Investment Commentary – June 12, 2019

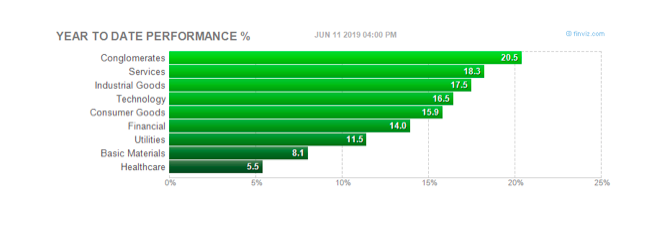

Year to Date Market Indices as of Market Close June 12, 2019

Dow 26,048 (11.66%)

S&P 2,885 (15.11%)

NASDAQ 7,822 (17.89%)

Gold $1339 (4.27%)

OIL $51.78 (13.05%)

Barclay Bond Aggregate (4.97%)

All World Index (12.78%)

JP Morgan: Thought of the week

Trade tensions weighed heavily on global activity in may as indicated by the Global PMI indicies. The manufacturing index fell below the key 50 level to 49.8, hitting its lowest level since October 2012 and indicating that manufacturing contracted in May. Similarly the services index fell 1.2 pts, hitting its lowest level since August 2016, but remained in expansion territory at 51.6. In aggregate, the decline in these two indicies reflects a slowing in economic activity across geographies and sectors, with the manufacturing sector continuing to struggle while services, which had been more resilient until recently, is beginning to be negatively impacted by the manufacturing slowdown. While labor markets continue to tighten in the developed world, which should provide support for the consumer, and stimulus out of China should support the emerging world broadly, the global slowdown has been led by a slowdown in business investment, which is likely to continue as long as trade tension remain elevated. Furthermore, the pressure on the services index confirms that the global slowdown is not solely concentrated in manufacturing as previous months’ reading had suggested. The slowing in global activity, escalating trade tension and uncertainty around global central bank policy all suggest volatility is like to increase. As a result, a more balanced approach to asset allocation, with a focus on income, seems warranted at this point in the cycle.

U.S. Core Inflation Cools, Bolstering Case for Fed Rate Cut

A closely watched measure of U.S. inflation trailed forecasts in May as prices fell for used vehicles, reinforcing the case among investors for the Federal Reserve to cut interest rates.

The core consumer price index, which removes energy and food costs, rose 2% from a year earlier, below forecasts, according to a Labor Department report Wednesday. The figure rose 0.1% from the prior month for a fourth-straight time and missed estimates. The broader CPI increased an annual 1.8%, less than projected.

Cooling Prices

U.S. core and headline inflation both eased in May, missing forecasts. U.S. stock futures briefly advanced and Treasury yields dipped as below-forecast inflation followed signs of slower economic growth that stands to bolster investor expectations for Fed rate cuts this year. Weighing even heavier are signs of lackluster expansions at home and abroad, along with President Donald Trump’s tariffs on Chinese goods.

Around the Web:

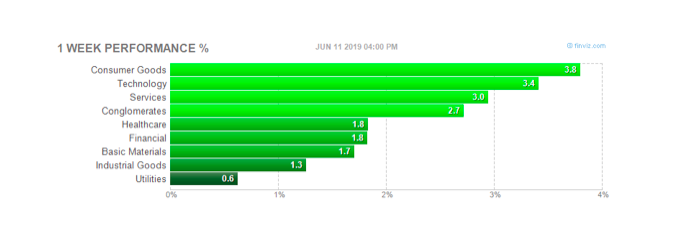

Roaring back: Stock indexes soared to weekly gains of more than 4% as the market recovered most—but not all—of the ground lost in May’s sell-off. For the Dow, the positive result snapped a string of six consecutive weekly declines; the S&P 500 had declined four straight weeks.

Fuel from the Fed: Stock indexes surged more than 2% on Tuesday after U.S. Federal Reserve Chairman Jerome Powell said the Fed is closely watching the negative impact that trade wars could have on the economy. He said the Fed “will act as appropriate to sustain the expansion”—a comment that was seen as increasing the potential that an interest-rate cut could come later this year.

Oil bear: Concerns about growing oil inventories sent crude prices into a bear market on Wednesday, as the price of U.S. crude fell more than 20% below a recent high in April. Oil closed below $52 per barrel on Wednesday, although prices recorded gains on Thursday and Friday.

Other Notable Indices (YTD)

Russell 2000 (small caps) 13.30

EAFE International 12.19

Emerging Markets 7.45

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://am.jpmorgan.com/us/en/asset-management/gim/adv/insights/weekly-strategy-report

https://www.bloomberg.com/news/articles/2019-06-12/u-s-core-inflation-cools-bolstering-case-for-fed-rate-cut?srnd=premium