Investment Commentary – April 12, 2022

Year to Date Market Indices as of April 12, 2022

• Dow 34,220 (-5.32%)

• S&P 4,397 (-7.06%)

• NASDAQ 13,371 (-13.22%)

• Barclay Bond Aggregate (-6.46%)

• Fed Funds Rate .50 (up .25)

• Annual Inflation Rate 8.5%

Simeon Hyman ProShares analyst

What trades are risk on, and what’s risk off in the current climate? With the war in Ukraine continuing, an extremely brief flight-to-safety Treasury rally was followed in March by a month of stocks solidly in the green and bonds in the red.

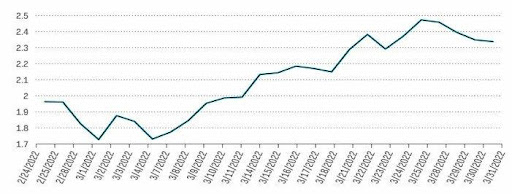

Chart of the Month:

U.S. Treasurys Sold Off and Yields Rose—Even During a War

10 Year Treasury Yield

Source: Bloomberg. Data from 2/24/22-3/31/22.

Some people seem to believe that the past month’s stock rally has been driven by just how unattractive bonds have been. Inflation, rate hikes and quantitative tightening all point to a period of rising interest rates. And the direct relationship between rising yields and falling prices for bonds may be moving investors toward stocks, where at least the outcome is more ambiguous.

Other people have seen stocks as attractive in their own right, with ample earnings, cash flow and dividend growth to overcome current inflation and rising interest rates.

The choice doesn’t have to be binary:

Considering bonds: A range of indicators suggest that corporate credit is comparatively strong (see our fixed income section below). Bond strategies that focus on credit while considering opportunities to mitigate Treasury rate risk may be effective ways to maintain bond exposure, even in a rising interest rate environment.

Considering stocks: A well-constructed core allocation that delivers consistent earnings, cash flow and, particularly, dividend growth is never a bad idea. It is especially important in a rising rate environment. However, there are opportunities to “lean into” it. You might consider sectors like financials, energy and basic materials that can have a leg up in a rising rate environment. You might also look to a real-asset-adjacent strategy like infrastructure (see our equity section below), where attractive yields and pricing power can come into play.

Inflation

Inflation has far exceeded the FOMC’s 2% target, with the headline PCE price index rising +0.6% m/m and +6.1% y/y in January. The core PCE deflator also rose to +0.5% m/m and +5.2% y/y. The February CPI report showed that even before Russia’s invasion of Ukraine, consumer prices were rising at their fastest pace in 40 years as gas prices spiked and food and rent prices continued to accelerate. Headline CPI rose 0.8% m/m and 7.9% y/y, while Core CPI rose 0.5% m/m and 6.4% y/y. The Russian invasion will likely pressure gas prices higher and cause further strain to supply chains, postponing the peak on inflation to later this year.

Jobs

March nonfarm payrolls rose by a robust 431K with upward revisions of 95K to the prior two months. The unemployment rate dropped to 3.6% from 3.8%, while the labor force participation rate ticked up to 62.4% from 62.3%. Wages grew by 0.4% and upward revisions to February showed the year-over-year gain in wages hit a recovery high of 5.6%. The labor force also grew by 418,000 with women returning to the job market in greater numbers. For investors, signs of a very tight labor market likely mean an even more hawkish Fed and higher interest rates in the months ahead, but they also should inspire some confidence in the economy’s ability to absorb those hikes without a recession.

https://www.proshares.com/browse-all-insights/insights-commentary/proshares-market-commentary-april-2022/

https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/economic-update/