Investment Commentary – February 15, 2023

Year to Date Market Indices as of February 15, 2023

• Dow 33,963 (2.35%)

• S&P 4,123 (7.25%)

• NASDAQ 11,943 (13.97%)

• OIL $78.00 (-3.13%)

• Barclay Bond Aggregate (1.35%)

• Gold (6.21%)

How European equities are defying the odds

Spotlight: The case for Europe, in 5 reasons

Defying all odds, the outlook for Europe has continued to brighten. Here are five reasons we think the tide is turning.

1) Growth has been much better than expected — so much so that leading indicators are signalling expansion again.

While the region seemed to be teetering on the edge of recession heading into winter, improving energy dynamics have staved off the contraction most thought was inevitable. Thanks to a heroic effort to rebuild natural gas reserves and a milder than anticipated winter, natural gas prices have fallen by over 80% and are back at levels from before the war started. Europe looks to exit winter with better gas reserves (about 50% of capacity) than it would even in a normal year (about 30%). What’s more, Europe stands to reap tailwinds from China’s rapid reopening, given the economies’ trade linkages.

2) All those good vibes translate into more resilient earnings. Banks largely reported stellar profits, lower gas prices have been a boon for industrials companies like Infineon, energy companies like BP are increasing capital expenditure (capex) for new projects, and luxury brands like LVMH seem to be going from strength to strength.

Looking ahead, improved growth should boost sales, particularly as the Chinese consumer gets back in action. For instance, while Asia only accounted for about 11% of Stoxx Europe 600 revenues in 2010, it now represents more than 20%. Moreover, moderating prices should continue to ease some margin pressures.

3) We don’t think it’s all priced in. Even with an over 20% rally from the lows, we think there could be more room to run. European stocks are trading at a 13x forward price-to-earnings ratio, below its 14.5x 10-year average. We also expect Europe’s discount to the U.S. to continue to narrow. It was at a historically wide 30% before this rally and has closed to about 26% today, and we expect it to finish the year closer to 20%.

4) But it’s not just a short-term story — Europe is home to some of the growth trends of tomorrow.

This isn’t the same old Europe. The European market has seen its sector makeup shift from inherently lower growth industries like telecoms and banks toward higher quality companies like luxury goods and semiconductors. Further, as the pandemic and war exposed supply-side vulnerabilities, we believe that a capex cycle focused on developing the real economy is underway (think supply chain resiliency, energy and food security, infrastructure, and defense) — in stark departure from the era of low interest rates that fuelled mega cap tech in the last cycle. Such a shift could benefit Europe’s higher weighting to industrials, materials, and energy versus its U.S. peers.

5) A weaker dollar adds an extra kicker for U.S. investors.

The U.S. dollar has weakened about 10% from its highs as U.S. inflation cools, other developed world central banks catch up to the Fed’s rate hikes, and growth outside the U.S. has markedly improved. Meanwhile, the euro has rallied and the dynamics above should also give it further support. That means USD-based investors could see even more enhanced returns when investing in European assets. For example, since the start of October, the Stoxx Europe 600 has generated a compelling approximate 20% return in local currency terms, but an even higher about 30% in dollars!

Market-moving news

Oil rally: The price of U.S. crude oil rose nearly 9% for the week to almost $80 per barrel on Friday. Some of the increase was attributed to Russia’s announcement on Friday that it plans to cut production in March by 500,000 barrels a day—about 5% of its output—in response to recently imposed sanctions.

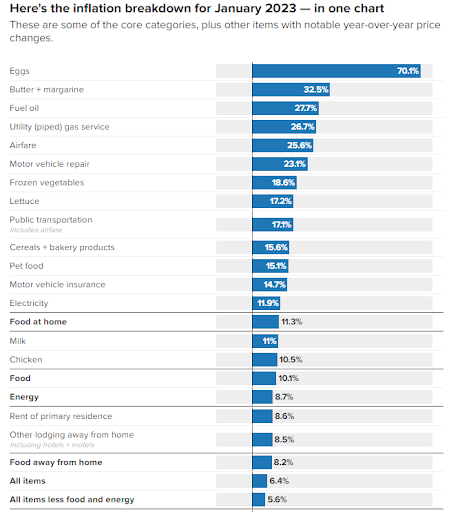

Inflation battle: U.S. Federal Reserve Chair Jerome Powell said on Tuesday that the process of lowering inflation to the central bank’s goal of 2% “is likely to take quite a bit of time” and will probably be “bumpy.” His comments in a moderated discussion came after a week highlighted by an unexpectedly strong jobs report and yet another Fed rate hike.

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.cnbc.com/2023/02/14/heres-the-breakdown-of-the-inflation-report-for-january-in-one-chart.html

https://www.jpmorgan.com/wealth-management/wealth-partners/insights/how-european-equities-are-defying-the-odds