Investment Commentary –December 15th, 2020

Year to Date Market Indices as of December 15th, 2020

• Dow 30,201 (5.82%)

• S&P 3,694 (14.36%)

• NASDAQ 12,595 (40.37%)

• Gold $1,857 (22.22%)

• OIL $47.57 (-22.27%)

• Barclay Bond Aggregate (4.97%)

• Fed Funds Rate 0-0.25 (0-0.25)

Markets

U.S. Stocks Climb, Bonds Fall on Stimulus Bets: Markets Wrap

U.S. stocks halted a four-day losing streak as Congress moved toward a federal spending package that would boost the economy. Treasuries retreated.

The S&P 500 rebounded from its longest slide since September. Senate Majority Leader Mitch McConnell said he will keep lawmakers in Washington until a deal gets done. The 10-year Treasury yield moved above 0.90% as the Federal Reserve began its two-day meeting. The dollar weakened for a second day. Oil advanced with gold.

Wall Street is growing increasingly confident that Democratic and Republican lawmakers will clinch a bill based on a $748 billion bipartisan proposal that would inject cash directly into the economy as prior benefits begin to expire at the end of the year. The vaccine rollout continues in the U.S. without any major disruptions so far.

“The markets really locked into the optimism trade and it’s been heavily discounting bad news and focusing on good news,” said Olivia Engel, chief investment officer of active quantitative equity at State Street Global Advisors. “I’m not surprised the market chose to focus more on the good news even as lockdown announcements are coming.”

Nasdaq surges to record ahead of coronavirus stimulus talks

The Nasdaq Composite rallied to a record Tuesday as investors weighed the latest proposal for COVID-19 relief.

House Speaker Nancy Pelosi, who has already spoken to Treasury Secretary Steven Mnuchin, was scheduled to meet with Senate Majority Leader Mitch McConnell and Senate Minority leader Chuck Schumer after the closing bell. Mnuchin was also expected to attend.

The tech-heavy Nasdaq surged 1.25%, edging out its record-high close helped by a jump in Apple Inc. after it asked suppliers to increase iPhone production by 30% in the first half of 2021 to 96 million units, according to a Nikkei report citing people familiar with the matter. Chip stocks also rose in tandem.

The Dow Jones Industrial Average, meanwhile climbed 339 points, or 1.14%, while the S&P 500 added 1.3%. Both of the indexes finished just shy of their own all-time highs. The advance snapped the S&P 500’s four-day losing streak, which was the longest since September.

A group of bipartisan lawmakers put forth two bills, totaling $908 billion, for coronavirus relief. The plan includes a $748 billion package that extends an additional $300 billion for Paycheck Protection Program loans and gives an extra $300 per week in federal unemployment benefits. A second bill, totaling $160 billion, grants aid to state and local governments and provides protections for businesses.

Around the Web

Inflation gauge: Consumer prices rose more than economists had expected last month. The latest Consumer Price Index rose 0.2% relative to the previous month after showing no change in October. Rising costs for hotel stays, airfares, and apparel triggered some of last month’s rise.

Euro stimulus: The European Central Bank expanded its economic stimulus program, citing risks that spiking coronavirus cases pose to the continent’s economy. The bank agreed to increase its asset-purchasing program by $605 billion, extend the program’s duration to at least March 2022, and grant more subsidized loans to banks.

Upcoming Events

Wednesday: U.S. Federal Reserve Board concludes two-day policy meeting

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.bloomberg.com/news/articles/2020-12-14/asian-stocks-set-for-muted-start-dollar-retreats-markets-wrap?srnd=markets-vphttps://www.reuters.com/article/us-usa-holiday-shopping-mastercard/record-online-sales-give-u-s-holiday-shopping-season-a-boost-report-idUSKBN1YT0PQ

https://www.foxbusiness.com/markets/us-stocks-dec-15-2020

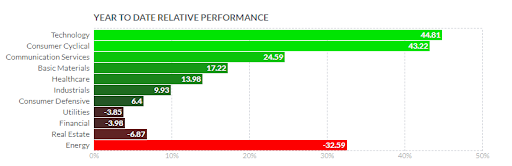

https://finviz.com/groups.ashx

Securities Offered Through Client One Securities, LLC Member FINRA/SIPC and an Investment Advisor. Advisory Services Offered Through Client One Securities, LLC and ChangePath, LLC.

Affinity Asset Management, LLC, ChangePath, LLC and Client One Securities, LLC are separate entities.