Investment Commentary – August 9, 2022

Year to Date Market Indices as of August 9, 2022

• Dow 32,771 (-9.77%)

• S&P 4,121 (-13.44%)

• NASDAQ 12,497 (-20.06%)

• OIL $90.76 (20.29%)

• Barclay Bond Aggregate (–9.77%)

On rare days, the market rises 5% — or even 10%, Wells Fargo finds. How to make sure you’re there for it

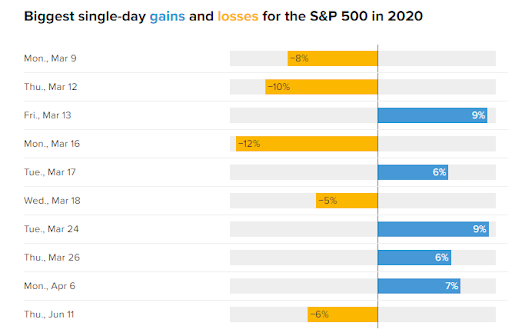

A new Wells Fargo analysis looked at the best 20 days for the S&P 500 between August 1992 and July 2022. Almost half of them occurred amid a downturn.

The findings underscore the impossibility of timing the market, with the dips and upswings being so jumbled together.

“It was the best of times, it was the worst of times.” With those classic words, author Charles Dickens famously opened his historical novel “A Tale of Two Cities.”

He could easily have been describing the stock market.

A new Wells Fargo analysis looked at the best 20 days for the S&P 500 between August 1992 and July 2022. Almost half of them, the investment bank found, occurred during a bear market.

In the Great Recession, on Oct. 28, 2008, the index shot up nearly 11%. On March 24, 2020, amid the coronavirus pandemic downturn, the S&P 500 rose 9%. (For perspective, the average daily return for the index over the last two decades is around 0.04%, according to Morningstar Direct.)

“During extreme market events, like the collapse of the credit market in 2008, or the beginning of the pandemic in 2020, the markets don’t digest this kind of news in an instant,” said Douglas Boneparth, a certified financial planner and founder of financial services firm Bone Fide Wealth in New York.

“We generally don’t know how it’s going to all play out,” he added. “This is why you see massive amounts of volatility and bad days clustered together with good days.”

The findings underscore the impossibility of timing the market, with the dips and upswings being so jumbled together.

“The odds of selecting the right days to be in or out of stocks are far less than winning the Powerball,” said Allan Roth, a CFP and founder of Wealth Logic in Colorado Springs, Colorado.

Around the Web

Jobs surprise

Despite the recent slowdown in U.S. economic growth, the labor market continues to exceed expectations. The government reported on Friday that the economy added 528,000 jobs in July—far exceeding most economists’ forecasts—and unemployment slipped to 3.5% from 3.6%.

Pandemic jobs recovery

.The latest monthly employment gain marked a milestone, as the U.S. economy recouped the 22 million jobs lost in the initial months of the pandemic nearly two and a half years ago. The unemployment rate also returned to its February 2020 prepandemic level.

Earnings momentum

Earnings performance continued to improve, as second-quarter profits at companies in the S&P 500 were expected to increase 6.7%, based on companies that have reported so far and forecasts for firms that haven’t yet released earnings, according to FactSet. That’s up from the 5.8% rise that had been projected at the end of the previous week. About 87% of companies had reported results as of Friday.

Upcoming Events

8/10/2022: Consumer Price Index, U.S. Bureau of Labor Statistics

The views presented are not intended to be relied on as a forecast, research or investment advice and are the opinions of the sources cited and are subject to change based on subsequent developments. They are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investments.

https://www.marketwatch.com/ (Market Indices)

https://www.jhinvestments.com/weekly-market-recap (Around the Web & Upcoming Events)

https://finviz.com/groups.ashx (YTD Performance Chart)

https://www.cnbc.com/2022/08/09/on-rare-days-markets-rise-10percent-how-to-make-sure-youre-there-for-it.html

https://finviz.com/groups.ashx