Happy Monday to you. Major League Baseball starts back up this week. Yeah, finally some team sports to watch. I was watching one inning of a Yankees preseason game this weekend where they are not allowing fans into the games, instead there was cardboard cut out of faces you can put into seats if you’re a season ticket holder. OMG, the Chiefs season isn’t too far away, I wonder what will happen with those games and fans? 24 years of being a professional money manager, I would describe my personality as middle of the road. Not too positive, not too negative. So my Chiefs prediction is 16-0 if we stay healthy. 14-2 if we have key player injuries. (this is me being “middle of the road” with my Chiefs enthusiasm).

There are a lot of things being announced over the next 11 days. Some good news and some not-so-good news. We will keep you posted as we know more.

Performance DJIA:

Mon 7/13 +0.04%

Tues 7/14 +2.13%

Wed 7/15 +0.85%

Thurs 7/16 -0.50%

Fri 7/17 -0.23%

Last week +2.29%

Since 2/19 market high -9.12%

Bond model you are in:

Last week +0.20%

Comparison:

Bond model last 30 days +0.78%

Tid Bits:

1. #PJR brokerage accounts. If you have a brokerage account, and the beginning of your account number starts with PJR, good news is coming your way. Watch for a separate email and a letter in the mail on changes to that account that will benefit you.

2. Congress’ recess is over and back to work today. Next stimulus is a priority. How much, when, who benefits, etc… All on the table to be discussed.

3. Many schools have pushed the start date back to after Labor Day. Thus giving the schools more time to plan.

a. In Johnson County Kansas, where our kids go, we have the option to have them do on-line schooling or back to being in school with masks and social distancing. Our son in college is having all his classes on-line as well. The ripple affect of how this impacts economics for the U.S. is huge. Just like not being able to attend sporting events.

4. August 31st, 2020 is the deadline to re-pay back your RMD for 2020 if you already previously took your RMD. This is going to be considered a Roth 60day rollover even if its over 60 days. Your accountant will code it this way on your tax return. STRATEGY here. If you have Non-IRA based money or what we refer to as non-qualified, then we can journal that money over from that account to your IRA to replace that RMD withdrawal, saving you taxes. Then you can consider doing a Roth IRA CONVERSION for future tax savings.

a. IRS announces rollover relief for required minimum distributions from retirement accounts that were waived under the CARES Act R-2020-127, June 23, 2020

b. WASHINGTON — The Internal Revenue Service announced that anyone who already took a required minimum distribution (RMD) in 2020 from certain retirement accounts now has the opportunity to roll those funds back into a retirement account following the CARES Act RMD waiver for 2020.

c. The 60-day rollover period for any RMDs already taken this year has been extended to August 31, 2020, to give taxpayers time to take advantage of this opportunity.

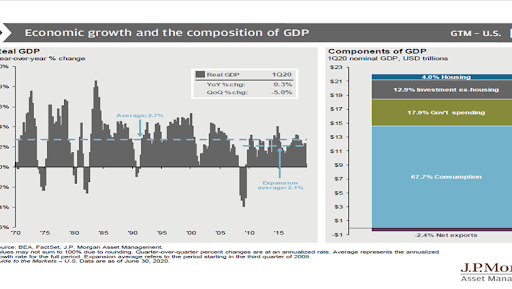

5. 2nd Quarter GDP numbers expected to come out by the end of July. See graph on what is GDP???

a. Gross domestic product (GDP) is the most commonly used measure for the size of an economy. GDP can be compiled for a country, a region, or a state (such as Kansas or Missouri or an entire country like the U.S.). The GDP is the total of all value added created in an economy. The value added means the value of goods and services that have been produced minus the value of the goods and services needed to produce them

6. Jamie Dimon’s warning for the U.S. economy — nobody knows what comes next.

a. The range of outcomes for the economy in the second half is incredibly wide: JPMorgan Chase sees no fewer than five different paths it can take. The bank has gotten more pessimistic, seeing unemployment in its default “base” scenario hitting nearly 11% by the end of this year, 4.3% worse than when it made the same forecast in April. In a worst-case scenario where the virus surges further in the fall, forcing another round of widespread shutdowns, unemployment could peak at roughly 23%, the bank said. More than four months into the coronavirus pandemic, the financial damage wrought by the outbreak has yet to fully register. Take JPMorgan, for instance: The bank added $15.7 billion to reserves for expected loan losses in the first half of this year. But second-quarter loan charge-offs in its sprawling retail bank actually declined 3% to $1.28 billion, or roughly the same level seen before the virus. “In a normal recession unemployment goes up, delinquencies go up, charge-offs go up, home prices go down; none of that’s true here,” Dimon said. “Savings are up, incomes are up, home prices are up. So you will see the effect of this recession; you’re just not going to see it right away because of all the stimulus.” “If you look at the base case, an adverse case, an extremely adverse case, they’re all possible and we’re just guessing at the probabilities of those things; that’s all we’re doing,” he said. “You’re going to have a much murkier economic environment going forward than you had in May and June, and you have to be prepared for that.” *“We simply don’t know,” Dimon added, “and, by the way, we’re wasting time guessing

7. Trump to consider not signing coronavirus relief bill without payroll tax cut

a. President Trump would consider “not signing” a fourth round of coronavirus relief funding if it doesn’t include a payroll tax cut, he said Sunday. “I want to see it,” Trump told “Fox News Sunday.” “I’ll have to see but, yeah, I would consider not signing it if we don’t have a payroll tax cut, yes.” The White House and Congress are expected to cobble together a “phase four” coronavirus relief bill as many Americans’ financial futures remain uncertain because of coronavirus. “We’re working on a ‘phase four.’ We’re working with Congress,” Trump said during a press briefing earlier in July. “Work has started. Steve Mnuchin can give you a little briefing. Talking about payroll tax cuts, we’re talking about more money being infused.” White House economic adviser Larry Kudlow has repeatedly brought up payroll tax holidays as part of coronavirus recovery. However, Kudlow’s support for such a provision is not shared by Treasury Secretary Steven Mnuchin, according to a report from FOX Business.

Facts:

Coronavirus

a) Global 14,670,426 cases 609,557 deaths

b) US 3,899,358 cases 143,310 deaths (+4.0%, +5,515 increase from last week)

c) KS 22,356 cases 307 deaths

d) MO 35,218 cases 1,165 deaths

**Deaths overall all are expected to go up with the recent increases of diagnosed cases. A partial positive lining is the cases going up are younger aged adults who are more likely to fight off this disease. But deaths are expected to start going up as the deaths are a lag of the initial cases indicated.

https://coronavirus.jhu.edu/data/mortality

Highlights from analysts and economists

1. From JP Morgan

a. Last week, second-quarter earnings results for Wall Street’s banks provided investors with some clarity on how financial companies are managing through the pandemic. While at the sector level earnings for financials are still expected to fall roughly -57% in 2Q20 relative to a year ago, earnings releases suggests banks with more diversified revenue streams are performing better than expected. The diversified banks generated half of their revenue in the second quarter through fee-based channels like banking and trading services, all of which improved noticeably as market volatility boosted trading activity and robust corporate borrowing boosted underwriting revenue. On the other hand, smaller regional banks generated most of their revenue from traditional lending, making their earnings much more sensitive to the low interest rate environment. It should also be noted that while many banks reported large increases in loan loss provisions – an expense set aside for uncollected loans and loan payments – in order to weather the expected increase in defaults caused by the pandemic, they are well capitalized and therefore able to bolster these positions. Going forward, the key question is whether missed payments will be forgiven or if the loans will be extended. Even so, the prospect of additional fiscal stimulus and monetary support suggests the loan loss build seen over the past two quarters should prove to be sufficient.

2. From Lord Abbett

a. Longer-maturity U.S. Treasury yields ended the week lower as investor concern over a slower economic recovery grew from the rise in COVID-19 cases in the U.S. However, risk assets were generally positive and non-Treasury sectors had strong returns on the week.

b. The U.S. Federal Reserve’s (Fed) balance sheet contracted last week for the fourth consecutive period. Modest securities purchases were offset by a contraction in domestic repo outstanding and diminishing use of foreign central bank swap facilities. This implies that the Fed backstop is enough to maintain smooth market functioning without the need to resort to large outright lending through the new facilities.

c. Both initial and continuing claims for unemployment insurance are declining gradually after rising extremely sharply. This asymmetry has been less damaging for the economy in the short-run than it could have been due to massive, immediate income transfer and loan programs that prevented the unprecedented layoffs from exerting very large second and third round effects that would have resulted from cuts in consumer spending and business failures. Since most of the programs – family assistance payments, payroll protection loans and supplemental unemployment insurances benefits – have already expired or are about to very soon even as massive job loss remains, it is important for Congress to pass legislation that provides ongoing support for the economy.

3. Jeffrey Gundlach, CEO DoubleLine Capital, 7/12/20

a. The Federal Reserve’s campaign to bolster the bond market is only postponing an inevitable collapse of many fixed-income issues, says Jeffrey Gundlach, aka the Bond King. In addition to Treasury debt and mortgage-backed securities, the Fed is buying corporate bonds, and even some that are junk-rated. The central bank has a program to purchase up to $250 billion, and it can go even higher if it chooses. The mere promise of possible Fed intervention in the bond market has had a big impact. The problem is that the Fed is “delaying the inevitable. In the meantime, they have a lot of wherewithal to continue delaying because they are spraying money all over the place and buying all these assets,” Gundlach said in an interview with Yahoo Finance. Gundlach, the CEO of DoubleLine Capital, argued that “the price of corporate bonds isn’t really real. There’s no price discovery mechanism that’s being pegged. There’s no message; there’s just a target price that the Fed has been doing, and that led to a pop-up in corporate bonds.” The big fear about corporate bonds rated BBB, the last investment-grade rung before junk, is that a lot of downgrades to high-yield are in the offing. Right now, BBBs comprise half of all investment grades. “So if they get downgraded,” he warned, “we know the pricing is going to suffer very significantly.” And that would harm bond investors.

i. These comments are expected at Affinity Asset Management. We have heard these type of comments before on bonds. This is why all of the bonds we use in your accounts right now are short term bonds that are all higher quality, and with immediate ability to get out, to go into stocks or anything else quickly if necessary. The key is short term/high quality/liquid…

4. From Blackrock

a. The outperformance of U.S. stocks in recent months has largely been supported by the historic policy response. The U.S. has so far delivered coordinated fiscal and monetary support sufficient to offset the estimated initial shock from the pandemic and spillovers to the full economy. Yet the resurgence of the virus is taking place just as Congress and the White House face a critical decision over whether to extend a number of crisis measures, including additional federal unemployment benefits set to expire at the end of July. Any premature reduction of stimulus in July, and as the shock persists, would increase the risk of financial vulnerabilities among businesses and households facing cash flow stresses. The risk of retrenching fiscal policy too soon in the U.S. comes as the euro area has been galvanizing its policy response to the coronavirus shock.

b. A slower economic restart could further dampen the earnings prospects of U.S. companies. Earnings per share of the benchmark S&P 500 Index are expected to decline 44% in the second quarter from a year earlier. That follows a 12.7% fall in the first quarter. Consensus estimates suggest U.S. corporate earnings will return to their 2019 levels by 2021, but we see downside risks given the likely slower restart. Renewed U.S.-China tensions and a looming presidential election with a historically wide gap between parties on policy add to the uncertainty.

Opportunities:

1.Community Café is Wednesday, July 22nd at 8:00am for 30 minutes. Topic will be on: “Is your trusted advisor a sales person or a business owner”?

Will live stream on Facebook Live anyone who is friends with me on Facebook.

Email invitations were sent to join on the Zoom.com platform

All 3 speakers, myself, Glenn Stockton, and Chris Toman

Invitations will go out via email with a link to join on zoom.com, plus those who are friends with me on Facebook

2. Estate Planning webinar on Tuesday, July 28 at 12:00 noon or July 29 at 6:00pm

Pros and cons of a Will based estate plan

Pros and cons of a Trust based estate plan

Co-hosted by Glenn Stockton with Stockton & Stern Law firm

Interested in attending? Register at the following link: Click the date for the link to join… Click Here For July 28 at 12pm Click Here For July 29 at 6pm or email Stacy at stacy@affinityasset.com

3. If you would like a copy of my 30 minute recording of Community Café on the topic of “Tax saving Strategies”, please contact Stacy and we can email it to you.

4. Are you over age 72? RMDs, can be re-invested back into your IRAs.

If you previously took your annual RMD, and with the stimulus package CARES allowing RMDs in 2020 only to be skipped, you can put that money back into your IRA. Call us for more details.

Referral rewards program:

Reminders:

Don’t forget that the news creates drama. The stock market moves for 2 reasons which are greed and fear.

Any service work you would like us to do for you, please email your request to us.

Please feel free to share this email with anyone you know, as the best way to battle stock market anxiety is education.

Thank you for your time in reading these updates.

Stay safe and stay healthy,

Mark Roberts