” said Brinkman.

In addition, the effects of the chip shortage will continue to linger. Companies will need to rebuild inventory, which means that wholesale demand will compete with retail demand, putting a floor on new vehicle prices. “Through to the end of 2022, new vehicle prices will be anywhere from +2.5% to -2.5%, with my bias toward the higher end of that range,” said Brinkman.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.cnbc.com/2022/09/14/producer-price-index-august-2022.html

https://www.jpmorgan.com/insights/research/when-will-car-prices-drop

https://finance.yahoo.com/news/stock-market-news-live-updates-october-12-2022-121220378.html