Hello again,

For those of you who follow me on Facebook, know I am not a fan of snakes. The month of May, I have seen more snakes in May 2020, than I have in the last 3 years at my golf course combined. And these are not little snakes either. On top of that, our farm Serendipity Farm & Vine at 183rd and Mission, we have killed so many copperheads and now 2 rattlesnakes. Yes rattlesnakes. I am no expert on snakes, but there is an abundance of them out there now.

Depending on what is in the news and what NEW data we receive from analysts and economists, we want to use these email and teleconferences as platforms to share valuable information and do not want to abuse your time on this. We have been in a relative flat market cycle now for many weeks now. The last week or two, its inched up which is good, but its not expected to continue. We are still living off of the enthusiasm of stay at home orders opening up and the CARES stimulus package. We haven’t seen the next dip of any size for several months now, so when we have more to report and what we feel is valuable for your time to listen in too, we will skip this week’s teleconference.

Having said that, we are also taking the Monday email on Coronavirus and Markets update week by week. We are not committed to doing an email for next Monday June 8th yet. We will see how this week unfolds.

Please check your junk/spam folder for any emails from [email protected] please. Kellie is Affinity’s Vice President. We are being told by some that they are not receiving emails when we have verified those emails are being sent to correct email addresses. We want to make sure you are seeing any invitation to the webinars, Community Café, and other Affinity communication.

Performance DJIA:

Mon 5/25 Holiday

Tues 5/26 +2.17%

Wed 5/27 +2.21%

Thurs 5/28 -0.58%

Fri 5/29 -0.07%

Last week +3.75%%

Since 2/19 market high -13.51%

Bond model you are in:

Last week +.96%

Comparison:

Bond model last 30 days +1.64% YTD Standard deviation (risk) = 12.5% (4 times less risk)

DJIA last 30 days +3.04% YTD Standard deviation (risk) = 50.1% (4 times more risk)

Considering the massive difference in risk between the stock market and 100% stocks to your current 100% bond model is vastly different. We have still a short rally from CARES stimulus package. We are very happy with this performance difference. Keep in mind, we want to re-enter the market as soon as possible. We are just waiting on a buy-in opportunity; meaning a dip in the market to buy lower. We are also considering multiple options from dollar cost averaging back in, to buying in blocks like 10% or 25%, in addition to the 50% cycle trade we have discussed previously. We think the end of July will be telling with the reports of 2nd quarter GDP and unemployment numbers. All of this just a few months before the Presidential Election.

Tid Bits:

1. Eviction ban expires June 1st: “If there’s not a stimulus package that comes forward, what we’re going to see is rises in homelessness, a huge rise in instability for families, but it’s also going to rock the housing market,” said Shamus Roller, executive director at the National Housing Law Project. “It’s going to hurt landlords, it’s going to hurt banks, it’s going to hurt the entire system of providing housing, both on the financial side and on the human side.” A number of states and cities have set up their own rental assistance funds, but they are “a drop in the bucket,” Roller said, given the level of need. Houston’s $15 million rental fund ran out in less than two hours.

2. China Halts Some U.S. Farm Imports, Threatening Trade Deal – Chinese government officials told major state-run agricultural companies to pause purchases of some American farm goods including soybeans as Beijing evaluates the ongoing escalation of tensions with the U.S. over Hong Kong, according to people familiar with the situation. The measures to halt imports come after President Donald Trump on Friday lobbed a barrage of criticism at Beijing after it moved to impose controversial new national security legislation on Hong Kong. Critics say it will crack down on dissent and undermine the “one country, two systems” principle that has kept Hong Kong autonomous of the mainland since the 1997 handover from the British.

3. A rocket ship built by Elon Musk’s SpaceX company thundered away from Earth with two Americans on Saturday, ushering in a new era in commercial space travel and putting the United States back in the business of launching astronauts into orbit from U.S. soil for the first time in nearly a decade. NASA’s Doug Hurley and Bob Behnken rode skyward aboard a sleek, white-and-black, bullet-shaped Dragon capsule on top of a Falcon 9 rocket, lifting off at 3:22 p.m. from the same launch pad used to send the Apollo astronauts to the moon a half-century ago. Minutes later, they safely slipped into orbit.

4. Moderna Shares Tumble as Insiders Caught Running for the Exits

A little over a week ago, shares of American biotech stock Moderna soared more than 30% following a bullish statement on the company’s vaccine results. A few days later, CNN reported that company insiders, including the company’s chief medical officer and chief financial officer, cashed out some $30 million in options. CEO Stephane Bancel has also cashed out enough Moderna shares to cement his status as a billionaire. The high-flying biotech stock was forced to reckon with the confidence-draining impact of insider sales when StatNews reported on Wednesday that insiders have sold more than $89 million in stock so far this year

5. *Worst in a decade: First-quarter earnings for companies in the S&P 500 dropped nearly 15% from the same period a year earlier, according to FactSet’s end-of-earnings season analysis. That’s the worst result since the third quarter of 2009. About 63% of companies beat analysts’ consensus expectations—the lowest quarterly figure in more than seven years.

6. Spending drop-off

a. Spending by U.S. consumers in April tumbled nearly 14%, the biggest monthly decline since the government began tracking spending data in 1959. However, personal income jumped nearly 11% last month, boosted by government stimulus payments to help offset the economic impact of the coronavirus pandemic.

7. Labor market losses

a. Friday’s monthly jobs report is expected to be the most closely watched economic release of the week. Uncertainty over the impact of coronavirus-related restrictions has challenged the ability of economists to make forecasts for the May report. The April report tallied 20.5 million job losses—the largest monthly decline on record—while the unemployment rate surged to 14.7%.

8. Fortune.com

a. The money, included in a government relief package enacted in March, is set to expire July 31. Yet with the unemployment rate widely expected to still be in the mid-teens by then, members of both parties will face pressure to compromise on some form of renewed benefits for the jobless. Democrats have proposed keeping the $600-a-week payments through January in a $3 trillion relief package that the House approved this month along party lines. Senate Republicans oppose that measure. They have expressed concern that the federal payments — which come on top of whatever unemployment aid a state provides — would discourage laid-off people from returning to jobs that pay less than their combined state and federal unemployment aid now does.

9. Marketwatch:

a. Many Republican lawmakers told that the $600 weekly boost in unemployment insurance during the pandemic is a disincentive to return back to work, given that people could earn more from not working.

Facts:

1) Coronavirus

a) Global 6,294,050cases 374,405deaths

b) US 1,837,830cases 106,208deaths (17%, 15,220 increase from 2weeks ago)

c) KS 9,827cases 217deaths

d) MO 13,476cases 785deaths

Highlights from analysts and economists:

1. BlackRock:

· Measures to contain the virus are gradually being eased in many developed economies. May’s data suggested the worst of the contraction may be behind us, but we see a bumpy restart in coming months. The big question remains: how successful policy execution will be in bridging cash flow constraints and preventing permanent damages to the economy – and what the risk is of policy fatigue in coming months. Markets became wary of rising U.S.-China tensions. A potential flashpoint is China’s proposed security law for Hong Kong, which caused the biggest drop in the Hang Seng Index in five years.

2. Northern Trust:

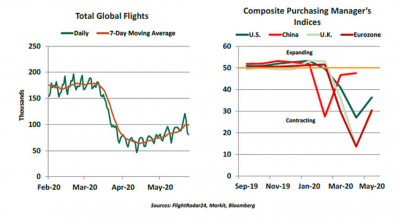

· We are as anxious as you are to begin seeing firm signs that the economy has bottomed. But recent headlines trumpeting rapid advances must be taken with considerable caution. In some cases, math can be misleading. Take, for example, a recent upbeat report stating that global airline traffic had increased by 162% between April 12 and May 21. While the calculation is correct, it compares a Sunday (when traffic is typically light) with a Thursday. Using a seven-day moving average, the rate of increase during that same interval slowed to 50%. Further, the number of flights (on a seven-day average basis) fell 65% from the beginning of the year through mid-April; gaining 50% from that low base still leaves traffic down 46% from January levels. And that does not account for the fact that passenger loads on many flights are a small fraction of what they had been before COVID-19.

Another example centers on the closely watched purchasing managers indices (PMIs) that are computed for a broad range of countries. PMIs are derived from a simple survey in which respondents are asked whether conditions have gotten worse, stayed the same, or improved. The index takes the fraction of those who reported improvement and adds half of those who reported that things stayed the same. Readings above 50% are presumed to signal economic advance.

“It’s easier to show progress from a low base.”

But if conditions descend sharply and then stabilize, you will see rising PMIs as more survey respondents report no change in their outlooks. We are seeing improvement in these measures for May, but activity is still deeply depressed.

Data can be viewed in a variety of ways, but conclusions can be shaped by the perspective of the analyst. While we would be delighted to embrace truly upbeat trends, we must remain as objective as we can in our interpretations.

3. JP Morgan:

· Recently, a new round of U.S.-China disputes, focused on financial flows, technology and human rights, has raised concerns about a re-emergence of tensions between the two countries. The U.S. administration has taken steps such as pressuring a federal pension fund not to invest in Chinese equities and imposing further restrictions on companies doing business with Huawei. Most recently, the U.S. Senate passed the Holding Foreign Companies Accountable Act, which would require U.S.-listed foreign firms to provide audit details and certify that they are not government-owned or controlled. As for China, it approved a national security law in Hong Kong, triggering new street protests and the announcement that the U.S. administration intends to remove its special treatment. As a result of the re-escalation of U.S.-China tensions, downside risks for emerging markets have increased. However, investors should recognize that the economic and political competition between the two countries will be one of the defining themes of this century. Indeed, we expect that the size of the Chinese economy will eclipse that of the U.S. by the mid 2030s, as shown in this week’s chart. Moreover, the rising tensions will increase China’s desire for self-sufficiency. For investors who want to take advantage of strong long-run Chinese growth, it will be even more important to participate in Chinese domestic companies and not only in global multinationals.

4. CNBC (Newsy News with Drama and Emotions)

· Only 22% of global CFOs expect the Dow to reach a new record high without first experiencing another major decline, while 51% of CFOs are betting that the Dow is headed back below 19,000 before it is able to reach a new stock market high

· A major U.S. consumer demand slump was cited by many respondents to the Q2 CNBC Global CFO Council survey. But there are stock market bulls, especially among U.S.-based CFOs, with roughly one-third saying the market can reach a new record level without experiencing the double dip that has many investors worried.

· C-suite executives are increasingly certain about a big hit to their business in 2020 from Covid-19.

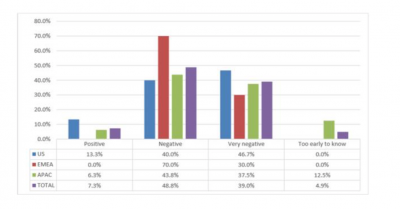

· Chief financial officers rate the GDP outlook for every world region as declining, according to the second-quarter CNBC Global CFO Council Survey. CFOs gave the U.S. economic outlook its worst rating in survey history.

Nearly half (48.8%) of leading chief financial officers surveyed in the latest CNBC Global CFO Council Survey say the Covid-19 pandemic will have a “negative” impact on their companies in 2020, while another 39% say it will have a “very negative” impact. (half (48.8%)= a “negative”,….39% = “very negative) — total 48=+39= 87% negative outlook)

The CFOs who responded to this quarter’s survey have grown more certain about the negative outlook for their businesses, and more downbeat about the outlook for the global economy, in the three months since CNBC last surveyed them.

5. From MarketWatch

· Protests Hammer U.S. Cities Still Recovering From Lockdown- The reopening of America was always going to be fraught, with competing fears of new virus outbreaks and economic meltdown. Now cities across the nation, from New York to Chicago to Los Angeles, are reeling from unrest that could worsen both.

6. From Bloomberg

· “I think people are coming to the realization that their jobs may not be coming back or coming back quickly. This is all conflating with the racial tensions and completely boiling over,” said Mark Zandi, chief economist at Moody’s Analytics. “This highlights the depth of despair in America,” he added, citing 20% unemployment and 50 million workers who’ve lost their jobs or had pay cuts.

Opportunities:

1. Community Café is Wednesday, June 3rd at 8:00am for 30 minutes. Topic will be: Why Can Income Taxes Go Up When I Retire?

a. Will live stream on Facebook Live anyone who is friends with me on Facebook.

b. Email invitations were sent to join on the Zoom.com platform

c. Co-Hosted by First Option Bank

d. Invitations will go out via email with a link to join, plus those who are friends with me on Facebook

2. Estate Planning webinar on Tuesday, June 2nd at 12:00 noon for 1 hour.

a. Pros and cons of a Will based estate plan

b. Pros and cons of a Trust based estate plan

c. Co-hosted by Glenn Stockton with Stockton & Stern Law firm

d. Interested in attending? Please email Stacy at [email protected]

3. Referrals – Please share us with your loved ones

4. Roth Conversions

5. Taking withdrawals

a. We never want to discourage you for taking withdrawals. However, the more you leave in the account, the more you will have working for you in our diversified investment mixture when the market goes up. If you need money always feel free to give us a call so that we can collaborate on what is best for your specific situation

If you are still working, call your 401K company, (not your HR department of your employer) and ask if you have access to an “in-service rollover”. And if you do, let us know ASAP as there are potential large benefits that you don’t have at work in that 401K.

Reminders:

1. Don’t forget that the news creates drama. The stock market moves for 2 reasons which are greed and fear.

2. Any service work you would like us to do for you, please email your request to us.

3. We are being told by our broker/dealer, Client One Securities (CIS), that your brokerage accounts should now be able to integrate with your personal tax software for those who do their own tax returns. Any problems or questions on this, can be directed to C1S directly at 913-814-6097

Please feel free to share this email and/or the teleconference information as the best way to battle anxiety is education

Thank you for your time in reading these updates.

Please share them with anyone you want to help

Stay safe and stay healthy,

Mark Roberts