Hello again,

Happy Independence Day to everyone. I hope you all had a rested weekend and were able to see some fireworks somewhere.

My two girls art with smoke bombs on the gravel road:

Performance DJIA:

Mon 6/29 +2.32%

Tues 6/30 +0.85%

Wed 7/1 -0.30%

Thurs 7/2 +0.36%

Fri 7/3 Market closed for 4th of July holiday

Last week +3.25%

Since 2/19 market high -12.00%

Bond model you are in:

Last week +0.42%

Comparison:

Bond model last 30 days +1.26%

Tid Bits:

1. Affinity Asset Management is making strategic adjustments in light of new information. Yes, there is still lots of fear of what all the Recession and economic backlash will be. However, we have seen with the stimulus package (CARES), that has held the market together, allowing some growth and lessened the volatility. The stimulus package is pushing these inevitable problems down the road to be handled later. President Trump has announced a 3rd round of stimulus. It is not known yet, how big, when, or what/who it will benefit, but stimulus is still stimulus. From a political strategy, President Trump wants to do all he can to make sure he gets re-elected. States all over are reporting Covid-19 increasing once again. Yet, the market isn’t being affected too much. Economists have said if round two of Covid-19 comes back, there is likely NOT going to be another stay-at-home order. The market hasn’t recovered all from its February 19th high, but recovered most of it. And with the pending round 3 of stimulus, Affinity Asset Management has made plans to get bought back in incrementally. Market drops, we buy in a little. It drops a little more, we buy in a little more. The concept of “cycle trading” is not gone, just pushed back while the stimulus money keeps the market up. Until the market shows a ww shape, cycle trading is not possible. It will become possible, just a little farther down the road.

a. We have received a tremendous amounts of “Thank You’ s” and praise for being out of the market during these current times. Even with the market being up on stimulus package enthusiasm, we still get a lot of compliments from our clients. Having said this, as you read Tid Bits #1 above here, if you are uncomfortable with even a small buy back into the market, you need to notify us, so we can put a “restriction” on your account. This means you will not get traded, buying or selling. Only you can have us take that “restriction” off. This also means, you will stay in your current bond mix until you notify us, you want to participate back in the buying and selling of our accounts.

2. THE TRUTH ABOUT PRESIDENTIAL ELECTIONS AND THE STOCK MARKET

2020 US Presidential Election: Politics and investing have always been spoken about in the same breath. Commentators and candidates alike often frame the performance of the stock market as a sort of “barometer” of a president’s policies. But the data don’t support this link. Over the past 120 years, the long-term performance of the market has shown almost no correlation with government policies. So what’s the real story when it comes to politics and investing? Consider these historical truths:

- Markets have performed well under both parties

- Neither party can lay claim to superior economic or financial market performance. The S&P 500 Index delivered an average annual return of approximately 11% over the past 75 years, through both Democratic and Republican administrations. The US economy also expanded around 3.0% during that period.

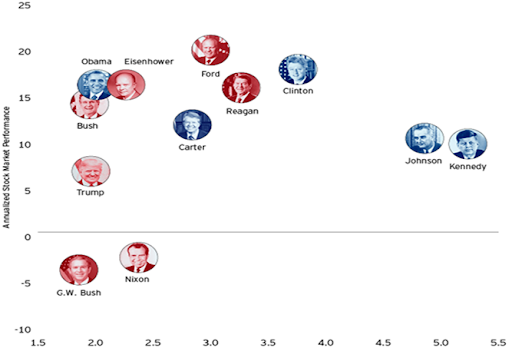

3. Presidential term stock market return vs. economic growth (1957-present)

https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/learning-center/061720_Invesco_Session1_Elections.pdf

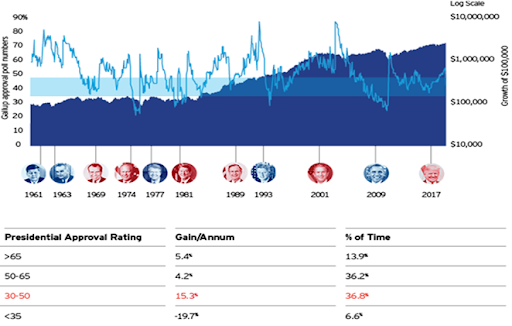

4. Markets don’t care if you don’t approve of the president. From the inauguration of President Kennedy through the current administration of President Trump, some of the best returns in the stock market have come when the president’s approval rating was between 36% and 50% — in other words, when at least half the country disapproved of the job performance of the sitting president.

5. Gallup poll presidential approval ratings and the growth of $100,000

https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/learning-center/061720_Invesco_Session1_Elections.pdf

Facts:

Coronavirus

Global 11,591,304 cases 537,436 deaths

US 2,985,490 cases 132,610 deaths (+3.24%, 4,167 increase from last week)

KS 16,215 cases 284 deaths

MO 24,444 cases 1,074 deaths

Highlights from analysts and economists

1. From JP Morgan

a. Notes on the week ahead

i. In the week ahead, as has been the case for most of the year, markets will likely take their cues from medical rather than economic data. The key question is whether America will see a second wave in the Covid-19 pandemic. The answer to that question has, of course, profound human and social consequences. However, it also has implications for the economy, for fiscal and monetary policy, and, ultimately, for investment strategy.

ii. In the short run, some caution is warranted. While U.S. equities still look attractive relative to Treasuries for the long run, there is a significant risk of disappointment in either the medical data or the economic numbers. This suggests the need to hedge equity exposure using either high-quality, long-duration bonds or, better still, more explicit hedging techniques.

iii. Finally, it is important to acknowledge that many countries in Europe and particularly in East Asia have been more successful than the U.S. in taming the virus and should consequently experience shallower recessions and quicker rebounds. This should boost overseas profits relative to those in the U.S. and could also precipitate a dollar decline, given the possibility of more monetary tightening overseas. This, along with the significant valuation advantage outside the U.S., argues for an overweight to international stocks in general, and emerging markets in particular.

There is no point in downplaying the negative impacts of the virus on our emotional and financial wellbeing. In the short run we will adapt to Covid-19. In the long run we will prevail over it. However, in the meantime, it remains important to see the pandemic for what it is, and position assets not just for the hope of an early cure but the more likely path of a long struggle with a rolling-wave pandemic.

2. Weekly Market Recap

i. The June jobs report showed rising employment and a lower unemployment rate for the second consecutive month. Nonfarm payrolls grew by 4.8 million, with two-fifths of the additional jobs in leisure and hospitality. The unemployment rate, which rose from 3.5% in February to 14.7% in April, fell to 11.1%. Although there were fewer misclassifications than in prior reports, some remained, and without them the unemployment rate would have been 1 percentage point higher.

ii. This report was directionally very positive, but unemployment is still extraordinarily high, and the recovery is just beginning. Nonfarm payrolls have recovered just 34% of their February to April losses. Temporary layoffs have fallen by 7.5 million, without a corresponding rise in permanent layoffs or those who dropped out of the labor force, but remain elevated on an absolute basis. Of 8.3 million people who dropped out of the labor force between February and April, largely as a result of losing their jobs during the lockdowns, about 3.1 million have rejoined the labor force, either seeking employment or rehired. This pushed the labor force participation rate up to 61.5%.

iii. Although solid progress has been made, it is likely that the pace of recovery will slow considerably or even partially reverse, as COVID cases increase and reopening plans pause. This increases the likelihood of a slower economic recovery, posing a challenge to the equity market rally.

3. From American Century

a. After a sharp decline in the first quarter, China’s economy has begun to recover. We believe a slow and extended U.S. recovery is beginning.

b. Because the stock market has priced in a sharp recovery that is yet to show up in the data, we believe caution is warranted.

c. In this unsettled environment, we believe making active decisions with a focus on higher-quality companies can help narrow the range of potential outcomes.

d. Despite a sharp rise in companies cutting or suspending their dividend payouts, we think historical long-term performance data demonstrates the value of owning dividend payers.

e. We believe companies whose products or services make it easier to work, shop, learn, eat and play at home will have advantages over traditional offerings for some time.

f. Regardless of which direction the investing style pendulum swings, we believe investors should maintain exposure to traditional growth sectors to participate in transformational advances in health care and technology.

g. We are monitoring the U.S.-China relationship, which is at risk of boiling over and reemerging as a source of volatility as the U.S. election season ramps up.

h. Our outlook for U.S. Treasuries, U.S. Treasury Inflation-Protected Securities (TIPS) and European sovereigns is positive, while our view of U.S high-yield and European credit is negative.

4. From FS Investments

a. Q3 starts off at a weaker place than any quarter since WWII as a result of the COVID-19 pandemic, but with reopening has come optimism. There are important supports for our nascent recovery that could fuel a strong rebound in Q3. However, our economy also faces significant challenges that could intensify and impact growth later in 2020. Investors will need to navigate a vastly altered landscape of sky-high equity market valuations, continued uncertainty about the economic recovery, and shrinking options to find income.

b. Key takeaways:

- Reopening has spurred hope that the worst economic news is in the rearview mirror.

- Lingering high unemployment could erode resilient consumer confidence.

- Acute volatility could return, driven by looming uncertainty surrounding the pandemic.

Opportunities:

1. Community Café is Wednesday, July 15th at 8:00am for 30 minutes. Topic will be: “I’ve Finished My Estate Plan, Now What?”

a. Will live stream on Facebook Live anyone who is friends with me on Facebook.

b. Email invitations were sent to join on the Zoom.com platform

c. Glenn Stockton of Stockton & Stern is speaking.

d. Invitations will go out via email with a link to join on zoom.com, plus those who are friends with me on Facebook

2. If you would like a copy of my 30 minute recording of Community Café last week, on the topic of “Tax saving Strategies”, please contact Stacy and we can email it to you.

3. Are you over age 72? RMDs, can be re-invested back into your IRAs.

a. If you previously took your annual RMD, and with the stimulus package CARES allowing RMDs in 2020 only to be skipped, you can put that money back into your IRA. Call us for more details.

Reminders:

1. Don’t forget that the news creates drama. The stock market moves for 2 reasons which are greed and fear.

2. Any service work you would like us to do for you, please email your request to us.

Please feel free to share this email and/or the teleconference information with anyone you know as the best way to battle stock market anxiety is education.

Thank you for your time in reading these updates.

Stay safe and stay healthy,

Mark Roberts