Investment Commentary – February 23, 2021

Year to Date Market Indices as of February 23, 2021

• Dow 31,537 (3.4%)

• S&P 3,881 (3.34%)

• NASDAQ 13,465 (4.48%)

• Gold $1,804 (-5.08%)

• OIL $61.90 (27.84%)

• Barclay Bond Aggregate (-1.75%)

• Fed Funds Rate 0-0.25 (0-0.25)

U.S. Stocks Roar Back After Powell’s Reassurance: Markets Wrap

The S&P 500 Index erased a drop to end the day higher after reassuring comments from Federal Reserve Chairman Jerome Powell on inflation and the outlook for growth spurred traders to buy the dip.

The benchmark stock gauge closed 0.1% higher after declining as much as 1.8% amid a rout in technology shares on concern the high-flying stocks had become overvalued. The Nasdaq 100 ended just slightly lower, mostly erasing a loss that reached 3.5% after Powell signaled the Federal Reserve was nowhere close to pulling back on its support for the economy. Airlines, lodging companies and cyclical shares set to benefit from the end of pandemic lockdowns outperformed.

So-called growth shares are having their worst month against value counterparts in more than two decades as vaccination campaigns gather pace and bond yields hover near a one-year high. Bets on faster growth have pushed the gap between 5- and 30-year yields to the highest level in more than six years.

As Powell reassured investors on stimulus, he voiced expectations for a return to more normal, improved activity later this year and said that higher bond yields reflected economic optimism, not inflation fears. That helped fuel a return of the buy-the-dip mentality that has limited equity drawdowns in recent months, with investors betting on a global economic recovery spurred by vaccines and U.S. spending.

“There was something in there for everyone today,” Leo Grohowski, chief investment officer at BNY Mellon Wealth Management, said in a Bloomberg TV interview. “Powell did recognize medium-term improvement in the economy but I think laid to rest some percolating inflation fears.”

Around The Web

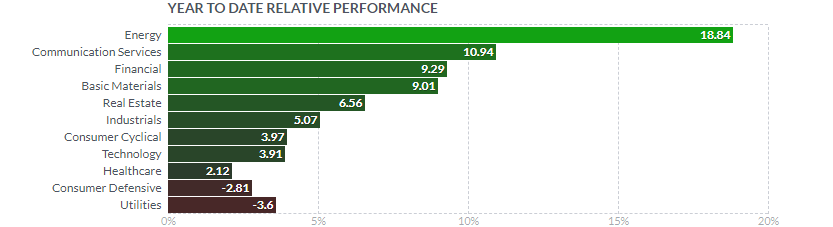

No clear direction: It was a mixed week for stocks, as the Dow recorded a slight gain and the S&P 500 and the NASDAQ posted modest declines. An improved economic outlook lifted many stocks in the energy and financials sectors, which tend to be more sensitive to shifting economic conditions than other market segments.

Yield spike: Prices of U.S. government bonds fell, sending the yield of the 10-year U.S. Treasury bond to the highest level in nearly a year. The 10-year yield rose on Friday to around 1.34%; the 30-year U.S. Treasury also rose, with a yield of around 2.14%.

Fed update: Wednesday’s release of minutes from the U.S. Federal Reserve meeting in late January showed that policymakers viewed economic conditions as being “far from” the Fed’s long-term goals despite currently accommodative policies. Investors will have another chance to gain insight on the Fed’s thinking, as Chair Jerome Powell is scheduled to testify before congressional panels on Tuesday, February 23, and the following day.

Value resurgence: In a reversal from 2020, large-cap U.S. value stocks have been outperforming their large-cap growth counterparts year to date, and they outperformed again in the latest week. A value stock benchmark rose 0.3% while a growth benchmark fell 1.7%.

Upcoming Events

Thursday: Fourth-quarter GDP, second estimate, U.S. Bureau of Economic Analysis

Today in Stock Market History

1995: Wall Street is in what a trader at Furman Selz calls a “jubilant, boisterous” mood as Alan Greenspan tells Congress that he sees no need for the Fed to raise interest rates. Less than four years after it broke the 3000 mark, the Dow Jones Industrial Average closes above 4000 for the first time, finishing the day at 4003.33. The Wall Street Journal declares the next day: “Stocks Cross 4000 for the First Time, But the Visit There May Be Brief,” and warns that a correction is now “inevitable.”

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://jasonzweig.com/this-day-in-financial-history/ (This day in Financial History)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.bloomberg.com/news/articles/2021-02-22/asian-stocks-to-open-weaker-commodities-rally-markets-wrap?srnd=markets-vp

Securities Offered Through Client One Securities, LLC Member FINRA/SIPC and an Investment Advisor. Advisory Services Offered Through Client One Securities, LLC and ChangePath, LLC.

Affinity Asset Management, LLC, ChangePath, LLC and Client One Securities, LLC are separate entities.