Investment Commentary –February 20th, 2024

Year to Date Market Indices as of February 20th, 2024

• Dow 38,563 (2.32%)

• S&P 4,975 (4.21%)

• NASDAQ 15,630 (4.01%)

• OIL $78.27 (9.73%)

• Barclay Bond Aggregate (-1.30%)

• Gold $2,035(-1.74%)

What does the election mean for taxes?

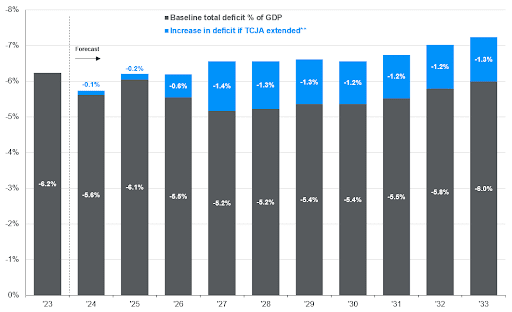

The decision on the 2017 TCJA could either add $2.6 trillion to the deficit, increasing federal debt, or to taxpayers, potentially impacting consumption. Therefore, this is likely to be one of the most consequential policy decisions the next administration makes.

Permanent provisions:

- Corporate tax rate reduced to 21% from 35%

- Eliminated corporate alternative minimum tax (subsequently revised to a 15% minimum tax for companies with income over $1 billion per the Inflation Reduction Act)

- Expanded depreciation deductions

Temporary provisions:

- Reduced federal income tax rates, with the top tax rate decreasing to 37% from 39.6%

- Raised alternative minimum tax exemption to $70,300 for single filers and $109,400 for joint filers

- Increased child tax credit to $2,000 per qualifying child and expanded the eligible income level

- Doubled estate tax exemption to $11.2 million from $5.6 million

- Expanded standard deductions

The extension or suspension of these tax changes have meaningful implications on companies, the federal deficit, and consumers. Most of the key provisions that impact companies, including the corporate tax rate reduction, are permanent. Therefore, there should be no tax-related impact to earnings in the coming years unless the next president raises or lowers the corporate tax rate. Any potential impact will be indirect and dependent on how changes in the temporary tax provisions influence consumer spending. Additionally, when looking at the impact of the TCJA on corporate profits so far, it is still too early to paint a clear picture. As per recent research from the National Bureau of Economic Research, it normally takes 5-8 years to see the true effects of a tax cut on a firm’s productivity and R&D.1 This timeframe is likely longer in the current environment given pandemic-related disruptions.

If tax cuts sunset and the taxpayer’s bill increases by $2.6 trillion over the next decade, this could impact consumption and therefore growth. Analyzing how income and federal taxes changed before and after the TCJA (2017 – 2019), for every dollar increase in income, federal taxes decreased by 25 cents for the bottom 90% of earners but increased by 42 cents for the top 10% of earners due to a 19% jump in average income before taxes, translating to higher tax revenue. Because the bottom 90% of earners have a higher marginal propensity to spend, a higher tax bill could negatively impact consumer spending.

Market News

Slight pullback

The S&P 500 posted a fractional decline, snapping a five-week string of positive results that had left the index at a record high. Despite the setback, the S&P 500 remained nearly 22% above a recent low in late October. The Dow finished the week essentially flat while the NASDAQ slipped more than 1%.

Inflation’s persistence

Stocks fell and bond yields rose on Tuesday after a monthly inflation report showed that U.S. consumer prices rose more than most economists had expected in January, with the Consumer Price Index’s annual rate coming in at 3.1%. A separate report on Friday reinforced the narrative of continuing inflationary pressures, as wholesale prices rose at the fastest pace in five months.

Shopping slowdown

U.S. consumers trimmed their spending more than expected after the holiday shopping season. In January, retail sales fell 0.8% on a seasonally adjusted basis compared with the previous month. In addition, sales figures for December and November were revised lower than the initially reported numbers.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://www.jhinvestments.com/weekly-market-recap#market-moving-news

https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/market-updates/on-the-minds-of-investors/what-does-the-election-mean-for-taxes/