Investment Commentary – July 13, 2021

Year to Date Market Indices as of July 13, 2021

• Dow 34,888 (13.99%)

• S&P 4,369 (16.32%)

• NASDAQ 14,677 (13.88%)

• Gold $1,807 (-4.94%)

• OIL $75.11 (55.18%)

• Barclay Bond Aggregate (-2.32%)

• Fed Funds Rate 0-0.25 (0-0.25)

• Annual Inflation Rae 5.4% (As of 7/3/21)

“Americans are spending way more than pre-Covid”

Jamie Dimon JP Morgan

JPMorgan’s profit spikes 155% as US economy booms

New York (CNN Business) JPMorgan Chase is minting money as the US economy races back from the pandemic.

America’s largest bank said Tuesday it hauled in $11.9 billion in profit during the second quarter, up 155% from the same period of 2020.

JPMorgan’s (JPM) bottom-line growth was driven in part by $3 billion of net reserve releases that underscore the bank’s confidence in the economic recovery.

Revenue fell 8% to $30.5 billion as JPMorgan’s booming Wall Street business cooled from elevated levels.

CEO Jamie Dimon said in a statement consumer and corporate balance sheets remain “exceptionally strong as the economic outlook continues to improve.” He pointed to a sharp decline in bad loans as evidence of the “increasingly healthy condition of our customers and clients.”

“We are encouraged by the continued progress against the virus and the economic recovery that is underway, especially the United States,” Jeremy Barnum, JPMorgan’s chief financial officer, told reporters during a conference call.

Barnum acknowledged, however, that there is “elevated uncertainty” about the evolution of the pandemic and the Delta variant is one element of that uncertainty.

Another risk to the recovery is surging inflation. Consumer prices surged in June at the fastest annual rate since 2008. Prices for used cars, airfare and appliances like washing machines skyrocketed.

Dimon is not so sure that prices will cool off as quickly as the Federal Reserve expects.

“Inflation could be worse than people think. I think it’ll be a little bit worse than what the Fed thinks. I don’t think it’s only temporary,” Dimon said during a conference call with analysts.

Americans are spending way more than pre-Covid

Inflation is being driven up in part by surging demand as consumers spend aggressively. JPMorgan said combined debit and credit card spending surged 45% in the second quarter from a year earlier. Spending is now 22% above 2019 levels.

Dimon pointed to “accelerating growth” across all categories, including travel and entertainment, which surpassed 2019 levels by 13%.

“Travel and entertainment has really turned a corner,” Barnum said.

The bank’s consumer deposits soared by 25% from a year earlier. Investment assets were up 36%, lifted by record stock prices and people adding more cash to portfolios.

JPMorgan’s Wall Street arm slowed down a bit. Total markets revenue tumbled 30%, led by a 44% decline for fixed income markets.

Yet JPMorgan continues to haul in fat fees from advising on M&A and IPO deals: Global investment banking revenue jumped 37% to $1.2 billion.

“Capital markets have just been wide open,” Barnum said.

News Around The web:

Edging higher: The S&P 500, the NASDAQ, and the Dow all posted weekly gains of less than 0.5%, adding slightly to their record highs set in the previous week. Within the major indexes, growth stocks extended their recent run of outperformance versus their value counterparts.

Earnings optimism: Entering earnings season, Wall Street analysts are expecting the biggest quarterly earnings growth rate in a decade, according to FactSet. As of Friday, second-quarter earnings for companies in the S&P 500 were forecast to jump an average of 69%ꟷin pa

Bond price rally: A recent trend of rising U.S. government bond prices accelerated, sending the yield of the 10-year U.S. Treasury bond below 1.30% in intraday trading on Thursday—the lowest in nearly five months. As recently as late March, the yield was 1.74%.rt owing to a favorable comparison relative to the depressed earnings from last year’s second quarter amid the pandemic.

THIS DAY IN FINANCIAL HISTORY

1852: Wells, Fargo & Co. is founded in San Francisco and Sacramento by Henry Wells and William G. Fargo to convert gold dust into cash for miners, as well as to transport and safeguard letters, gold nuggets and other valuable byproducts of the California Gold Rush.

Views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

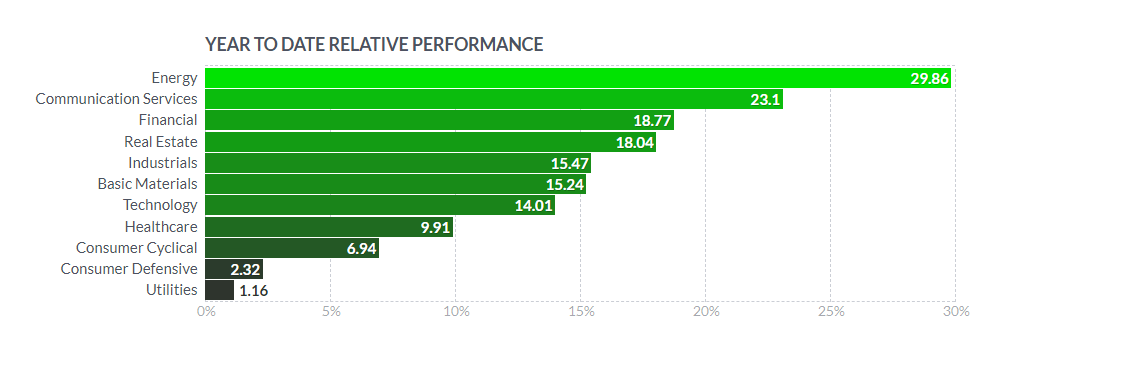

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.cnn.com/2021/07/13/investing/jpmorgan-earnings-economy/index.html