Investment Commentary – March 23, 2022

Year to Date Market Indices as of March 23, 2022

• Dow 34,709 (-4.47%)

• S&P 4,305 (-5.73%)

• NASDAQ 14,533 (-11.00%)

• Barclay Bond Aggregate (-6.46%)

• Fed Funds Rate .50 (up .25)

• Annual Inflation Rate 7.9%

The Impact of Geopolitics, Importance of Quality Equities, and the Opposing Forces Affecting Bonds

Simeon Hyman ProShares analyst

February was largely defined by Russia’s invasion of Ukraine. Our thoughts are with the people of Ukraine, and we hope that peaceful political solutions emerge soon. Understandably, war triggers an intense emotional response for many. As difficult as it may be confronting the investment challenges caused by major world events, it more often than not requires a distinctly non emotional response. Geopolitical events have historically had short-lived impacts on financial markets.

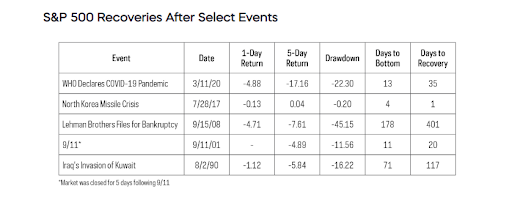

Drawdowns and subsequent recoveries have generally been measured in days or weeks, such as at the beginning of the pandemic or post 9/11, and confounded the timing of safe-haven trades. The speed of reversals also was not limited to the equity markets. The beginning of the pandemic saw investment grade credit spreads widen dramatically, but most of that move was reversed within a month. In just three months, those spreads were actually tighter.

The only event on this list with a longer-term impact was the Lehman Brothers bankruptcy. That event was a marker along the path of a deep and prolonged recession. Russia’s invasion of Ukraine, on the other hand, comes with a backdrop of a strong economy—a backdrop confirmed by the strong March 1 ISM Manufacturing report. The shorter-duration investment storms above may turn out to be reasonable guides.

https://www.proshares.com/browse-all-insights/insights-commentary/proshares-market-commentary-march-2022/

https://www.jhinvestments.com/weekly-market-recap

https://www.cnbc.com/ (indices)