Investment Commentary – January 5, 2021

Year to Date Market Indices as of January 5, 2021

• Dow 30,391 (-0.70%)

• S&P 3,726 (-0.78%)

• NASDAQ 12,818 (-0.54%)

• Gold $1,953 (2.74%)

• OIL $49.80 (2.85%)

• Barclay Bond Aggregate (-0.23%)

• Fed Funds Rate 0-0.25 (0-0.25)

Dow gains over 160 points as investor’s eye runoffs in Georgia for U.S. Senate

U.S. stocks finished higher Tuesday as investors focused on a pair of runoff elections in Georgia, given the possibility of a more aggressive fiscal policy to combat the coronavirus pandemic should the Democrats win control of the Senate.

Investors were also monitoring the spread of COVID-19 as a more transmissible variant of the pathogen leads to stiffer lockdowns in parts of the world which resulted in a poor start to the year for stocks on Monday.

On Monday, stocks fell to start trade in 2021, with the Dow, S&P 500 and the Nasdaq Composite falling more than 1%. The Dow and S&P saw their sharpest daily drops in almost 10 weeks.

What’s driving the market?

In Georgia, Democratic challengers Jon Ossoff and Raphael Warnock are facing off against Republican Sens. David Perdue and Kelly Loeffler, but the results may not be known for several days.

Betting markets and polls were signaling some confidence in the Democratic Party’s prospects which could result in some repeal of corporate tax reductions and other measures that could weigh on stocks, market strategists said. However, a Democratic win also could lead to another large round of economic aid to boost the economy.

“If the Democrats win both runoff elections in Georgia this would open the door to a large fiscal stimulus package and more expansive fiscal policy in the coming years. Part of this will likely be financed by higher taxes somewhere down the road,” said Philip Marey, senior U.S. strategist at Rabobank, in a note.

If Republicans win at least one of the seats, Senate Republicans will likely block further fiscal stimulus and crimp any Democratic plans for expansive spending after President-elect Joe Biden takes office, Marey said.

“Consequently, there will be more pressure on the Fed to provide monetary stimulus during the course of 2021 if the economic recovery falters,” he wrote.

Republicans currently have a 51-48 majority in the Senate. If Democrats win both Georgia races, the party will gain control because Vice President-elect Kamala Harris would cast tiebreaking votes. If Republicans win one of them, the GOP will maintain its majority.

Around The Web

Closing on a high note: The major U.S. stock indexes all set record highs over the course of 2020’s final week, posting gains of around 1%. Markets were generally calm in a holiday-shortened week amid continuing gridlock in Washington over further coronavirus relief.

A tumultuous 2020: A year that was weighed down by a pandemic and a sudden end to the longest bull market in history nevertheless ended positive overall for the stock market. The major indexes produced widely varying gains, with the NASDAQ adding nearly 44% on a price basis, the S&P 500 around 16%, and the Dow about 7%.

Jobs ahead: A monthly labor market update due out on Friday is likely to be the week’s most closely watched economic report. The new release will show whether December marked the sixth consecutive month of a slowdown in jobs growth. In November, 245,000 jobs were added—about half of the amount that economists had expected

Tech dominance: Three giants—Apple, Amazon.com, and Microsoft —generated 53% of the S&P 500′s total return in 2020, according to S&P Dow Jones Indices. Furthermore, information technology—just one of 11 sectors overall—accounted for about 69% of the index’s total return.

Upcoming Events

Thursday: Weekly unemployment claims, U.S. Department of Labor

Today in Stock Market History 1999

Amazon.com announces that fourth-quarter sales totaled $250 million, up more than 200% from the same quarter a year earlier. Never mind that the company is gushing red ink: The stock surges $6.1875 to $124.50. On immense volume of 31.4 million shares, it’s the most active stock on NASDAQ today, and a sign that the Internet bubble is getting out of hand.

Securities Offered Through Client One Securities, LLC Member FINRA/SIPC and an Investment Advisor. Advisory Services Offered Through Client One Securities, LLC and ChangePath, LLC.

Affinity Asset Management, LLC, ChangePath, LLC and Client One Securities, LLC are separate entities.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/story/dow-futures-slide-lower-tuesday-morning-after-stocks-first-decline-to-start-a-year-since-2016-11609850205?mod=mw_latestnewshttps://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

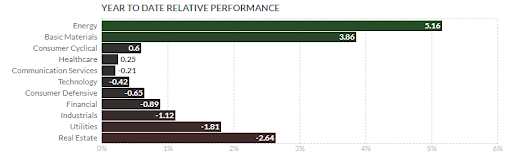

https://finviz.com/groups.ashx (YTD Performance Chart)