Investment Commentary – June 18, 2019

Year to Date Market Indices as of Market Close June 18, 2019

Dow26,465 (13.45%)

S&P 2,017 (16.39%)

NASDAQ 7,953 (19.87%)

Gold $1349 (5.06%)

OIL $54.08 (18.05%)

Barclay Bond Aggregate (5.25%)

All World Index (12.10%)

Dow surges more than 350 points on hopes for a China trade deal and an easy Fed

Stocks surged on Tuesday as Wall Street increased bets on a U.S.-China trade deal after President Donald Trump said he will be meeting with his Chinese counterpart, Xi Jinping, at the upcoming G-20 summit. Sentiment was also lifted by hope that the Fed will ease monetary policy later this year.

The Dow Jones Industrial Average jumped 353.01 points to 26,465.54 as 3M and Boeing outperformed. The S&P 500 climbed 1% to 2,917.75 while the Nasdaq Composite advanced 1.4% 7,953.88. The S&P 500 also closed 1.2% from its all-time intraday high of 2,954.13, which was reached May 1.

Trump said in a tweet he “had a very good telephone conversation ” with Xi. He added: “We will be having an extended meeting next week at the G-20 in Japan. Our respective teams will begin talks prior to our meeting.” The summit will start on June 28.

Boeing and Caterpillar shares, two trade bellwethers, rose 5.4% and 2.4%, respectively. Deere shares also gained more than 3%. Semiconductor stocks jumped on Trump’s tweet. The VanEck Vector Semiconductor ETF (SMH) surged more than 4%, led by strong gains from Nvidia and Micron Technology.

“Certainly, there’s ground for optimism,” said Michael Geraghty, equity strategist at Cornerstone Capital Group. “However, we have to remember there have been a lot of negotiations between China and the U.S. where they seem to be close to a deal and then things fell apart.”

Hope for a U.S.-China trade deal diminished last month after both countries raised tariffs on billions of dollars worth of their goods. Trump also floated the possibility of imposing tariffs on more Chinese imports.

Trade tensions weigh on Fed meeting this week

Expectations grow that US central bank will move towards monetary easing

Federal Reserve policymakers are set to meet on Tuesday and Wednesday for a gathering that is laden with anticipation because of the possibility that Chairman Jay Powell could start steering the US central bank towards monetary easing.

Few economists expect the Fed to cut interest rates from their current level of 2.25-2.5 per cent, but they do believe Mr. Powell and his colleagues on the Federal Open Market Committee could send strong signals about the conditions under which they might do so later in the year.

In the run-up to the meeting, Fed officials have suggested they were ready to act to sustain the economic expansion due to the growing risk of damage from President Donald Trump’s trade policies. But the case for such a move is hardly a slam dunk, with unemployment at record lows and few signs that a serious downturn or recession is around the corner. Here are five things to watch in a pivotal week for the Fed.

Tracking the dots

The Fed is keen to point out that the direction of monetary policy should not be deduced from its economic projections, which are released at every other FOMC meeting. But analysts and investors will nonetheless pay close attention to the so-called dotplot — in which individual Fed officials map their forecasts for interest rates. In December, they were projecting two interest rate increases this year. But by March, they were forecasting none this year, and just one in 2020, as Mr Powell slammed the brakes on his tightening cycle. Some Fed officials will almost certainly chart interest rate cuts this year at the June meeting, completing the shift. The question is whether the median forecast will be one notch lower than it is today, or more.

Around the Web:

Eyes on the Fed: The U.S. Federal Reserve will open a two-day policy meeting on Tuesday amid market expectations that at least one interest-rate cut could come this year, given recent softness in employment growth and inflation data. If the Fed doesn’t announce a rate cut at its June meeting, it will have another opportunity at its July 30–31 session.

Industrial slowdown: China’s growth in industrial output was just 5% in May, the slowest pace in more than 17 years for the world’s second-largest economy. The government data was released on Friday as policymakers consider whether to take further steps to stimulate China’s economy amid a trade war with the United States.

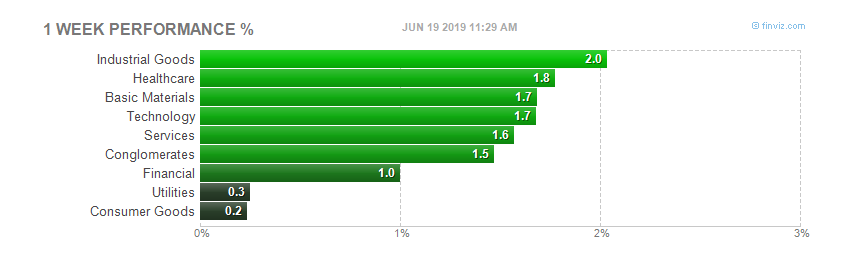

Tech lift: Technology stocks have been a big source of the broad market’s gains so far in June. The six-day stretch that ended on Tuesday, June 11, marked the best such period in more than seven years for the S&P 500 Index’s information technology sector, as those stocks posted a nearly 9% gain, according to Dow Jones Market Data.

Other Notable Indices (YTD)

Russell 2000 (small caps) 13.30

EAFE International 10.57

Emerging Markets 4.68

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.cnbc.com/2019/06/18/stock-market-wall-street-monitors-federal-reserve-meeting.html

https://www.ft.com/content/6b6405da-9142-11e9-aea1-2b1d33ac3271